Key Market Catalysts: Earnings Releases and Economic Data to Monitor

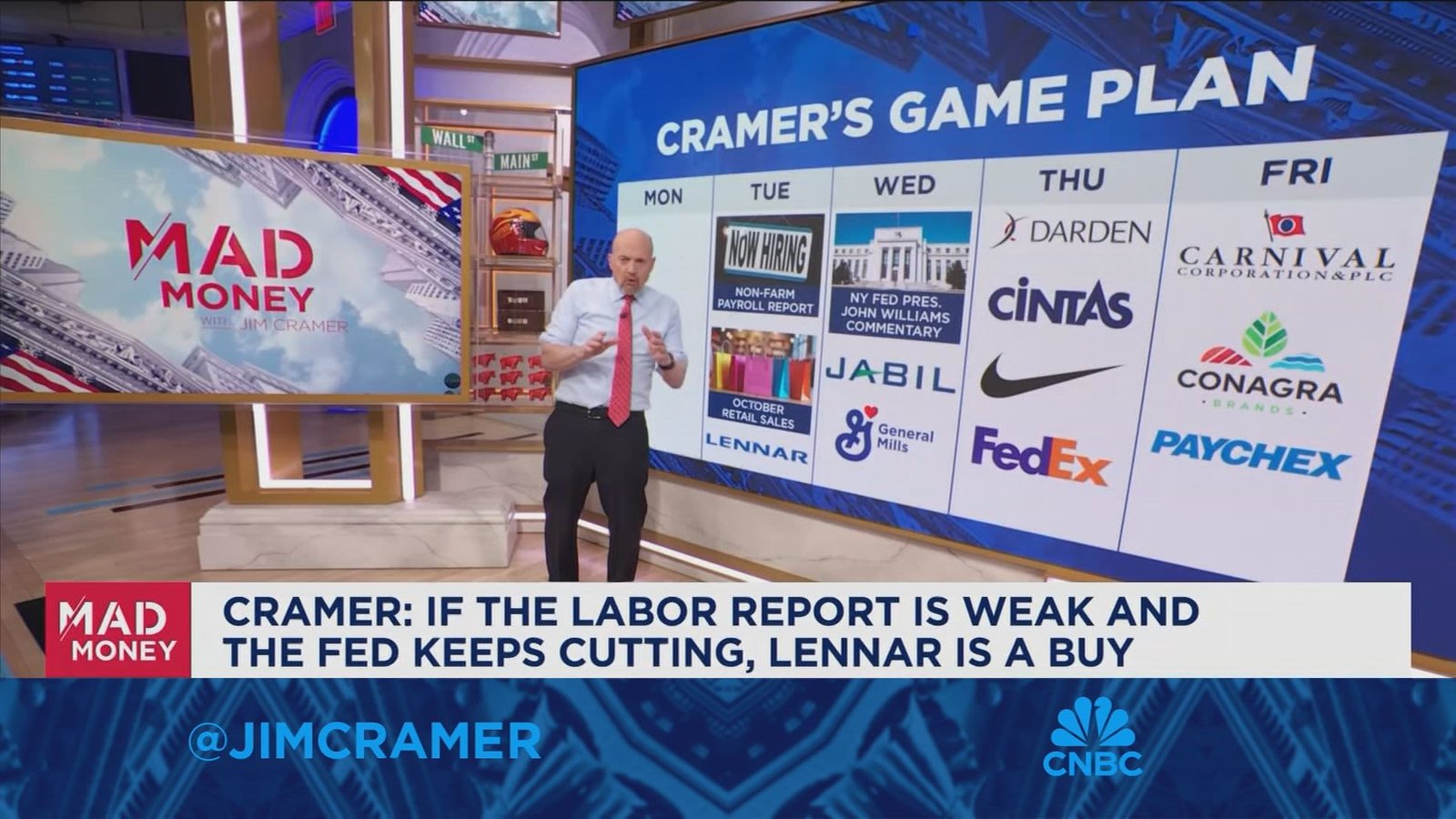

The upcoming week on Wall Street is poised for meaningful activity as investors anticipate a series of significant economic reports and corporate earnings announcements. Notable companies such as FedEx, Jabil, and General Mills are set to release results that could steer market sentiment across various industries.

Economic Indicators Shaping Market Sentiment

Tuesday will spotlight the Labor Department’s nonfarm payroll report, a vital measure of employment trends. After a period marked by limited macroeconomic updates due to earlier goverment interruptions, this data will offer fresh insight into the economy’s current trajectory. Strong job growth may temper expectations for additional federal Reserve interest rate cuts, whereas weaker employment figures could bolster arguments for continued monetary easing.

In tandem with payrolls, retail sales data will also be published on Tuesday. Analysts suggest that subdued retail sales would reinforce calls for further rate reductions by highlighting restrained consumer spending patterns amid inflationary pressures.

Midweek Corporate Earnings with Sector Implications

Wednesday brings earnings reports from Jabil and General Mills-two companies positioned in sectors undergoing notable shifts. Jabil’s role in supplying components critical to data centers ties it closely to the expanding artificial intelligence industry. Positive results here might help stabilize AI-related stocks following recent volatility within tech markets.

General Mills faces headwinds stemming from evolving consumer preferences influenced by rising popularity of GLP-1 weight management drugs and an increased focus on healthier eating habits.the company’s performance will shed light on how traditional food manufacturers are adapting amid these changing dynamics.

Diverse Industry Updates midweek

- Darden restaurants: Despite widespread inflationary pressures affecting beef prices nationwide, Darden’s Olive Garden brand reportedly experiences minimal impact from these cost increases, perhaps shielding it compared to competitors facing higher input expenses.

- Cintas: As a key provider of uniforms and safety equipment primarily serving small businesses, cintas’ earnings may reveal insights into how smaller enterprises are faring under current economic conditions marked by supply chain challenges and labor market tightness.

- Nike: Investor optimism remains cautious regarding Nike’s near-term recovery prospects amid ongoing global supply disruptions coupled with shifting consumer demand trends in athletic apparel.

- FedEx: Benefiting from sustained growth in e-commerce worldwide-which saw global online sales surpass $5 trillion last year-FedEx is well-positioned as a potential standout performer given its effective management strategies navigating this expansion phase.

Earnings Reports Closing Out the Week: consumer Behavior Insights

The week wraps up with financial disclosures from Carnival Corporation, Conagra Brands, and Paychex scheduled for Friday. Carnival’s results will provide valuable indicators about discretionary spending within travel and leisure sectors as consumers continue adjusting post-pandemic behaviors amidst fluctuating confidence levels.

Conagra Brands’ performance offers clues about whether home cooking remains prevalent or if dining out is regaining momentum after years shaped by pandemic restrictions altering eating habits globally. simultaneously occurring, Paychex delivers critical perspectives on employment trends among small- to medium-sized businesses through its payroll processing services-a key gauge during ongoing labor market fluctuations worldwide impacted by wage inflation concerns.

Navigating Market Rotation Amid Technology Sector Volatility

“Careful analysis of incoming economic data is essential,” experts emphasize as capital begins shifting away from dominant technology giants often referred to collectively as “the Grand Seven” toward other promising areas like manufacturing infrastructure.”

This rotation highlights growing investor caution surrounding high-flying tech stocks despite persistent belief in artificial intelligence innovation potential. Recent weeks have witnessed notable pullbacks among AI-focused equities; however some analysts view these corrections as opportunities for entry once valuations align more closely with long-term growth fundamentals tied to essential technological advancements.

Sectors Driving Investment Strategies This Week

- E-commerce Expansion: The rapid rise in online shopping continues fueling demand for logistics providers like FedEx; global e-commerce revenue topped $5 trillion last year with forecasts projecting steady annual growth through at least 2027 driven by evolving consumer habits worldwide.

- Sustainable Food Trends: Increasing adoption of plant-based diets combined with pharmaceutical influences such as GLP-1 medications are reshaping consumption patterns impacting food producers including General Mills and Conagra Brands alike amidst health-conscious shifts globally.

- Tight Labor Markets: Payroll processors like Paychex offer real-time visibility into hiring activities among smaller firms contending with wage pressures amid persistent inflation across multiple economies around the world today.

Ahead: Strategic Insights for Investors Navigating Uncertainty

An integrated understanding of diverse factors-from macroeconomic indicators such as job creation rates to sector-specific earnings outcomes-will be crucial when approaching next week’s trading environment effectively.Staying alert to capital reallocations moving away from technology leaders toward industrials or consumer staples can uncover new investment opportunities while managing risks during periods characterized by uncertainty across multiple fronts globally.