Google’s Bold Move into India’s Digital Credit Revolution

Addressing teh Credit Accessibility Challenge in a Rapidly Digitizing Nation

With a population exceeding 1.4 billion, India represents one of the largest untapped markets for credit expansion, as fewer than 50 million people currently hold credit cards. Despite widespread adoption of digital payment systems like the government-supported Unified Payments Interface (UPI), many consumers still face hurdles accessing formal credit facilities. This gap has created opportunities for tech giants and financial institutions to embed lending options directly within popular digital wallets and payment apps.

Flex by google Pay: Transforming UPI-Linked Credit Solutions

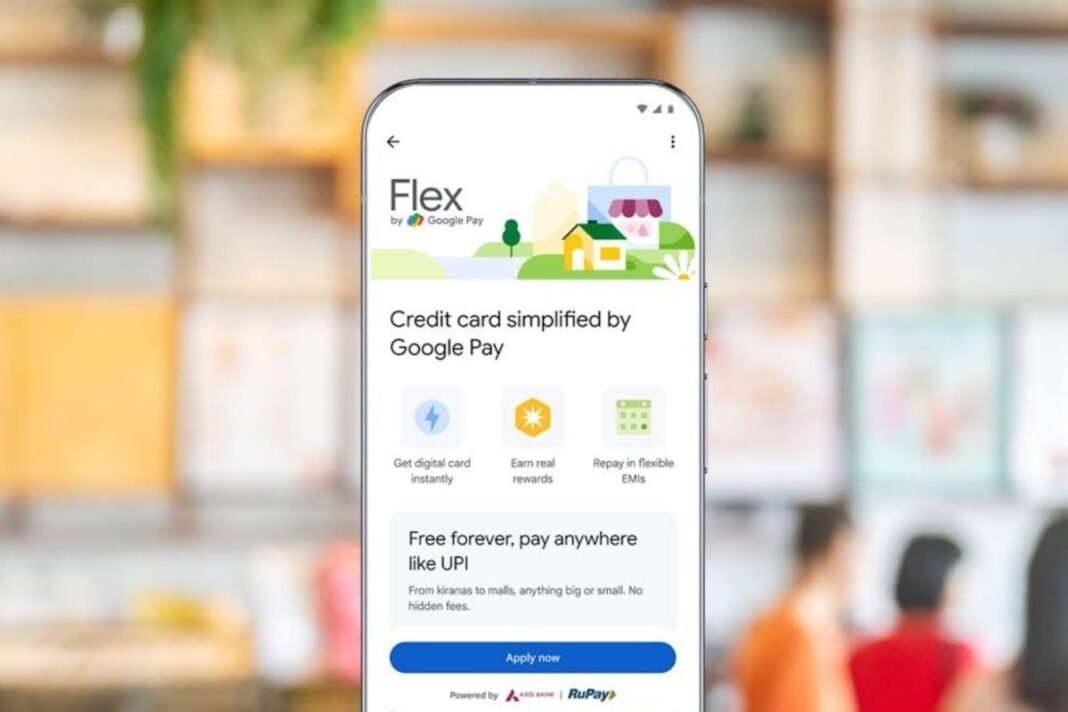

Flex by Google Pay, recently introduced through a collaboration with Axis Bank, is a co-branded credit card tailored specifically for India’s UPI ecosystem. Offered entirely through the Google Pay app, this card supports seamless transactions both online and at physical retail outlets nationwide.

The card operates on the RuPay network and introduces an innovative rewards program where users earn virtual “Stars” valued at ₹1 per Star on every purchase. The app equips users with thorough expense tracking tools,bill management features,flexible repayment choices-including full payments or converting balances into easy monthly installments-and robust security controls such as PIN blocking or resetting.

Designed with New Credit Users in mind

The Flex card addresses common apprehensions among first-time borrowers by providing adaptable repayment plans that alleviate stress over fluctuating billing cycles. Interest rates and fees are personalized based on individual creditworthiness and clearly disclosed upfront within the app before any transaction commitment is made. While there are no fees to apply for the card itself, processing charges apply when opting to convert outstanding balances into Equated Monthly Installments (EMIs), alongside late payment penalties consistent with Axis Bank policies.

The Expanding Indian Credit Card Market Backed by Digital Growth

The Indian credit card industry has experienced significant momentum recently; active cards have grown approximately 14% annually over three years to reach around 110 million nationwide. Transaction volumes surged nearly 30%, while average yearly spending per user climbed from ₹132,000 (~$1,450) to ₹192,000 (~$2,100). This shift reflects increased everyday usage rather than sporadic high-value purchases.

however, much of this growth stems from existing customers increasing their activity rather than onboarding new users-a challenge that Google aims to overcome through its flexible offerings designed especially for hesitant first-time borrowers wary of traditional lending models.

The Rise of Co-Branded Cards Amid Fierce Competition

The co-branded credit card segment in India is rapidly gaining ground amid intense rivalry from major players such as Amazon and Flipkart (owned by Walmart),alongside fintech innovators like PhonePe. Consumer internet companies including Swiggy (food delivery) and MakeMyTrip (travel bookings) have also partnered with banks to offer integrated cards within their apps.

- Co-branded cards represented about 12-15% of all Indian credit cards in FY2024;

- This share is expected to surpass 25% by volume by 2028;

- The segment grows annually between 35-40%, driven largely by digital-first strategies targeting younger demographics seeking convenience paired with rewards benefits.

Cultivating Financial Obligation Among Youth: The Pocket Money Initiative

Apart from launching its co-branded product line, Google unveiled “Pocket Money”, a parental control feature embedded within Google Pay utilizing UPI Circle technology. This innovation enables parents to set monthly spending limits up to ₹15,000 or approve individual transactions initiated directly from children’s accounts-without requiring preloaded funds onto separate prepaid instruments unlike earlier fintech solutions such as FamPay or Junio which depended on prepaid models.

“By keeping funds securely in parents’ accounts until spent via UPI Circle,” explained company representatives-“this method offers a safer introduction for children into digital payments.”

this feature not only fosters prudent money management skills among younger generations but also expands Google’s market reach amid stiff competition against other leading UPI platforms like PhonePe backed by Walmart.

Empowering Small Enterprises Through Advanced Digital Tools

Google continues enhancing merchant experiences across its platform; customers can now instantly rate small businesses post-purchase with reviews automatically updating merchants’ public profiles on Google Maps-boosting organic visibility based on real customer feedback.

AI-powered advertising features baked into Google Pay for Business app simplify ad creation processes helping merchants attract more clientele efficiently without needing deep marketing expertise.

A Massive User Base drives Confidence in New Financial Offerings

- Total unique users: Over 530 million individuals have completed at least one transaction using Google Pay;

- Migrant small merchants onboarded: more than 23 million businesses utilize Google’s platform;

This extensive footprint provides strong assurance that newly launched financial products will resonate well among digitally savvy consumers familiar with smooth mobile payments across both urban centers and rural areas alike.