India’s Evolving Strategy to Propel Deep Tech Innovation

Startups focused on deep technology sectors such as space exploration,semiconductor fabrication,and biotechnology frequently enough face substantially longer development timelines than conventional startups. Acknowledging these unique demands, india is overhauling its startup policies and increasing public funding to better accommodate the extended growth phases typical of deep tech enterprises.

Enhancing Policy Support for Long-Term Deep Tech Growth

The Indian government has recently amended its startup criteria by doubling the eligibility period for deep tech companies from 10 years to 20 years. Alongside this extension, the revenue threshold for tax benefits and regulatory incentives has been raised from ₹1 billion (about $11 million) to ₹3 billion (approximately $33 million). These changes are designed to align policy frameworks with the inherently prolonged innovation cycles characteristic of science-driven ventures.

This policy shift forms part of a larger initiative aimed at cultivating a robust ecosystem for deep technology in India.Central to this vision is the ₹1 trillion (around $12 billion) Research, Development and Innovation Fund (RDI), established last year to provide patient capital tailored specifically for R&D-intensive startups. Complementing government efforts, a consortium of venture capital firms from both India and the U.S.-including Lightspeed Ventures India, Matrix Partners India, Elevation Capital, Qualcomm Ventures-and global chipmaker Intel have collectively pledged over $1.2 billion toward nurturing emerging deep tech companies through the newly formed India Deep Tech Alliance.

Tackling Funding Barriers Beyond Initial Stages

A notable challenge faced by founders in deep tech has been losing thier startup status prematurely under previous regulations-often before achieving commercialization milestones-resulting in misleading perceptions about their viability based on arbitrary time limits rather than technological progress. By explicitly recognizing deep tech firms within regulatory frameworks,fundraising obstacles are reduced while access improves for follow-on investments and government support programs.

Despite these regulatory enhancements easing early-stage pressures, investors continue highlighting difficulties in securing considerable capital beyond seed rounds due to high costs associated with scaling complex technologies like quantum computing or synthetic biology platforms. The RDI fund aims precisely at bridging this financing gap by injecting long-term resources into Series A rounds and subsequent stages without compromising private sector investment discipline.

“The strength of the RDI framework lies in channeling public funds through vehicles that adopt private investment horizons,” states Anjali Mehta from Matrix Partners India. “This model helps close persistent funding gaps while maintaining commercial rigor.”

Preventing Support Loss During Critical Scaling Phases

Sanjay Rao of elevation Capital emphasizes how India’s updated policies help avoid what he calls a “graduation cliff,” where startups lose essential backing just as they begin scaling operations-a common pitfall previously encountered by many science-led ventures.

The operational rollout of the RDI fund is progressing swiftly with initial fund managers appointed and further selections underway. Unlike traditional fund-of-funds approaches that invest indirectly via othre funds only, this vehicle plans direct equity participation alongside credit facilities and grants targeted at promising startups across sectors such as advanced materials engineering or renewable energy technologies.

The Rising Trajectory of india’s Deep Tech Ecosystem

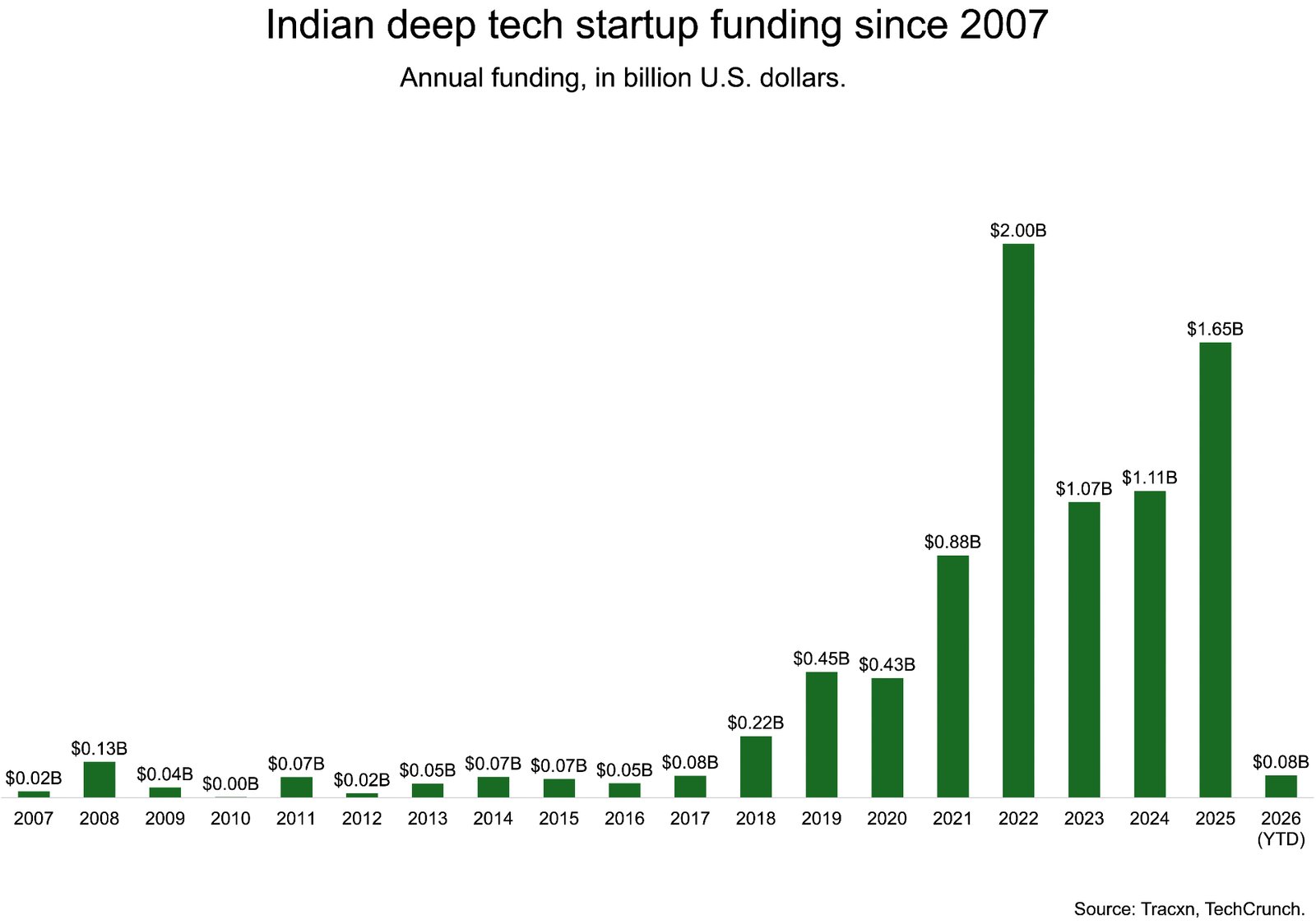

Although still nascent compared with global leaders like China or the U.S.-where American firms secured nearly $160 billion in funding during 2025 alone versus India’s approximately $1.8 billion-the Indian market demonstrates accelerating investor enthusiasm following a slowdown after peak investments recorded in 2023.

- Cumulative funding raised by Indian deep tech startups now surpasses $9 billion globally.

- This resurgence reflects intensified focus on strategic areas including defense innovation, climate technology , semiconductor manufacturing capabilities, advanced manufacturing , among others aligned closely with national priorities.

- The trend indicates growing appetite among investors for patient capital compatible with longer development horizons typical within frontier technology domains.

Navigating Global Competition While Leveraging Domestic Assets

The gap between India’s current investment scale relative to international benchmarks highlights ongoing challenges despite abundant domestic engineering talent fueling innovation pipelines. Sustained policy support combined with expanding private-public partnerships remains critical to catalyze deeper investor engagement over time amid intensifying global competition.

A Vision Anchored in long-Term Technological Breakthroughs

The extension of recognized startup lifespans sends an critically important signal internationally: New Delhi is committed not just to short-term gains but sustained backing for breakthrough technologies requiring decade-long gestation periods.

rohit Sharma from Lightspeed Ventures notes that although immediate shifts in investment patterns may take time due to inherent risks involved, “this regulatory clarity reassures investors about stable conditions throughout lengthy product development cycles.”

This approach draws lessons from mature ecosystems across Europe and North America where patient frameworks underpin frontier research commercialization effectively over extended durations without abrupt policy reversals disrupting progress trajectories.

while it remains uncertain whether these reforms will fully stem tendencies among indian entrepreneurs relocating headquarters abroad; nevertheless,

the improved runway strengthens incentives encouraging founders both buildup & sustainment

of cutting-edge enterprises domestically amid evolving market dynamics including expanding local IPO opportunities supported by growing interest within national stock exchanges over recent years.

Such developments could alleviate pressure points historically driving incorporation overseas while procurement considerations & late-stage financing options continue influencing ultimate scaling decisions globally.

Ultimately,the true test will be whether India can nurture multiple world-class success stories competing robustly on international stages-a milestone signaling maturation beyond mere financial inputs into tangible technological leadership.

Anjali Mehta summarizes:

“Creating ten globally competitive deep tech champions originating here would signify meaningful validation that our ecosystem has reached critical mass capable of sustained impact.”