Chinese AI stocks Surge Amid New Model Releases and Government Backing

Breakthroughs in china’s AI Sector Ignite Investor Enthusiasm

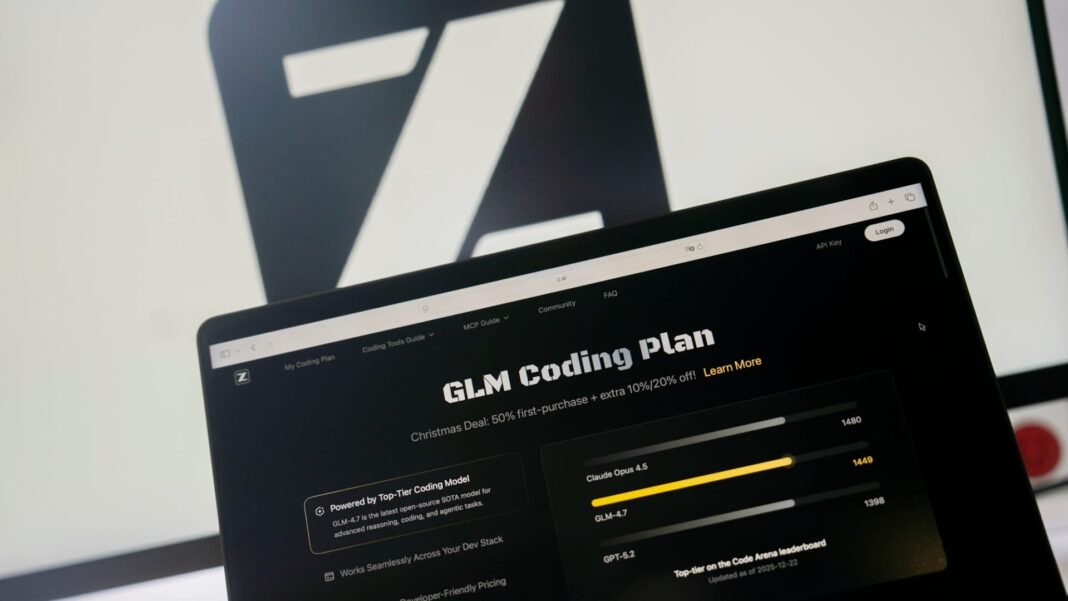

The Chinese artificial intelligence industry has recently experienced a significant uplift, driven by the launch of advanced AI models alongside strong governmental initiatives promoting widespread technology adoption. Hong Kong-listed Zhipu AI, operating as Knowledge Atlas Technology, saw its stock soar by 30% after unveiling its latest GLM-5 model. This open-source large language model features enhanced coding abilities and improved performance in handling complex agent-based tasks.

Zhipu asserts that GLM-5 matches the coding proficiency of Anthropic’s Claude Opus 4.5 while surpassing Google’s Gemini 3 Pro in select benchmarks, though these claims await independent verification.

Key Competitors Accelerate Innovation with New Releases

MiniMax also made headlines when its shares rose 11% following the introduction of M2.5, an upgraded open-source model emphasizing complex AI agent capabilities on a global platform. The company highlights M2’s design focus on streamlining coding processes and enhancing autonomous agent operations.

This momentum underscores intensifying rivalry among Chinese developers aiming to challenge U.S.-based leaders through rapid innovation cycles and cutting-edge intelligent agents.

ecosystem Partners Ride the Wave of Growth

- UCloud Tech: As a cloud infrastructure provider supporting Zhipu’s operations, ucloud Tech witnessed a remarkable 20% jump in share price, hitting daily trading limits on Shanghai’s exchange.

- SenseTime: Transitioning from facial recognition toward extensive AI software solutions, SenseTime’s Hong Kong-listed shares climbed by 5%, reflecting growing investor confidence.

- DeepSeek: Building on last year’s international spotlight, DeepSeek expanded its flagship model with a larger context window and updated knowledge base to strengthen market positioning further.

- Ant Group: Released Ming-Flash-Omni 2.0-a versatile multimodal open-source system capable of generating speech, music, sound effects, and visuals-broadening creative industry applications substantially.

- Baidu & ByteDance Innovations:

Baidu introduced Ernie Bot Turbo featuring enhanced efficiency for natural language processing tasks while bytedance launched Seedance 2.0-its newest AI-driven video generation app-which sparked rallies among related stocks. Additionally, ByteDance is reportedly partnering with Samsung to develop proprietary chips aimed at boosting domestic AI hardware performance.

The Impact of Policy: Government Fuels Commercial Expansion

The sector’s growth received further impetus when Premier Li Qiang emphasized accelerating “scaled commercialization” of artificial intelligence technologies during recent policy discussions. He outlined plans to improve coordination between power grids and computing resources critical for fostering innovation within China’s expanding tech ecosystem.

Apart from infrastructure upgrades, Beijing aims to create an environment conducive to attracting elite talent while nurturing startups focused on pioneering advancements across various artificial intelligence domains nationwide.

Divergence Between Startups Focused Solely on AI Versus Established Conglomerates

This surge contrasts sharply with broader declines seen among major tech giants maintaining diversified investments across multiple sectors; tencent shares fell roughly 2.6%,Alibaba dropped about 2.1%, while the Hang Seng Tech Index declined nearly two percent amid concerns over stretched valuations globally within the sector during recent market volatility periods.

“Labeling this phase as an ‘AI bubble’ appears premature,” noted JP Morgan Asia Pacific strategist Tai Hui.

He emphasized that investors are increasingly prioritizing companies backed by solid fundamentals rather than speculative hype.

Chinese firms have adopted more conservative capital expenditure approaches compared with their American counterparts-focusing mainly on domestic markets-which may support sustainable long-term growth.”

Navigating Market Volatility: Strategic Opportunities Ahead

The fluctuations observed across global equity markets reflect investors recalibrating valuations for artificial intelligence companies rather than signaling imminent collapse.

Industry experts recommend viewing current price corrections as potential entry points instead of signs indicating systemic risk or overvaluation bubbles-especially given robust earnings reported recently by leading cloud service providers underpinning much infrastructure progress worldwide.

This outlook encourages sustained confidence despite short-term turbulence affecting sectors closely tied to emerging technologies such as generative AI models or autonomous agents commercially deployed since late last year (2024-2026).

A Glimpse Ahead: China Poised for Leadership in global Artificial Intelligence Innovation

The rapid emergence of new large-language models combined with supportive government policies signals china’s ambition not only to catch up but perhaps lead specific segments within global artificial intelligence ecosystems over coming years.

With increasing investments targeting scalable solutions integrating multimodal data processing-including seamless combinations of text generation alongside audio/video synthesis-the nation aims at expanding practical applications ranging from enterprise automation tools through creative content production platforms accessible worldwide.

Zhipu’s GLM series along with contemporaries like MiniMax mark pivotal milestones representing this transformative journey into next-generation machine learning capabilities optimized both technically and commercially across diverse industries today-and tomorrow alike globally.