James Cameron Raises Alarm over Theatrical Film Industry Amid Netflix-Warner Bros. Merger

Uncertainty Clouds the Future of Movie Theaters

Renowned director James Cameron, celebrated for cinematic milestones such as “Avatar,” has voiced serious concerns regarding the potential fallout if Netflix finalizes its takeover of Warner Bros. Discovery’s film division. He compares the theatrical movie-going experience to a “sinking ship” threatened by this consolidation, warning that it could fundamentally alter Hollywood’s ecosystem and jeopardize countless jobs.

In a letter addressed to Senator Mike Lee, chairing the Senate subcommittee on antitrust and consumer protection, Cameron cautioned that merging Netflix’s streaming dominance with Warner Bros.’ historic studio operations might led to fewer films debuting in theaters and reduced opportunities for filmmakers across all levels.

Theater Releases and Employment at Risk

Cameron emphasized his lifelong commitment to cinema as an art form, underscoring how vital theatrical exhibition remains in his creative workflow despite films also reaching digital platforms later. Warner Bros., which typically launches about 15 theatrical releases annually, plays a crucial role in supplying content that supports struggling cinemas amid evolving viewer habits and declining production volumes.

The filmmaker fears that integrating with Netflix-a company focused primarily on direct-to-consumer streaming-could shrink both the number of feature films produced and deter studios from financing diverse projects. This contraction would inevitably result in significant job losses throughout Hollywood’s extensive workforce.

Preserving america’s Cultural Influence Through Film

Cameron also highlighted broader economic stakes beyond entertainment alone.While industries like U.S. steel manufacturing have lost global prominence over recent decades, American movies remain one of the nation’s most powerful cultural exports worldwide.

“Although America no longer leads sectors like automotive or steel,” he remarked,“it still holds a dominant position globally in filmmaking-and this merger threatens to erode that advantage.”

Netflix’s growth Strategy: Expansion or Contraction?

Netflix executives defend their acquisition plans by pointing to commitments exceeding $20 billion toward film and television production through 2026-much of which is slated for domestic investment including new studio facilities opening soon in states like New Mexico and New Jersey.

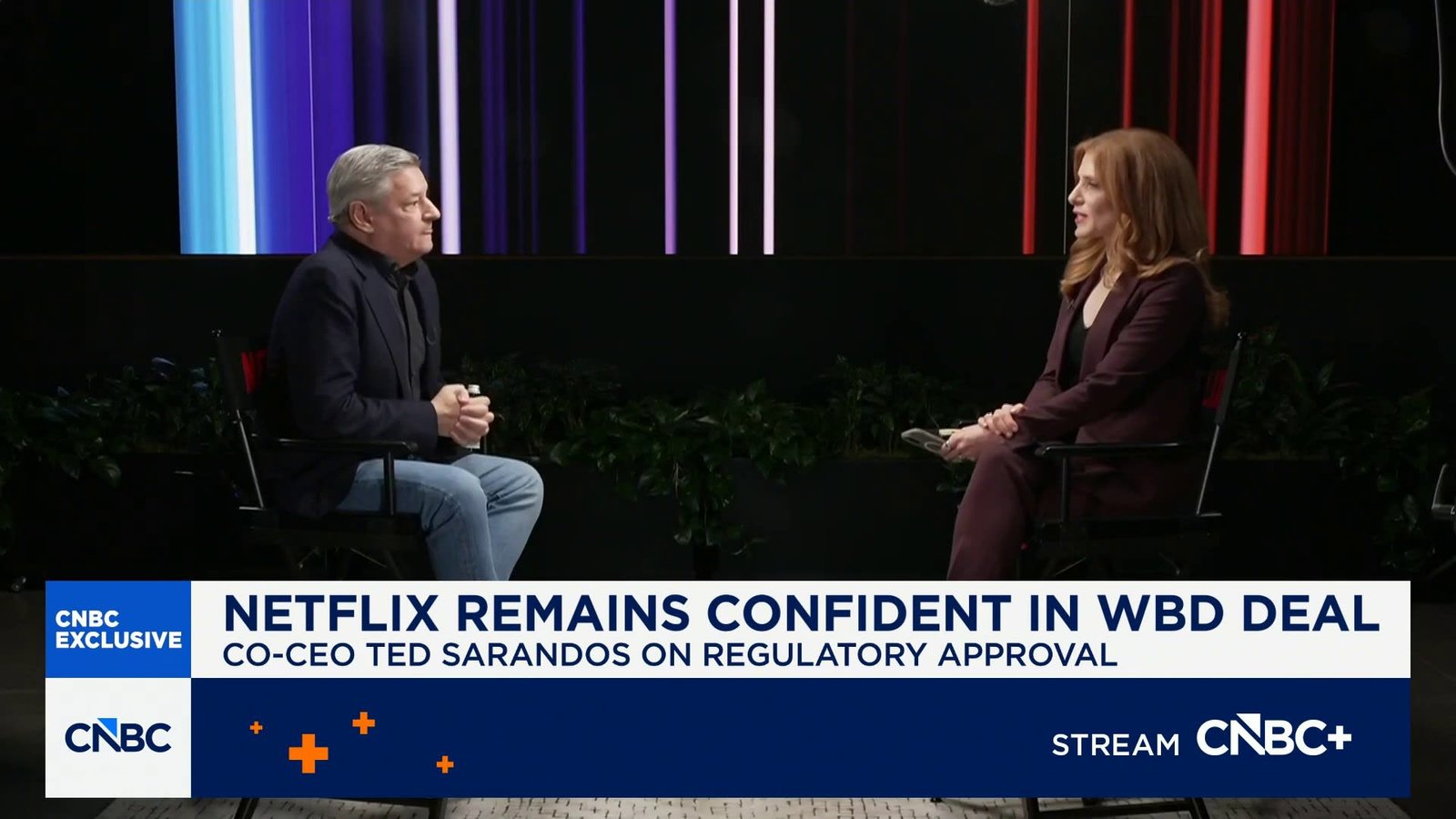

Ted Sarandos, co-CEO at Netflix, describes the deal as advantageous not only for consumers but also for fostering innovation and sustaining employment within creative sectors. despite widespread layoffs across media companies nationwide recently, Sarandos insists they plan to retain experienced teams from Warner Bros., aiming to grow rather than reduce creative output under their umbrella.

“We need those seasoned teams running these businesses,” Sarandos stated during an earnings call where he labeled the merger “pro-consumer” and “pro-worker.”

A Broader Competitive Landscape Beyond Studios

Sarandos further argued competition extends well beyond customary studios or streaming services alone; it includes social media platforms such as TikTok alongside cable networks-making Netflix just one among many contenders vying globally for viewers’ attention.

Tightening Regulatory Oversight Amid Industry Consolidation

The proposed merger has ignited regulatory scrutiny due to concerns over market concentration given Netflix’s 330 million global subscribers combined with HBO Max’s approximately 130 million users reported recently. Lawmakers are examining potential effects on pricing models and consumer choice resulting from merging two major streaming giants into one entity.

This transaction has even spurred rival bidders like Paramount Skydance into launching competing offers aimed at acquiring Warner Bros., citing similar worries about industry consolidation harming creativity and employment prospects within Hollywood.

Theater Industry Faces Crossroads Between Innovation and Tradition

Cameron himself is no stranger to pushing technological boundaries; he pioneered high-frame-rate filming techniques along with immersive visual effects tailored specifically for theater experiences including advanced 3D productions designed around audience engagement.

However, this passion contrasts sharply with comments from some Netflix leaders who have dismissed movie theaters as outdated venues misaligned with their core business model-a stance conflicting directly with traditional theatrical distribution systems supporting hundreds of thousands employed nationwide through exhibition chains alone.

Skepticism Surrounding Long-Term Theater Commitments

- The current agreement: A minimum exclusive theatrical window lasting 45 days before digital release;

- Cameron’s doubts: He questions whether these promises will hold once full ownership transfers occur given inherent tensions between streaming-first priorities versus cinema-focused distribution models;

“Once they fully control a major studio,” Cameron warns,“the future of theaters becomes uncertain-the ship may either sail forward or sink.”

A Defining Moment For Both Film and Streaming Sectors Worldwide

This critical juncture underscores ongoing tensions between rapidly evolving digital consumption patterns versus preserving cherished cinematic traditions upheld by creators like James Cameron who view theaters not merely as venues but essential artistic spaces nurturing communal storytelling experiences across cultures.