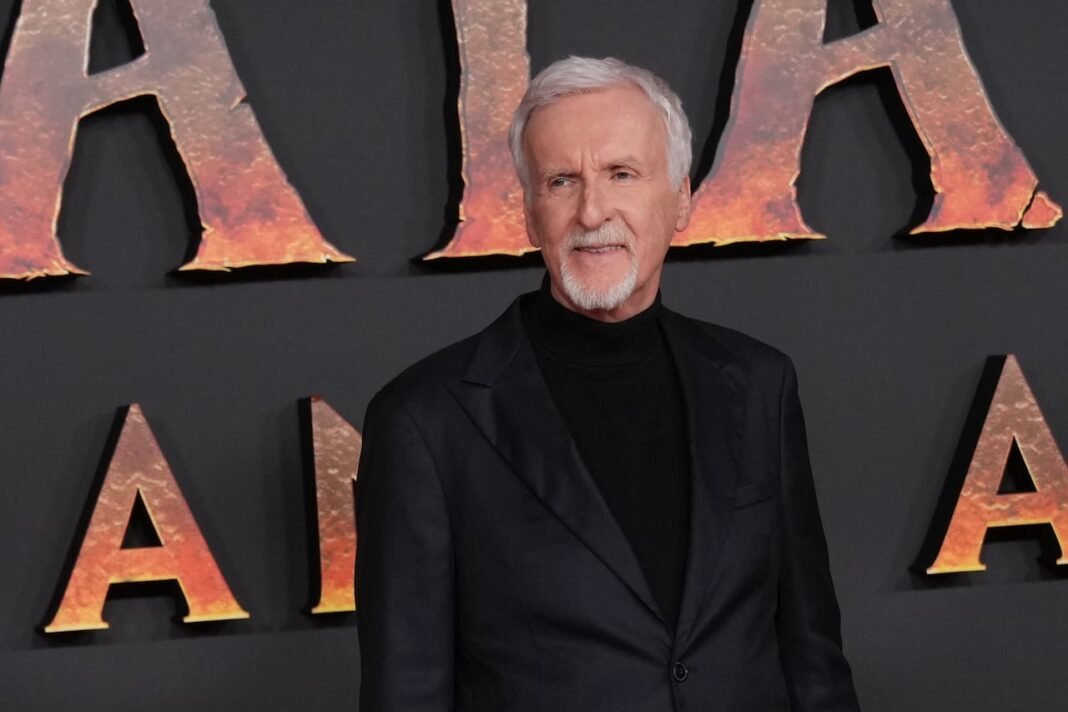

James Cameron Calls on U.S.Senate to Block Netflix’s Warner Bros.Discovery Takeover

Acclaimed Canadian director James Cameron has publicly opposed Netflix’s bid to acquire Warner Bros. Discovery, urging a U.S. Senate subcommittee to intervene and prevent the merger. He warns that this deal coudl jeopardize conventional movie theaters and instead advocates for Paramount Skydance’s competing offer.

Contenders in the Warner Bros. Acquisition Race

The battle for control over Warner Bros. Discovery features two distinct proposals, each with unique strategies for shaping Hollywood’s future.

- Netflix’s Proposal: The streaming powerhouse aims to absorb major assets such as HBO, HBO Max, Warner Bros.’ film and TV studios,along with DC Studios-integrating them into its expansive content ecosystem.

- Paramount Skydance’s Offer: This rival bid seeks extensive ownership of all studios, streaming services, cable networks including CNN-substantially broadening Paramount’s media reach.

The Future of Movie Theaters at Stake

Cameron cautions that Netflix’s acquisition might diminish the theatrical experience by favoring direct-to-streaming releases over traditional cinema runs. Although netflix has experimented with limited theatrical windows recently-often releasing films exclusively on its platform shortly after brief theater showings-the company’s co-CEO Ted Sarandos once described movie theaters as an “outdated concept.” Despite this history, since announcing their bid in late 2025, Netflix has committed to preserving theatrical releases alongside home viewing options.

The streamer confirmed plans to maintain a 45-day exclusive theatrical window for new Warner Bros. titles in an effort to balance both distribution channels effectively.

Paramount Skydance: A Strong Advocate for Cinemas

In contrast, Paramount Skydance pledges over 30 annual film releases exclusively in theaters before transitioning titles onto streaming platforms like Paramount+. As one of Hollywood’s “big five” studios-including Walt disney Studios and Sony pictures Entertainment-Paramount depends heavily on box office revenue and is motivated to uphold longer theater exclusivity periods than typical streaming-first models.

Evolving Streaming dynamics: What Lies Ahead?

If either acquisition succeeds, it will dramatically alter global content access-including markets like Canada where HBO programming is licensed through Bell Media’s Crave under long-term agreements.

A merger led by Netflix could centralize vast premium content within a single dominant platform; alternatively,a Paramount-led deal would strengthen its own service while incorporating additional cable networks such as CNN into its portfolio. For consumers already subscribed separately to platforms like Netflix or Paramount+, these changes may mean more consolidated libraries but also raise concerns about rising subscription costs and reduced competition across the industry landscape.

The Impact on Employment within the Industry

The Directors Guild of America (DGA), under director Christopher Nolan since early 2024 leadership changes, is closely watching potential job losses tied to these mergers due to overlapping roles across companies. Nolan acknowledges consolidation often leads to workforce reductions but stresses ongoing discussions aimed at safeguarding creative professionals involved throughout production pipelines nationwide.

Tightening Regulatory Scrutiny Amid Media Consolidation Fears

“Consolidation drives up consumer prices while limiting choices,” stated California Attorney General Rob bonta regarding antitrust concerns surrounding these deals.

“Such mergers threaten competition essential for innovation and fair market pricing.”

This viewpoint aligns with lawmakers’ warnings who have labeled both bids risky: Senator Elizabeth Warren called Paramount’s unfriendly takeover attempt a “five-alarm antitrust fire,” emphasizing dangers related especially to news media concentration given CNN’s inclusion; she also described the proposed Netflix-Warner merger as an “anti-monopoly nightmare” likely resulting in higher subscription fees without viable alternatives for consumers.

A Challenging Path Through Approval Processes

Beyond congressional examination lies regulatory review from agencies such as the Federal Communications Commission (FCC) alongside state-level antitrust authorities tasked with determining whether either transaction benefits public interest without harming economic competition or workforce stability within entertainment sectors nationwide.

A Defining Moment Approaches for Hollywood Powerhouses

This high-stakes contest between two influential bidders signals profound transformations not only in how films are produced but also where audiences consume them-from bustling multiplexes filled with eager viewers down through homes illuminated by countless screens worldwide.

Cameron’s intervention highlights growing industry concern about protecting cinematic traditions amid rapid digital disruption-and underscores broader debates around monopolistic practices reshaping today’s media environment.

The final decision will resonate far beyond corporate boardrooms: influencing filmmakers’ careers,moviegoers’ experiences ,and a global audience craving diverse storytelling across multiple platforms alike.