Nvidia’s Market Valuation Skyrockets Driven by AI Hardware Boom

Historic Market Capitalization Achievement

During intraday trading, Nvidia’s market value briefly exceeded an remarkable $4 trillion, a landmark moment for the semiconductor giant leading advancements in generative artificial intelligence. Even tho the stock ended the day with a 1.8% increase, it’s closing valuation stood just below this peak at $3.97 trillion, cementing Nvidia’s status as the world’s most valuable company.

Surpassing Established Technology Leaders

This remarkable feat places nvidia ahead of tech behemoths like microsoft and Apple, both of which have previously surpassed $3 trillion in market capitalization.Notably, Microsoft remains one of Nvidia’s largest customers, highlighting a important collaboration within the technology sector. Furthermore,Nvidia is distinguished as the first firm ever too reach such an elevated market cap during active trading hours.

The catalyst: Explosive Demand for AI-Specific Chips

since its founding in 1993 and headquartered in California, Nvidia has witnessed exponential growth fueled by surging demand for AI-focused hardware solutions. The company crossed a $2 trillion valuation milestone earlier this year before rapidly advancing past $3 trillion by mid-2024-a trajectory largely propelled by breakthroughs such as ChatGPT’s debut in late 2022.

GPUs Powering Next-Generation AI Models

Nvidia has become indispensable through its production of graphics processing units (GPUs), which serve as foundational components enabling large language models and other refined artificial intelligence applications globally.

Investor Optimism Amidst Market Volatility

Nvidia’s stock performance over recent years reflects strong investor confidence despite various challenges; shares have surged more than fifteenfold over five years. In just the past month alone, shares rose over 15%, contributing to gains exceeding 22% since January 2024.

Tackling Geopolitical Challenges and Export Limitations

The company continues to thrive even amid geopolitical tensions and export restrictions that curtail sales to China-one of its key markets valued at approximately $50 billion annually. earlier concerns emerged when China introduced DeepSeek technology suggesting future AI systems might require fewer chips; however, these worries have since eased considerably.

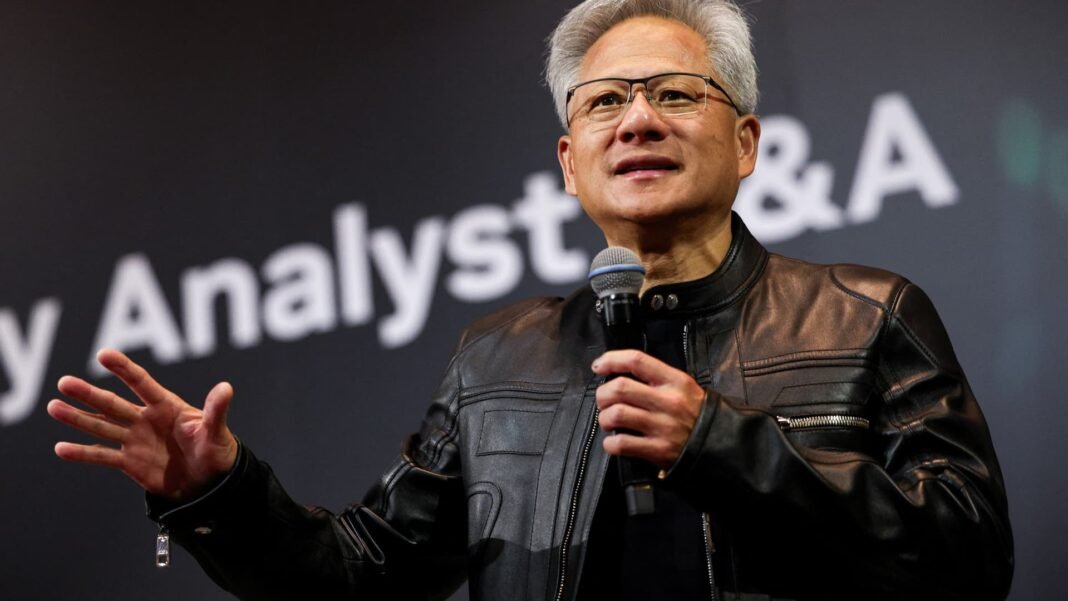

“U.S.-imposed bans on selling H20 chips to China are projected to cause around $8 billion in lost revenue,” explained CEO jensen Huang during an earnings call earlier this year.

Huang underscored that losing access to China’s vast consumer base would represent “a tremendous setback” for Nvidia’s growth prospects and global influence within semiconductor manufacturing sectors.

A Transformative Phase for Semiconductor Industry Dominance

The accelerating demand for specialized AI hardware not only solidifies Nvidia’s leadership but also exemplifies broader shifts reshaping worldwide supply chains amid intensifying technological rivalry between major global powers.

An Analogy from electric Vehicle Battery Competition

This scenario parallels trends observed within electric vehicle battery manufacturing where companies securing essential raw materials gain strategic leverage-similarly illustrating how mastery over advanced chip technologies can determine future innovation leadership across diverse fields including cloud computing and autonomous vehicles.