Nvidia’s Financial Surge Amidst Expanding AI Landscape

As a frontrunner in artificial intelligence technology, Nvidia recently disclosed its quarterly financial results, revealing yet another record-setting revenue milestone driven by the accelerating AI revolution. despite robust sales growth, profit expansion slowed noticeably due to newly imposed U.S.export restrictions affecting its business dealings with China.

Investor Response and Revenue Achievements

Following the release of stronger-than-anticipated earnings, Nvidia’s stock price rose by 3%, closing at $138 per share. The company reported quarterly revenue of $44.1 billion for the period ending April 27, surpassing Wall Street’s consensus estimate of $43.3 billion compiled by FactSet analysts.

This figure marks an notable 69% year-over-year increase and eclipses the previous quarter’s record revenue of $39.3 billion.

Profit Growth Slows Amid Regulatory Hurdles

Nvidia outperformed earnings forecasts with adjusted diluted earnings per share reaching $0.83 compared to expectations of $0.73,while net income hit $19.9 billion versus a predicted $18.3 billion-representing a 33% rise from last year.

This growth rate contrasts sharply with Nvidia’s earlier streak of more than 70% annual profit increases sustained over seven consecutive quarters.

The slowdown is primarily attributed to a one-time charge near $4.5 billion linked to export controls enforced by Washington on Nvidia’s H20 AI chips destined for China-a market estimated at approximately $50 billion according to Rosenblatt Securities analysts.

Forecasted Effects and Margin Dynamics

Revenue Projections impacted by Export Restrictions

Nvidia expects these new export constraints on its advanced H20 chip technology will reduce revenues by about $8 billion in the upcoming summer quarter alone.

Gross Margin Trends Reflect Temporary Challenges

The company recorded a gross margin of 61% last quarter-the lowest since 2022-indicating margin pressure caused by geopolitical tensions and supply chain disruptions. However, Bank of America forecasts margins will recover toward approximately 75% before year-end as operational efficiencies improve and market conditions stabilize.

Nvidia’s Command Over AI Hardware Market Share

Nvidia continues to dominate as the leading designer of semiconductor components critical for powering generative AI platforms like OpenAI’s chatgpt and Tesla’s autonomous driving technologies. Its graphics processing units (GPUs) hold an estimated commanding share near 75% within this rapidly growing sector focused on accelerating artificial intelligence workloads.

This leadership has elevated Nvidia into elite ranks among global tech giants; its current market capitalization hovers around an impressive $3.3 trillion-just shy of microsoft’s top valuation near $3.4 trillion-as investors remain heavily invested in AI-driven growth prospects following ChatGPT’s launch that ignited widespread corporate enthusiasm starting late 2022.

A transformational Rise From Modest Origins

The story behind Nvidia is remarkable considering its humble beginnings: cofounders first met over breakfast at a Denny’s diner back in 1993 before building what would evolve into one of Silicon Valley’s most influential companies today-a journey akin to planting seeds that grew into towering redwoods within decades rather than centuries.

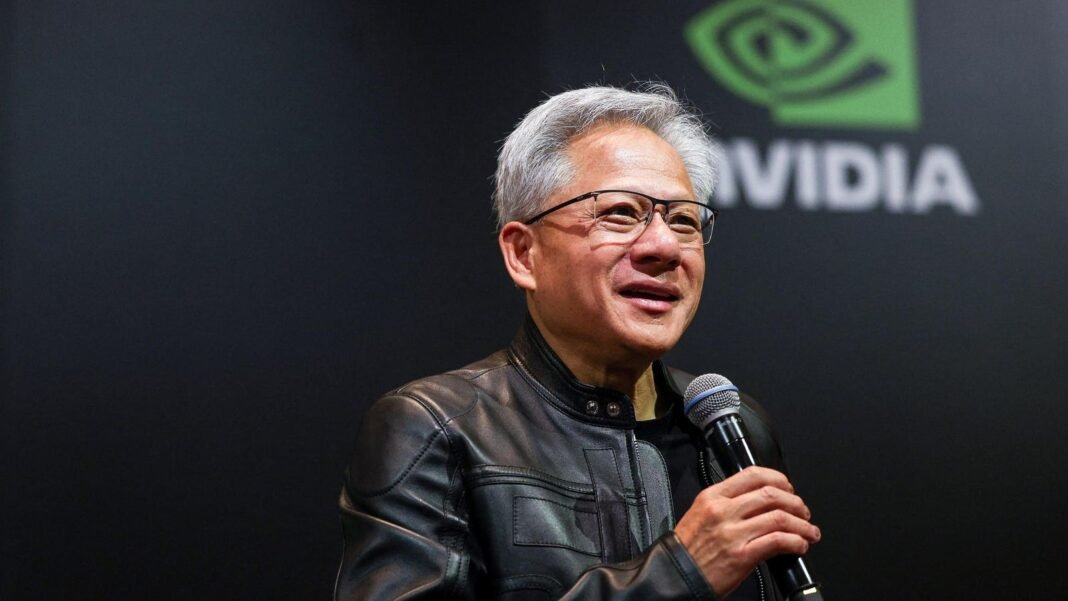

The Visionary Leadership Steering Success

Jensen Huang-the sole CEO as inception-has transformed his early career experience working as a busboy into extraordinary wealth; he now ranks as the world’s eleventh-richest individual with an estimated net worth exceeding $119 billion based on recent valuations reflecting his pivotal role in steering Nvidia through rapid technological evolution and market expansion.

Stock Performance Leading Up to Earnings Release

Pretax trading saw shares dip slightly around half a percent to roughly $134.81 amid cautious investor sentiment ahead of this crucial earnings proclamation-a key event often triggering broader market movements given Nvidia’s outsized influence across sectors tied closely to technological innovation and artificial intelligence development trends.

Market analysts suggest that only another “positive earnings surprise” could further elevate stock prices after recovering strongly from tariff-related setbacks earlier this spring when major indices such as the S&P500 gained nearly six percent during May-their best monthly performance since last year.