JPMorgan Chase’s Bold Branch Expansion Transforms U.S. Banking Landscape

Expanding Horizons: From Regional Roots too Nationwide Reach

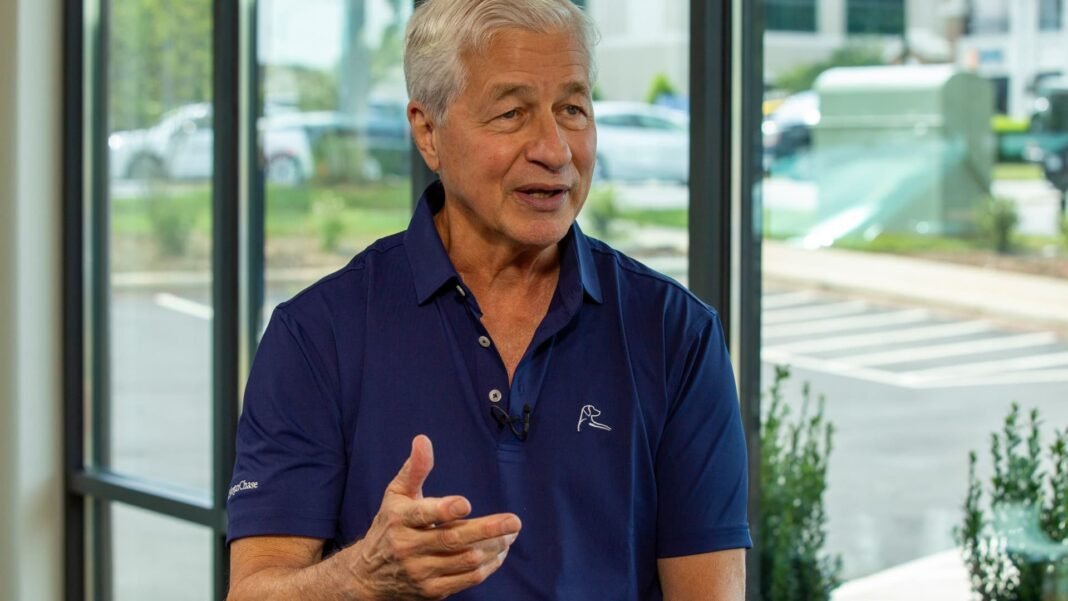

in recent years, JPMorgan Chase has embarked on an aggressive campaign to broaden its physical footprint, unveiling over 1,000 new branches across the United States. This expansion surpasses the combined branch totals of many leading competitors and marks a notable milestone in the bank’s growth strategy. The initiative was highlighted during a grand opening event in Charlotte, North Carolina, were leadership emphasized their unwavering commitment to extending their retail banking presence.

Today, JPMorgan Chase operates close to 5,000 branches nationwide-the largest network among U.S. banks according to the latest Federal Reserve statistics-cementing its role as a dominant player in retail banking.

A Nationwide Footprint: Strategic market Penetration and Growth Plans

Back in 2018, JPMorgan Chase maintained operations in only 23 states but announced aspiring plans to enter up to 20 additional markets by adding roughly 400 new locations within five years. By mid-2021, this vision materialized with branches established throughout all contiguous states except Alaska and Hawaii.In early 2024, the bank revealed an even more expansive multibillion-dollar project aimed at launching another 500 branches by 2027.

This ongoing expansion reflects not just growth ambitions but also a strategic response to shifting demographics and evolving customer preferences across diverse regions.

The Competitive Ripple Effect: How Rivals Are Reacting

The rapid increase of JPMorgan’s branch network has spurred other major banks into action amid intensifying competition for deposits nationwide. As an example, Bank of America recently announced plans for adding approximately 150 new financial centers by decade’s end while committing over $5 billion toward these developments.

Similarly,wells Fargo is poised for accelerated growth after lifting regulatory constraints that previously limited branch openings; it now targets expanding its footprint considerably with particular focus on metropolitan hubs such as New York City and Chicago.

The Revival of Physical Banking Post-pandemic

After decades marked by steady declines due largely to digital banking adoption following the financial crisis of 2008,the pandemic triggered demographic shifts that encouraged banks like JPMorgan Chase to rethink their geographic strategies-and reinvest heavily in brick-and-mortar locations once again.

This renewed emphasis on physical branches aims at capturing deposits more effectively while serving communities experiencing rapid population growth or economic change-such as Sun Belt cities witnessing influxes of younger residents relocating from higher-cost urban areas.

Charlotte: A Strategic Battleground for Market Share

The choice of Charlotte as a focal point underscores fierce competition between JPMorgan Chase and Bank of America-the latter holding approximately a commanding 71% local market share according to industry analysts KBW and S&P Global Market intelligence. Following recent expansions,JPMorgan now operates around seventy-five branches throughout North Carolina-a state noted for its youthful demographic surge alongside rising wealth inflows driven by tech sector growth and corporate relocations.

Economic Impact & Future Projections

- $160 billion+: Estimated incremental deposits expected from newly opened locations over time based on current projections.

- Four-year profitability horizon: each branch is anticipated to reach break-even within four years after launch due primarily to optimized operational efficiencies combined with strong local demand.

- Total planned additions: More than 1,100 new branches will be introduced nationally, complemented by renovations at nearly 4,300 existing sites.

- Eighty+ emerging markets:The expansion will bring services into numerous previously underserved or untapped regions across America-including fast-growing suburban corridors outside major metro areas like Atlanta and Dallas-Fort Worth.

An estimated three out of four Americans will live within convenient driving distance from one of JPMorgan’s accessible locations once these initiatives are fully realized-significantly enhancing customer convenience nationwide through increased accessibility combined with personalized service offerings tailored regionally.

“Our extensive network build-out exemplifies our long-term commitment toward lasting retail banking growth,” stated senior executives at Chase Consumer Banking. “Our scale now surpasses many regional competitors combined.”

A New Chapter for Branch banking Amid Digital Innovation

this resurgence highlights how customary bank branches continue playing an essential role despite rapid advances in digital technology-serving as vital centers for personalized advice especially among younger generations relocating into dynamic metropolitan areas such as Austin or Nashville today.

A recent survey found nearly half of millennials still prefer visiting physical bank offices when making complex financial decisions like home purchases or retirement planning-even though they rely heavily on mobile apps daily for routine transactions.