unpacking the Windsurf-Google Agreement: Implications for Founders, investors, and Staff

A Multifaceted Deal with Varied Consequences

The proclamation that Google invested $2.4 billion to license Windsurf’s technology while concurrently recruiting its CEO and key team members has sparked widespread discussion among startup founders and employees across Silicon Valley. This complex transaction highlights the diverse effects such deals can have on different groups within a company.

detailed Overview of the $2.4 Billion Arrangement

Insider facts reveals that Google’s payment was split evenly into two parts. One half-$1.2 billion-was paid directly to investors as returns on their stakes in Windsurf.

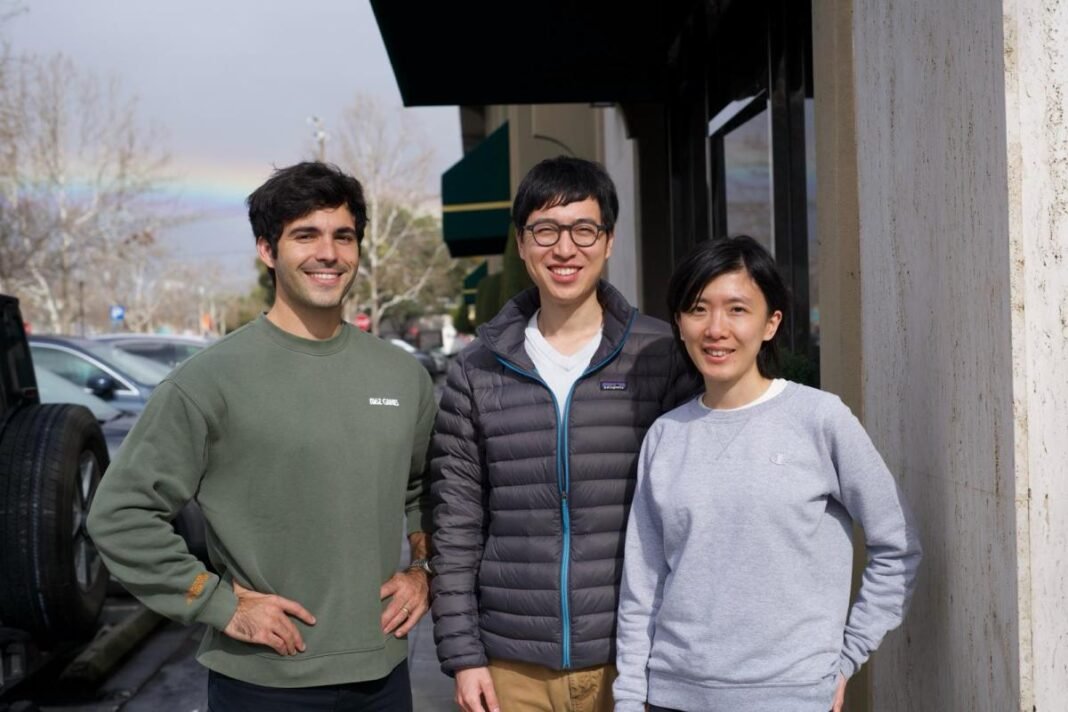

The other $1.2 billion was allocated as compensation packages for about 40 Windsurf employees who transitioned to Google, with co-founders Varun Mohan and Douglas Chen receiving a substantial portion of these funds.

Investor Gains: Examining the Returns

This deal proved highly profitable for venture capital firms backing windsurf, including Greenoaks Capital, Kleiner Perkins, and General Catalyst. Prior funding rounds had raised roughly $243 million by early 2024 at an estimated valuation near $1.25 billion-resulting in nearly fourfold returns for investors.

- Greenoaks capital: Leading both seed and Series A rounds with a 20% ownership stake, Greenoaks reportedly earned approximately $500 million from an initial investment of around $65 million.

- Kleiner Perkins: As lead investor during Series B financing, Kleiner Perkins secured close to triple its original capital through this exit event.

The Employee Experiance: Disparities in Financial Rewards

While founders and investors enjoyed important financial benefits from the acquisition, many of Windsurf’s roughly 250 employees were left without meaningful monetary gains-a stark departure from typical startup buyouts where employee equity often results in payouts or accelerated vesting schedules.

A large segment of staff hired within the past year reportedly received no payout under this deal structure. Additionally, some individuals who joined Google through this transition faced revoked stock grants alongside extended vesting periods lasting up to four more years before full compensation could be realized via Google shares.

The Impact of OpenAI’s Abandoned Acquisition Attempt

Prior negotiations had positioned OpenAI as a potential buyer willing to pay around $3 billion for Windsurf (formerly known as Codeium), which would have significantly raised employee expectations regarding exit-related financial rewards.

This anticipated sale fell apart when OpenAI unexpectedly withdrew its offer; shortly afterward, Google stepped in with an alternative agreement focused primarily on delivering investor returns while securing intellectual property rights and talent without acquiring equity stakes outright.

Cashing Out vs retaining Funds: Post-Deal Controversies

An unusual feature of this transaction involved leaving over $100 million inside Windsurf after Google’s payment-a sum reportedly funded either solely by venture capitalists or jointly by founders alongside investors according to varying accounts from sources close to the matter.

“The retained capital could have enabled payouts comparable per share across all remaining employees,” one insider explained-but distributing it immediately risked exhausting operational funds essential for business continuity amid founder departures.”

divergent Opinions Surround Financial management Strategy

- Certain voices argue withholding cash reserves prevented premature shutdowns but left many workers feeling financially sidelined despite their contributions;

- Others maintain there was adequate liquidity both for employee compensation aligned with deal valuations plus ongoing operations;

Cultural Backlash Over Leadership’s Distribution Choices

This episode has drawn sharp criticism within venture circles concerning perceived imbalances between leadership windfalls versus team rewards during exits at high-growth startups like Windsurf:

“Windsurf illustrates how some founders neglect their teams by not sharing financial successes equitably,” commented industry observers reflecting broader frustration over such practices.”

The Next Chapter: Cognition AI Acquires Remaining Assets and Personnel

In days following uncertainty after Google’s licensing announcement-and amid growing dissatisfaction among non-transitioned staff-the residual entity led temporarily by interim CEO Jeff Wang finalized acquisition terms with Cognition AI Technologies.

- Cognition acquired Windsurf’s intellectual property portfolio along with products developed under its brand;

- The company also absorbed all remaining staff members not recruited into Google’s workforce;

This secondary purchase valued at approximately $250 million provided every remaining employee an opportunity for financial participation tied directly to corporate assets they helped build-addressing earlier grievances stemming from exclusion during Google’s licensing phase.