Next Federal Reserve Chair: Treasury Secretary Details Upcoming Steps

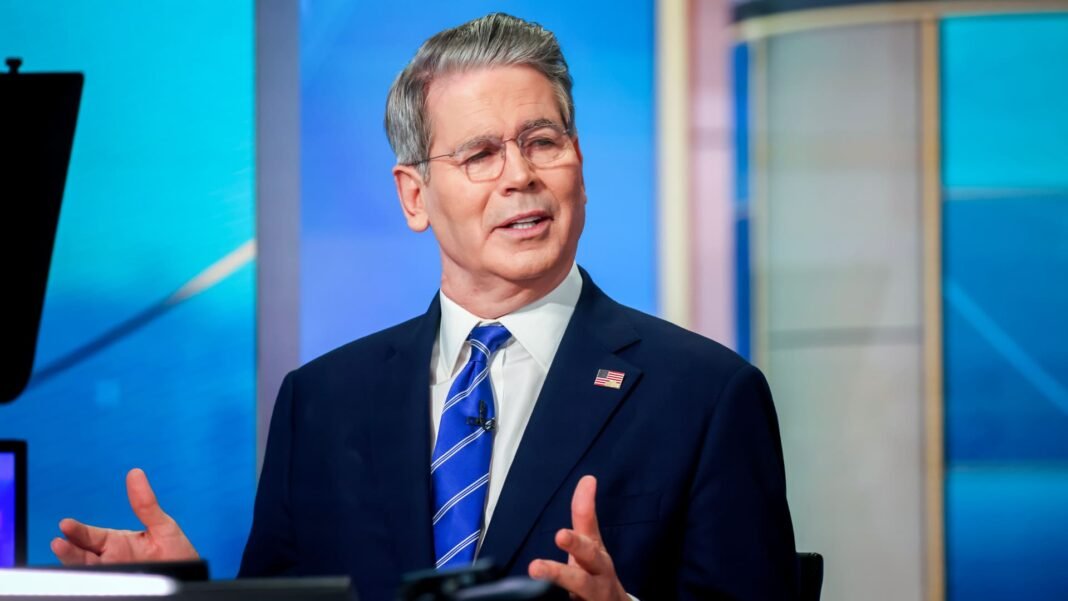

The process to appoint the next Federal Reserve chair is accelerating as Treasury Secretary Scott Bessent revealed plans to start interviewing candidates shortly after Labor Day. This growth comes amid efforts by the White House to streamline an unexpectedly large and competitive pool of contenders aiming to replace Jerome Powell.

robust and Varied Candidate Pool

The shortlist currently includes 11 distinguished individuals, blending former and current central bank officials, economists, and financial market specialists. notable names under consideration are Governors Michelle bowman and Christopher Waller, Dallas Fed President Lorie Logan, White House economist Kevin Hassett, along with former Governor Kevin Warsh. The roster also features investment strategists Rick Rieder from BlackRock and David Zervos of Jefferies, economist Marc Sumerlin, ex-Governor Larry Lindsey, plus former St. Louis Fed President James Bullard.

Interview Phase Approaching Rapidly

Bessent highlighted the caliber of this candidate group during a recent CNBC “Squawk Box” interview, confirming that meetings will commence soon after Labor Day. The objective is to narrow down this list further before submitting final recommendations for presidential approval.

Accelerated Timeline Despite Powell’s Extended Term

Although Jerome Powell’s tenure officially runs through May 2026, internal pressures are mounting to hasten the selection due to urgent economic challenges-especially concerning interest rate policies. The administration is pushing for rate reductions aimed at revitalizing sectors like housing that have struggled amid rising borrowing costs.

Housing Market Constraints Amplify inflation Concerns

Bessent underscored how persistent limitations on new home construction exacerbate inflation by restricting supply while demand remains robust. He proposed that easing interest rates could stimulate building activity over the next few years-perhaps easing housing prices and alleviating inflationary pressures in this critical sector.

Federal Reserve Meeting Expected To Signal Policy adjustment

the Federal Open Market committee (FOMC) will meet on September 16-17 with widespread expectations among analysts for a quarter-point interest rate cut-the first since December 2024. Despite recent data revealing a sharp surge in producer prices-the largest monthly jump in three years-Bessent expressed optimism that much of this inflation spike results from increased portfolio fees tied to elevated stock market valuations rather than basic economic weakness.

Powell’s Jackson Hole Speech May Reveal Future Monetary Strategy

This Friday marks what could be Jerome Powell’s final keynote at the Fed’s annual Jackson Hole symposium in Wyoming-a key event often used by policymakers to hint at future monetary directions. While his address may focus on reviewing long-term policy frameworks updated every five years by the central bank, many expect subtle signals regarding September’s rate decision or broader strategic shifts ahead.