NvidiaS Dynamic Growth Fueled by AI Innovation and Market Expansion

Remarkable Financial Results Driven by AI Infrastructure Demand

Nvidia recently unveiled quarterly earnings that outperformed Wall Street forecasts, underscoring its dominant position in the artificial intelligence infrastructure market. The company posted adjusted earnings per share of $1.05, surpassing the expected $1.01, while generating revenue of $46.74 billion, exceeding projections of $46.06 billion.

This achievement marks Nvidia’s ninth straight quarter with year-over-year revenue growth above 50%, a streak initiated in mid-2023 as generative AI technologies gained widespread adoption worldwide. Although this quarter reflected the slowest growth rate within this period, it still demonstrates remarkable resilience amid evolving market conditions.

Data center Operations: The Core Driver Behind Nvidia’s Expansion

The data center segment continues to be the primary engine for Nvidia’s rapid expansion, delivering revenues of $41.1 billion, representing a 56% increase compared to last year-slightly under analyst expectations of $41.34 billion for the quarter.

Within this division,GPU chip sales dedicated to compute workloads reached approximately $33.8 billion. This figure experienced a minor 1% decline from the previous quarter due to reduced shipments of specialized H20 chips intended for China amid export restrictions.

Networking components crucial for constructing advanced systems contributed nearly $7.3 billion, almost doubling their contribution from last year and highlighting surging demand for integrated hardware solutions tailored to AI applications.

The Role and Challenges Surrounding H20 Chips Amid global Trade tensions

Nvidia has encountered important obstacles shipping its proprietary H20 processors to China because of regulatory constraints, leading to an asset write-down valued at $4.5 billion related solely to these chips.

If commercial shipments had been allowed during this timeframe, these processors might have generated an estimated additional $8 billion in sales last quarter; however, no deliveries were made into Chinese markets recently.

Rather, roughly $180 million worth of H20 inventory was sold outside China territories.

The company anticipates potential revenues ranging between $2 billion and $5 billion from future H20 chip sales should geopolitical conditions ease and U.S export licenses be granted.

A Visionary Outlook on Expanding AI Infrastructure Investments

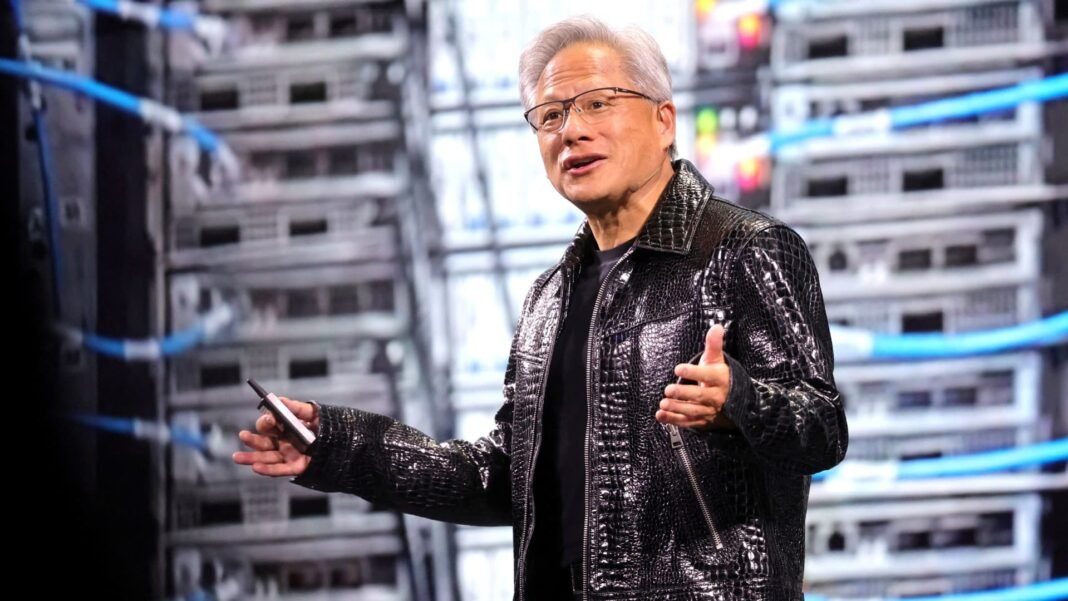

“Global spending on artificial intelligence infrastructure is projected to reach between three and four trillion dollars by 2030,” emphasized Nvidia leadership during recent financial disclosures-highlighting how integral Nvidia remains within global efforts building next-generation computing platforms that power advanced AI breakthroughs.

Diverse Revenue streams Beyond Core Data Centers Fuel Growth Momentum

- Gaming Sector: Despite being overshadowed by AI-focused products recently, gaming revenues surged 49% year-over-year reaching about $4.3 billion; notably, Nvidia is enhancing gaming GPUs capable not only for entertainment but also running certain OpenAI models locally on personal computers-blurring traditional boundaries between gaming hardware and machine learning tools.

- Robotics Division: Emerging rapidly as a high-growth area with quarterly revenues near $586 million;a striking annual increase close to 69%. This reflects ongoing investments into clever automation powered by proprietary chips such as Thor T5000.

- Largest Customers Driving Demand:

Around half of data center revenue stems from major cloud providers actively acquiring Blackwell generation GPUs; these latest products accounted for nearly 70%, or approximately $27 billion of recent data center income alone.

This surge aligns with aggressive infrastructure investments made quarterly by tech giants including meta Platforms, Alphabet (Google), Microsoft, and Amazon-all dedicating tens of billions toward scalable AI model advancement serving millions globally across consumer-facing services and enterprise solutions alike.

Nvidia Stock Performance & Strategic Share Repurchase Initiatives Signal Confidence

Nvidia shares have climbed over 35% so far this year following an almost threefold rise throughout 2024 fueled by investor optimism regarding its leadership role in artificial intelligence hardware markets.

Even though there were minor declines after earnings announcements partly linked to slightly missed data center revenue targets relative to forecasts,

the company reaffirmed confidence through board approval of an unlimited-duration share buyback program capped at $60 billion, supplementing recent repurchases totaling nearly $9.7 billion during just the past quarter alone.

The Road Ahead: Balancing Innovation with Geopolitical Realities

Navigating complex international trade environments remains essential as Nvidia pursues expanded access into critical markets like China while accelerating innovation across product lines-from high-performance GPUs powering massive cloud training clusters down through robotics processors enabling smarter automated machines at scale.

The company’s ability to manage regulatory challenges alongside technological advancements will shape its trajectory well into the coming decade when trillions are expected globally invested toward foundational artificial intelligence ecosystems heavily supported by industry leaders such as nvidia.