JPMorgan CEO Signals Economic Deceleration Amid Revised employment Data

Notable Downward Revision in U.S. Job Numbers

The U.S. Labour Department recently adjusted its nonfarm payroll statistics for the period ending March 2025, cutting nearly 911,000 jobs from previous tallies. This represents the most significant downward revision in over two decades and surpassed Wall Street’s expectations for a negative correction.

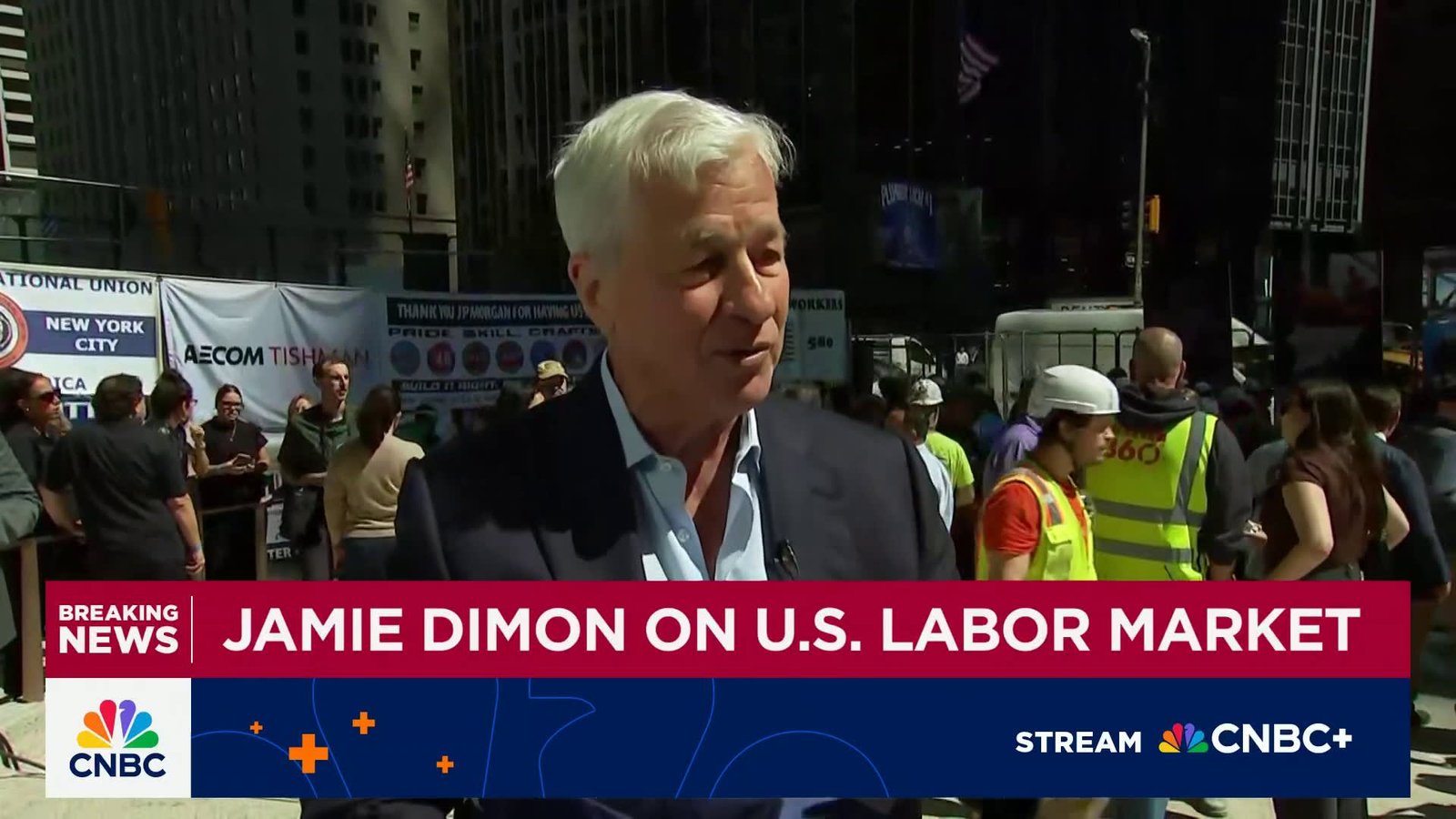

Jamie Dimon’s Perspective on Current Economic trends

Jamie Dimon, the head of JPMorgan Chase, voiced concerns following these updated employment figures. He remarked, “The economy appears to be losing steam. Whether this points to an imminent recession or simply a phase of slower expansion is still unclear.”

Diverse Indicators: Consumer Spending Versus Corporate Earnings

Dimon highlighted that JPMorgan leverages comprehensive data sets encompassing consumer purchasing patterns, corporate earnings reports, and global trade activity. While many Americans remain employed and continue spending-albeit unevenly across different income groups-there are growing indications that consumer confidence is softening.

“Multiple forces shape the economic environment,” he explained,noting a divergence between declining consumer engagement and robust corporate profitability. “we require additional time to see how these opposing trends will unfold.”

Recent Hiring Patterns Point Toward Slower Growth

The latest labor market updates reinforce this cautious stance: July recorded only 73,000 new jobs nationwide-a sharp slowdown compared to prior months-and August added just 22,000 positions. These modest gains highlight ongoing difficulties in expanding employment opportunities.

Tensions Surrounding Labor Statistics Leadership changes

The release of July’s underwhelming job report coincided with President Donald Trump’s abrupt removal of the Bureau of labor Statistics commissioner shortly after publication-a move that sparked debate about transparency in economic data dissemination.

The Federal Reserve’s Approach amid Economic Ambiguity

Looking forward to upcoming monetary policy decisions this month,Dimon expects the Federal Reserve will probably reduce its benchmark interest rate again as part of efforts to stimulate growth; however,he warned such cuts may have limited effectiveness against broader economic headwinds at this juncture.

A Global Lens: Trade Disruptions and Market Fluctuations

The worldwide economy continues grappling with challenges stemming from supply chain interruptions and geopolitical conflicts impacting trade flows-factors closely watched by financial institutions like jpmorgan when evaluating future risks.

Main insight: Despite persistent obstacles reflected in revised employment figures and sluggish hiring during mid-2025, leading financial experts remain vigilant yet uncertain whether these signs indicate an approaching recession or merely a temporary easing in growth momentum.