Exploring the Cost Structure of Robotaxis Versus Customary Ride-Hailing Services

Decoding the Economics of Autonomous Ride Pricing

Robotaxis are often touted as a future solution for affordable urban transportation by cutting down on driver-related expenses and enhancing vehicle usage efficiency. Yet,current market data indicates that autonomous rides still come with a premium price tag compared to conventional ride-hailing options.

San Francisco Fare Analysis: Waymo Compared to UberX and Lyft

A comprehensive month-long study in San Francisco analyzed nearly 90,000 ride quotes from Waymo alongside UberX and Lyft’s standard offerings. Results revealed that Lyft maintained the lowest average fare at $14.44 per trip, followed by UberX at $15.58. In contrast, Waymo’s autonomous rides averaged substantially higher costs around $20.43 per journey.

Higher Costs During Peak Hours Reflect Consumer Interest in Autonomy

The disparity becomes more pronounced during rush hours: Waymo fares surged approximately $11 above Lyft’s prices and nearly $9.50 more than UberX during these busy periods. This pattern suggests many riders are willing to pay extra for the novelty and convenience of driverless travel despite its current expense.

How Fleet Size Limitations and Pricing Strategies Affect Robotaxi Fares

Unlike Uber and Lyft-platforms refined over a decade with refined surge pricing algorithms-Waymo operates with a relatively small but gradually growing fleet constrained by regulatory approvals and technology deployment challenges.

This limited supply leads to greater fare volatility since Waymo relies on simpler supply-demand pricing models rather than dynamic surge mechanisms employed by traditional services where drivers can flexibly log in or out based on demand.

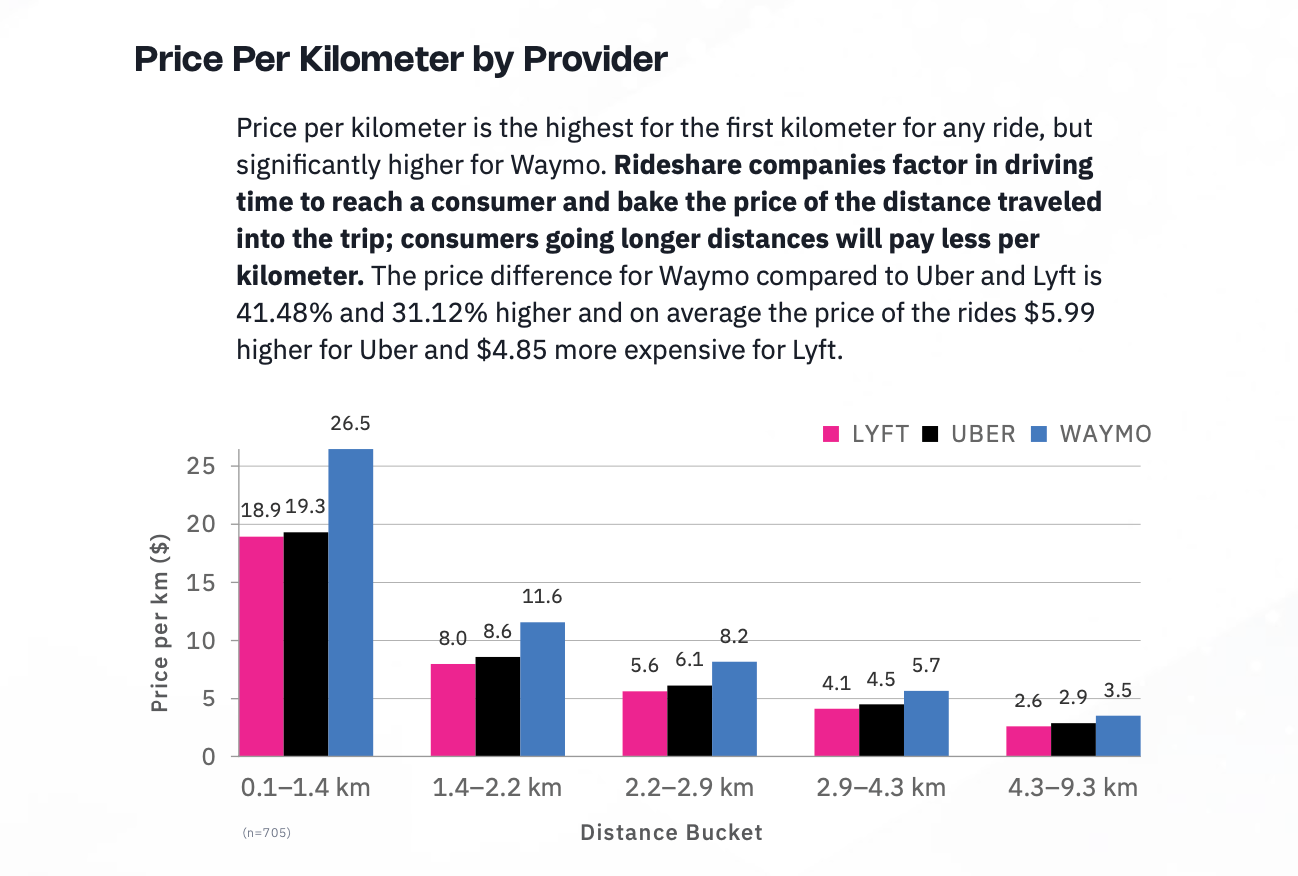

The Disproportionate Expense of Short-Distance Trips in Robotaxis

An interesting trend emerges when examining trip distances: short rides under 1.4 kilometers cost about $26 per kilometer via Waymo-41% higher than comparable trips with UberX and 31% above Lyft rates for similar distances.

For longer journeys between 4 to 9 kilometers, this gap narrows but remains meaningful ($3.50/km for Waymo versus roughly $2.60-$2.90/km for competitors).

The Influence of Waiting Periods on Total Ride Expenses

Wait times before pickup also impact overall costs; extended delays increase expenses as vehicles spend more time idle or traveling without passengers instead of completing multiple profitable trips consecutively.

User Insights Highlight Enthusiasm Coupled With safety Reservations

A survey conducted among riders from Los Angeles, San Francisco, and Phoenix showed strong interest in autonomous vehicles-with roughly 70% preferring driverless cars over traditional taxis or ride-hailing services.

However, safety remains a top priority: nearly three-quarters identified it as their main concern while close to 70% supported some form of remote human monitoring during trips despite ongoing advancements ensuring operational reliability.

Diverse willingness To Pay Mirrors varied Consumer Preferences

- Approximately 40% would pay the same or less compared to existing options;

- An additional 16% were open to paying up to an extra $5;

- Slightly over 10% accepted paying an additional amount up to around $5;

- An equal portion (16%) expressed readiness to spend up to an extra $10 per robotaxi ride.

The Appeal behind Premium Pricing: Privacy And Unique Travel Experience

This willingness aligns with passenger gratitude for the distinct experience offered by robotaxis-a private “sanctuary” free from driver interaction or distractions-a feature increasingly valued amid shifting urban mobility trends worldwide seeking comfort alongside convenience.

The Future Outlook: Scaling Up Robotaxi Accessibility While Reducing Costs

Although robotaxi fares currently exceed those of established platforms like UberX and Lyft due mainly to smaller fleets and simpler pricing frameworks,

recent expansions at manufacturing plants combined with accelerated deployments across major cities indicate promising progress toward closing this price gap.

A notable rise in robotaxi availability has already demonstrated encouraging signs that fare differences will shrink while maintaining high user satisfaction driven by enhanced safety measures plus improved convenience factors.