Transformations in the U.S. Automotive Industry Amid Economic and Geopolitical Pressures

Resilience in a Challenging Environment

The U.S. automotive industry has navigated a complex landscape throughout 2025,contending with geopolitical conflicts,tariff impositions,inflationary trends,and ongoing supply chain interruptions. Despite initial forecasts predicting downturns due to these obstacles,the sector has shown remarkable resilience. Financial institutions have adjusted their outlooks positively after observing stronger-than-expected performance during the first half of the year under new trade restrictions.

Industry experts share this tempered optimism, recognizing that while significant hurdles persist, catastrophic outcomes have largely been avoided.Recent analyses indicate that although tariff pressures are easing somewhat, consumer demand remains delicate amid slower growth in disposable incomes and heightened economic uncertainty.

Encouraging Sales data and Economic Signals

Projections for light vehicle sales in 2025 have been revised upward to around 16.1 million units-a modest increase reflecting improved production capabilities and steady consumer spending habits. Expectations for 2026 remain positive as well, with estimates suggesting sales near 15.3 million vehicles.

A leading automotive economist highlights how markets have adapted more effectively than anticipated despite tariff challenges: “The impact of tariffs on autos was less severe than feared; we’re managing through it.” However, upcoming quarterly earnings from major manufacturers such as General Motors, Ford, and Tesla will be critical tests of this optimistic sentiment since all are forecasted to report double-digit declines in adjusted earnings per share while still maintaining profitability.

Complex Forces Shaping Industry Dynamics

The sector is currently balancing multiple pressures together. Tariffs have added billions of dollars in costs for manufacturers this year; though recent regulatory rollbacks on fuel economy standards combined with corporate tax incentives introduced by new legislation provide some financial relief.

Tensions remain regarding auto lending risks among consumers with lower credit scores-highlighted by recent bankruptcies within subprime lenders-but vehicle sales volumes and pricing through Q3 continue to outperform earlier expectations.

Analysts describe their stance as “cautiously optimistic,” acknowledging potential setbacks such as further tariff escalations or reduced consumer spending alongside bullish factors already incorporated into forecasts for 2025-2026.

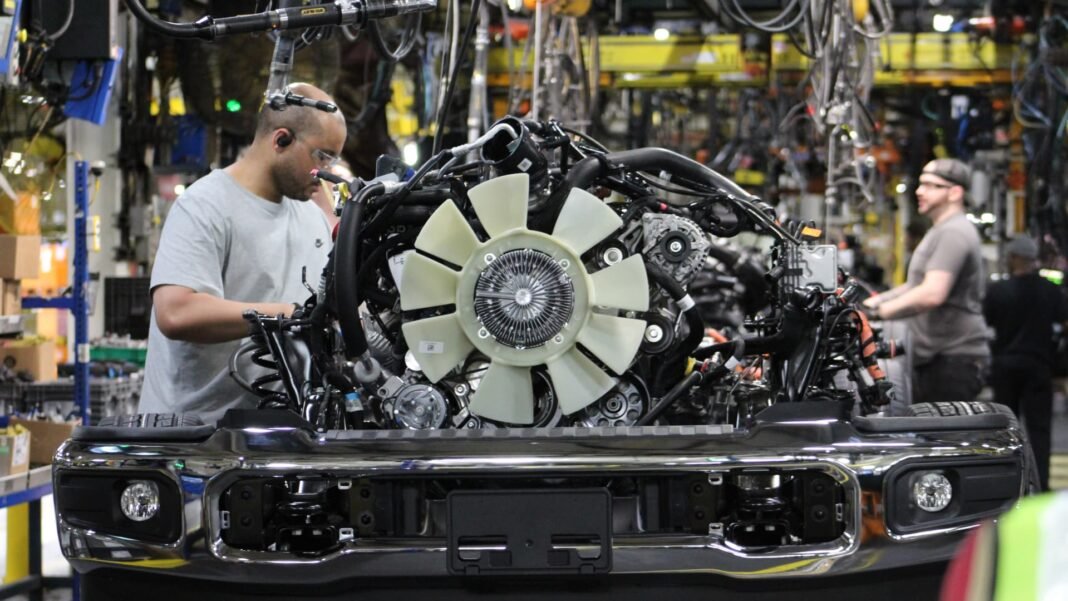

The Ripple Effects of Supply Chain Interruptions

A significant disruption occurred recently when a fire at an aluminum supplier impacted Ford’s production capacity substantially-Wall Street analysts estimate this event could reduce operating income by $500 million to $1 billion this year alone-adding complexity amid ongoing volatility related to electric vehicle transitions and global trade uncertainties.

The Supplier Network: Vulnerabilities Amid Adaptation Efforts

The extensive network of automotive suppliers remains one of the industry’s most fragile components. This ecosystem includes thousands of companies ranging from large multinational firms to small specialized manufacturers producing niche parts-all facing intense cost pressures that leave little room for further price increases without risking insolvency or operational difficulties.

While many agile suppliers have successfully repositioned themselves amidst fluctuating raw material prices and market shifts, recent bankruptcy filings within private credit markets signal growing fragility affecting supplier stability worldwide.

Original equipment manufacturers (OEMs) continue efforts to support their supply chains without passing additional tariff-related expenses downstream; though sustaining these measures long-term is uncertain given persistent inflationary pressures beyond tariffs alone across North America’s intricate trade environment involving Mexico, canada, China-and rare earth elements essential for EV manufacturing sourced primarily overseas.

Diverse Performance Among Publicly Traded Suppliers

- Aptiv’s stock surged over 20% year-to-date despite macroeconomic headwinds;

- BorgWarner saw similar gains fueled by strong demand for electric vehicle components;

- Dana Incorporated reported double-digit stock appreciation;

- Maga International increased approximately 7%, overcoming early concerns about exposure risks related to tariffs;

This contrasts sharply with persistent caution among North American supplier executives-the fourteenth consecutive quarter reflecting guarded sentiment according to recent industry barometers tracking supplier confidence levels nationwide.

K-Shaped Recovery Patterns Among Auto Consumers

“Economic disparities widen as wealthier consumers benefit from asset growth while subprime borrowers face rising delinquency rates,” observe analysts studying current trends impacting car buyers across different credit tiers.

The automotive market exemplifies broader economic divides frequently enough described as a K-shaped recovery where affluent segments continue prospering whereas lower-income groups encounter increasing hardships during post-pandemic recovery phases.

Divergent Consumer Realities Affecting Demand Trends

- Younger buyers or those with limited incomes face growing affordability challenges driven by rising inflation coupled with stricter lending criteria;

- Lenders report record-high delinquency rates nearing historic peaks specifically within subprime auto loans (currently at approximately 6.43% past due two months or more);

- Around two-thirds (~66%) of new car purchases come from households earning above the median U.S income ($83,730), highlighting uneven purchasing power distribution;

This split raises important questions about how future price hikes caused by tariffs or regulatory changes might influence overall demand elasticity heading into 2026-a key uncertainty automakers must monitor closely amid evolving consumer tolerance toward higher point-of-sale costs.

Navigating Uncertainty While Embracing Opportunity Ahead

“Recent years’ volatility surpasses anything previously experienced,” note senior economists tracking global supply chain realignments reshaping automakers worldwide.”

The American automotive industry stands at a pivotal juncture shaped by shifting trade policies; rapid electrification mandates; volatile raw material markets; changing demographics among consumers; plus lingering pandemic effects influencing credit availability-all converging into an unprecedented era marked equally by risk alongside opportunity and resilience alike.