Alibaba’s Financial Update: Balancing Expansion and Investment Pressures

Robust Profit Gains Despite Slight Revenue Miss

in its fiscal first quarter ending June, Alibaba reported earnings that exceeded market forecasts on the profit front, even though total revenue narrowly fell short of expectations. The company recorded revenue of 247.65 billion Chinese yuan ($34.6 billion), slightly below the predicted 252.9 billion yuan.

However, net income surged impressively to 43.11 billion yuan, outperforming the anticipated 28.5 billion yuan and representing a striking 78% year-over-year increase. This boost was primarily fueled by returns from equity stakes and the divestment of its Turkish e-commerce platform Trendyol.

When excluding these investment-related gains, Alibaba’s core net profit actually declined by about 18%, reflecting substantial expenditures in China’s highly competitive instant commerce arena.

The Rising Influence of Cloud Computing on Alibaba’s Growth

The cloud computing division stood out as a major growth engine with revenues reaching 33.4 billion yuan-a strong year-over-year rise of 26%, accelerating from an earlier pace of 18%. This segment is pivotal to Alibaba’s ambitions in harnessing artificial intelligence technologies.

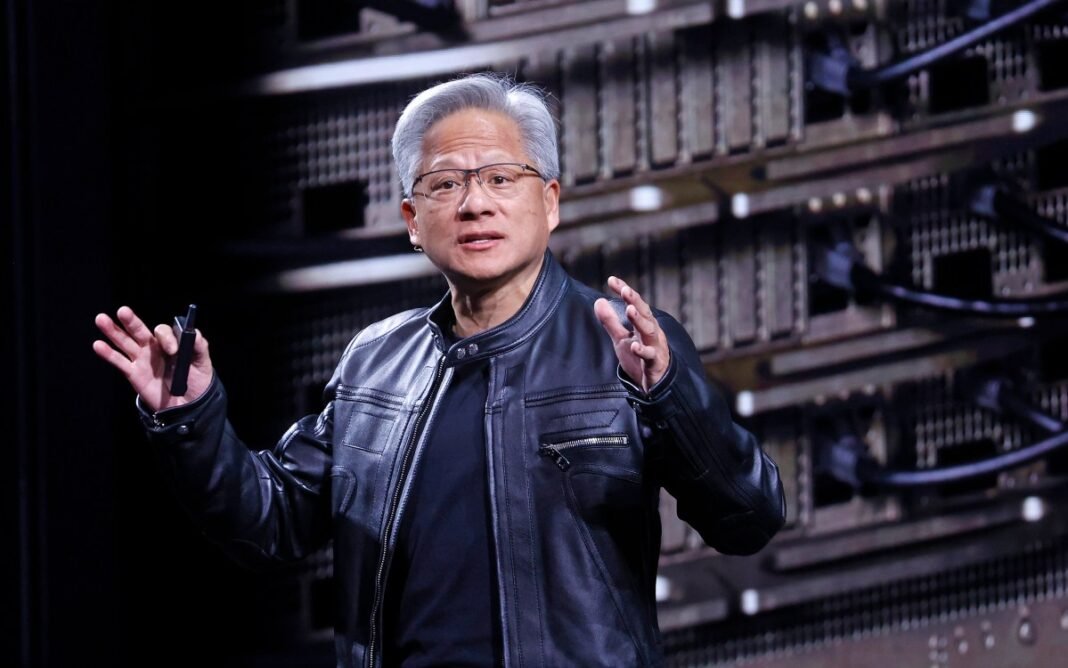

The CEO of Alibaba Cloud Intelligence Group emphasized that AI-driven demand has substantially propelled their cloud services’ revenue growth, with AI-based products now making up a meaningful portion of sales to external clients.

Alibaba has established itself as a global player in AI innovation by releasing several open-source models for free use and modification worldwide while together monetizing proprietary AI solutions through its cloud infrastructure offerings.

The company highlighted that revenues from AI products have sustained triple-digit annual growth for eight consecutive quarters-an achievement underscoring their leadership position in this domain.

Profitability also improved notably; adjusted EBITA for the cloud unit increased by 26% compared to last year’s figures.

E-commerce Segment Shows Varied Performance Amid Intense Rivalry

Alibaba’s core e-commerce business remains central but delivered mixed outcomes this quarter. Total e-commerce revenue grew modestly by approximately 10% year-on-year to nearly 19.6 billion yuan.

A significant share comes from customer management revenue (CMR), which includes fees charged for marketing services provided to merchants on Alibaba’s platforms; CMR expanded at roughly the same rate as overall e-commerce sales during this period.

Despite top-line improvements, adjusted profits within this segment dropped sharply-around a 21% decline annually-as Alibaba increased investments into “instant commerce.” This emerging service offers ultra-fast delivery options via Taobao and other apps across China, with some orders arriving within an hour after purchase.

The Competitive Landscape in Instant Commerce

- This fast-delivery sector is fiercely contested among key players such as Meituan and JD.com alongside Alibaba;

- Tensions are high as competitors grapple with profitability challenges-as a notable example, Meituan recently experienced an alarming near-90% drop in second-quarter adjusted net profit;

- Alibaba’s quick commerce division generated over $2 billion (14.8+ billion yuan) in revenues, growing at roughly double-digit rates annually despite margin pressures;

Diversification Beyond China Strengthens Outlook

Away from domestic markets, international operations like AliExpress contributed positively with nearly a fifth increase in quarterly revenues while reducing losses-offering reassurance amid economic uncertainties impacting China as mid-2024 despite government stimulus efforts aimed at boosting consumer spending nationwide.

“Striking a balance between bold innovation investments and sustainable profitability remains our focus,” stated company representatives regarding ongoing strategies involving artificial intelligence integration alongside evolving retail formats across multiple regions.”

Navigating Forward: Strategic Priorities Amid Economic Challenges

This year alone has seen shares listed on U.S exchanges climb over forty percent driven largely by renewed momentum both domestically and internationally plus accelerated adoption within cloud computing services enhanced through advanced AI capabilities embedded into solutions spanning logistics optimization to personalized online shopping experiences.

Navigating China’s slowing economic environment demands prudent allocation between pioneering technology ventures such as generative AI tools versus maintaining steady growth amid intensifying competition-especially within instant delivery ecosystems where consumer expectations continue rising rapidly worldwide.