Asia-Pacific Markets Show Mixed Reactions Amid Economic Reports and Geopolitical Shifts

China’s Manufacturing Data Reflects Subtle Economic Adjustments

On Monday, stock markets across the Asia-Pacific region exhibited a range of movements as investors processed new manufacturing statistics from China. The latest RatingDog manufacturing index for August indicated a slight expansion at 50.5, rebounding from July’s contraction reading of 49.5.

Conversely,official data showed China’s manufacturing Purchasing Managers’ Index (PMI) dipped marginally to 49.4 in August from July’s 49.3, signaling persistent difficulties within the sector despite some signs of stabilization.

India-China Diplomatic Developments Shape investor Outlook

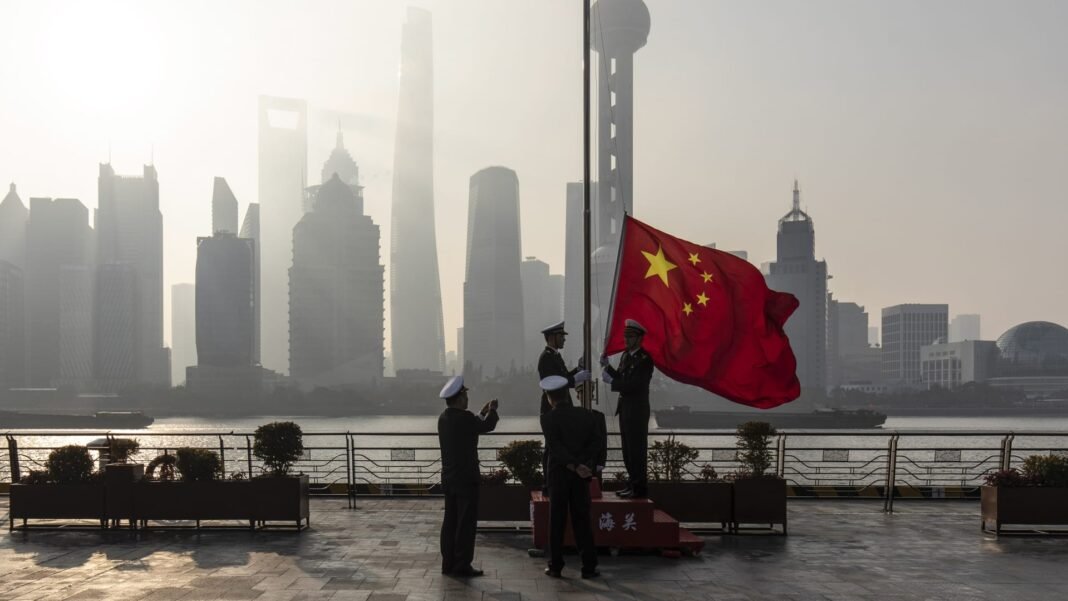

The evolving diplomatic ties between India and China drew importent market focus after leaders at the shanghai Cooperation Organization summit described their nations as partners in growth rather than rivals. Chinese President Xi Jinping highlighted plans to boost cooperation on artificial intelligence among member countries while criticizing outdated Cold War mentalities that hinder global progress.

Performance Overview of Key Regional Stock Indices

- Hong Kong: The Hang Seng index climbed sharply by 2.17%, closing at 25,617.42 points with strong rallies in technology and healthcare sectors-Meituan surged nearly 17%, BeiGene advanced over 10%, and JD Health increased by more than 7%.

- Mainland China: The CSI 300 index posted moderate gains around 0.6%, settling near the mid-4500s amid choppy trading conditions influenced by mixed economic signals.

- Japan: The Nikkei 225 fell approximately 1.24% to just below the mid-42,000 level as semiconductor stocks faced steep losses; Tokyo Electron dropped close to 9%, Renesas electronics declined about 7%, while Advantest slipped over six percent overall.

Meanwhile, japan’s broader Topix index edged down roughly one-third of a percent ending slightly above three thousand points. - Korea:The Kospi retreated about 1.35% closing near 3,143 points; its smaller counterpart Kosdaq also weakened with losses approaching one-and-a-half percent amid tech sector pressures.

- Australia:The S&P/ASX200 eased back modestly by half a percent finishing just under nine thousand points around 8,928 due to cautious investor sentiment ahead of key economic releases later this week.

- India:The Nifty50 rose moderately by two-thirds of a percent while BSE Sensex gained approximately six-tenths reflecting positive reactions toward diplomatic progress despite ongoing global uncertainties impacting markets worldwide.

Tensions Over U.S Trade Policies Complicate Global Market Dynamics

A recent decision from the U.S Court of Appeals invalidated most tariffs imposed under former President Donald Trump’s reciprocal tariff program citing presidential authority overreach concerns-this ruling affects trade relations globally since these levies targeted multiple countries together during announcements dubbed “liberation day” last April.

This legal development introduces additional complexity for investors balancing geopolitical risks alongside fluctuating economic indicators across international markets today.

Divergent Wall Street Trends Ahead Of Holiday Break Highlight Investor Caution

The previous Friday saw U.S equities retreat amid ongoing inflation concerns threatening recovery momentum entering September.

The S&P500 closed down roughly two-thirds of one percent near its mid-4400s level but still recorded its fourth consecutive monthly gain-a sign that cautious optimism persists among market participants.

The nasdaq Composite dropped more than one percent finishing just above twenty-one thousand four hundred points while Dow Jones Industrial Average declined slightly less than quarter-percent settling around forty-five thousand five hundred points.

U.S exchanges remained closed Monday observing Labor Day nationwide festivities which limited trading activity early this week.

“Financial markets worldwide continue navigating an intricate web where economic data releases intersect with geopolitical developments-highlighting how deeply interconnected today’s investment landscape has become.”

An In-Depth Look: Semiconductor sector Volatility Mirrors Broader Technology Industry Challenges

The pronounced decline among Japanese semiconductor companies reflects wider industry headwinds including supply chain bottlenecks and shifting demand patterns seen globally throughout this year-for example south Korea’s SK Hynix recently issued profit warnings linked partly to inventory adjustments amid slowing smartphone sales during Q2-Q3 periods alike.

These sector-specific challenges considerably influence regional indices’ uneven performances despite pockets of strength elsewhere such as pharmaceuticals or e-commerce platforms benefiting from evolving consumer trends post-pandemic recovery phases across Asia-Pacific economies today.