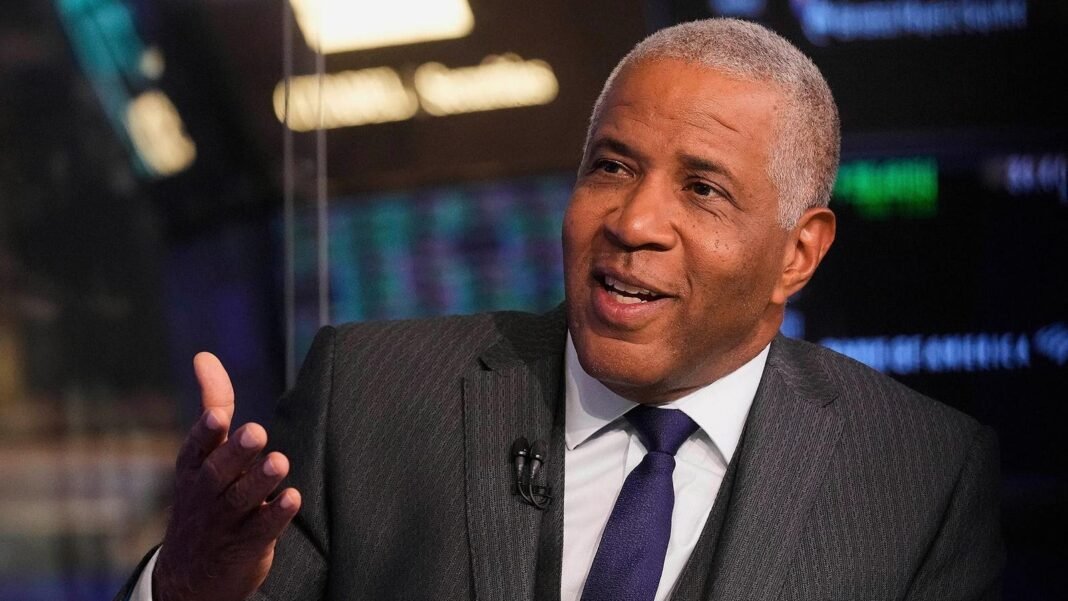

Robert Smith’s Tax controversy and His Close Ties to the President

A High-Profile Inquiry Near Mar-a-Lago

In the final months of 2020, shortly before the Department of Justice revealed one of the most significant tax evasion prosecutions in recent U.S. history, Palm Beach law enforcement received a report from Hope Smith, spouse of billionaire investor Robert Smith. While organizing their move, she noticed that a rare 3.63-carat diamond ring valued at around $1.1 million had mysteriously disappeared from their home safe.

The police documentation indicated that Mrs. Smith was unable to specify when or where the ring went missing but confirmed it was last seen inside their Palm Beach residence earlier that year.

Residing Next Door: Leasing from Donald Trump

The residence involved was situated at 1125 South Ocean Boulevard-directly neighboring President Trump’s winter retreat, Mar-a-Lago. even though Robert Smith did not own this opulent 10,500-square-foot estate, he began leasing it in late 2019 directly from Donald Trump.

With an estimated net worth approaching $6 billion as of mid-2024 and extensive real estate assets spanning Colorado and Europe, Robert smith could easily cover a monthly rent reportedly exceeding $65,000. However, his decision to lease property adjacent to Trump attracted scrutiny amid an ongoing federal investigation into alleged offshore tax concealment involving hundreds of millions.

An Urgent Move Amid legal Pressures

A representative for Smith explained that urgency influenced their choice: after another rental fell through due to mold contamination just before his children’s academic year started, an agent swiftly secured this nearby mansion without Robert personally inspecting it beforehand.The family resided there for approximately six months until March 2020 when pandemic restrictions compelled them to temporarily relocate to Colorado and homeschool their children over two years.

Despite official claims suggesting brief occupancy, details such as Hope’s missing ring report hint they may have stayed closer to a full year before departing amid mounting legal challenges.

The Billionaire’s Public Commitment During Federal scrutiny

In May 2019-while under federal examination-Smith gained widespread attention by pledging at Morehouse College’s commencement ceremony to erase student debt for all graduates in that class. This philanthropic act resonated politically; notably Ivanka Trump engaged regularly with him throughout the COVID-19 pandemic as they collaborated on channeling relief funds toward minority-owned businesses disproportionately affected by economic downturns.

Smith also maintained consistent communication with Treasury Secretary Steven Mnuchin during this period as part of efforts aimed at ensuring fair distribution of emergency aid across diverse communities nationwide.

Navigating Cooperation and Consequences

A month after reporting his wife’s lost jewelry in September 2020, Robert smith entered into a non-prosecution agreement admitting guilt on charges related to tax evasion while agreeing to pay $139 million in penalties-thus avoiding criminal prosecution entirely.

“Smith engaged in serious illegal conduct,” declared U.S. Attorney David Anderson upon announcing the deal. Nevertheless, his cooperation allowed him to evade indictment.”

This resolution had minimal financial impact relative to his wealth; on the very day he signed the agreement he acquired two North Palm Beach properties valued near $48 million-a clear indication both of his vast fortune and ongoing investment activity despite looming legal issues.

The Aftermath: Trials That Never Materialized for Associates

If prosecutors anticipated leveraging Smith’s cooperation against business partner Robert Brockman-a software tycoon accused of concealing nearly $2 billion-they were ultimately disappointed. Brockman faced multiple counts including wire fraud and conspiracy but passed away six months prior to trial at age 81 without pleading guilty or serving jail time alongside Smith within what remains one of America’s largest-ever tax fraud probes.

No jail Time Despite Unprecedented scale

- Billionaire investors implicated avoided imprisonment despite allegations involving hundreds of millions hidden offshore;

- This case underscores challenges inherent in prosecuting complex white-collar crimes;

- Sheds light on intersections between wealth preservation tactics and political connections;

- Drew public interest partly because one defendant leased property promptly adjacent to than-president Trump’s private club mar-a-Lago;

- Presents ongoing debates about accountability among ultra-high-net-worth individuals involved in massive financial misconduct investigations globally (with illicit global financial flows estimated above $1 trillion annually according to recent United Nations analyses).