Boeing’s Revival: Overcoming Obstacles and Expanding Production Capacity

Rebuilding Manufacturing Strength Amid Industry challenges

After enduring several difficult years, Boeing has reached it’s highest aircraft delivery figures since 2018, marking a notable turnaround in its production capabilities. The aerospace giant is now gearing up to increase manufacturing rates, focusing especially on the popular 737 Max series and the long-range 787 Dreamliner. This resurgence follows a period marked by safety concerns and quality control setbacks that had considerably disrupted output.

According to aviation analyst Richard Aboulafia of AeroDynamic Advisory, Boeing’s internal culture experienced serious dysfunctions in recent times; however, meaningful reforms are underway as the company works to restore confidence among regulators and customers alike.

From Crisis to Recovery: Navigating safety Setbacks

Boeing’s production faced severe restrictions after two tragic crashes involving the 737 Max models in late 2018 and early 2019. Further complications arose from an incident in early 2024 when a door plug detached mid-flight.These events triggered intense global regulatory scrutiny.Additionally, pandemic-related supply chain interruptions affected both Boeing and Airbus assembly lines worldwide, causing delays amid labor shortages.

The return of CEO Kelly Ortberg from retirement proved instrumental during this turbulent phase. His leadership has prioritized stabilizing manufacturing processes while rebuilding trust with aviation authorities.

enhancing Factory Operations for Improved Quality Control

The company has revamped its assembly procedures by addressing issues related to “traveled work,” where tasks were previously completed out of sequence-an approach linked to past errors. Enhanced training initiatives have been rolled out following National Transportation Safety Board findings that highlighted insufficient oversight as a factor contributing to earlier accidents.

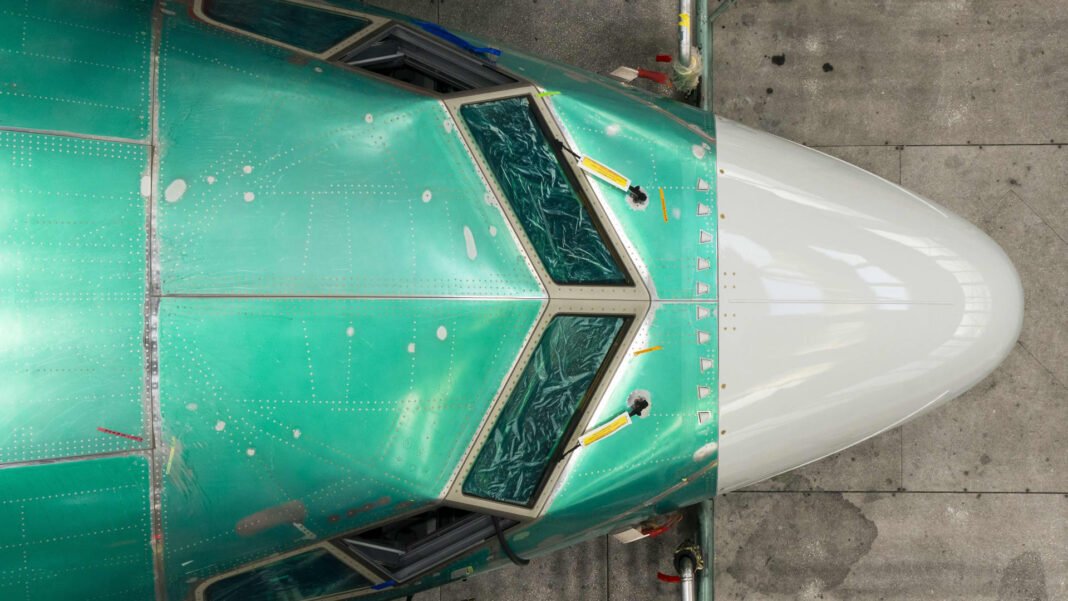

A strategic milestone was achieved when Boeing reacquired Spirit AeroSystems-the primary supplier of fuselage components it had divested two decades ago-enabling tighter integration over critical parts essential for timely aircraft completion.

Key Production Achievements and Delivery Patterns

- Boeing delivered roughly 537 airplanes during the first eleven months of last year; December likely added about 61 more jets, with nearly three-quarters belonging to various versions of the highly demanded 737 Max family.

- this represents progress compared with previous years but remains below pre-crisis peaks-for instance, over 800 aircraft were delivered back in 2018 alone.

- The Federal Aviation Governance (FAA) recently raised monthly production limits for the 737 Max from 38 units up toward or beyond 42 per month-a threshold expected early next year-with plans for further incremental increases thereafter.

- CFO Jay Malave confirmed that upcoming deliveries will predominantly consist of newly built planes rather than clearing existing inventory stock moving forward into this year.

Certification Delays Affect Financial Performance

Certain variants such as the delayed max 7-which Southwest Airlines eagerly anticipates-and larger models like Max 10 remain uncertified despite initial expectations set several years ago.These certification hold-ups constrain revenue streams while increasing costs due to prolonged advancement schedules.

Sustained Global Demand Drives Market Confidence

The demand for commercial jets remains strong worldwide as airlines plan fleet expansions well into the mid-2030s amid rising passenger numbers post-pandemic recovery. By November last year alone, Boeing secured approximately 1,000 gross orders, surpassing Airbus’ order count despite Europe’s competitor slightly leading on actual deliveries during that timeframe.

“Our commitment for over one hundred new-generation jets demonstrates robust faith not only in their certification process but also in Boeing’s ongoing transformation,” stated Alaska Airlines’ fleet director Shane Jones regarding their recent agreement involving multiple 737 Max 10s.

This order complements Alaska Airlines’ expanded international footprint following its acquisition of Hawaiian Airlines-adding Dreamliners alongside Airbus A330s-to access destinations across Asia and Europe previously unreachable without direct flights or suitable aircraft types within their fleets.

The Resurgence of Wide-Body Aircraft Demand

Aerospace experts observe renewed momentum within wide-body segments fueled by growing international travel demand among affluent passengers seeking premium experiences on long-haul routes served by planes like Boeing’s Dreamliner series or Airbus’ A350 family.

Specifically:

- The International Air Transport Association reported global load factors reaching an unprecedented near 84%, highlighting sustained passenger willingness even amid economic uncertainties;

- This trend supports ongoing replacement cycles targeting aging fleets alongside growth-driven acquisitions;

- Aviation specialists emphasize that air travel remains indispensable until futuristic alternatives akin to teleportation become reality;

Looking forward: Strategic Prospects beyond This Year

Boeing stands at a pivotal crossroads where consistent delivery performance will be crucial for fully regaining profitability lost since safety crises emerged seven years ago. Investor sentiment has been positive so far-with shares climbing approximately 36%, outperforming broader market indices throughout this recovery phase.

The forthcoming quarterly report scheduled late January is expected to provide insights into planned output rates heading into calendar year ’26 along with updates on certification progress across jet families still awaiting final approvals before entering service globally.

meanwhile airline executives express cautious optimism about future fleet modernization opportunities enabled through these developments despite lingering delays affecting some key models under regulatory review worldwide.