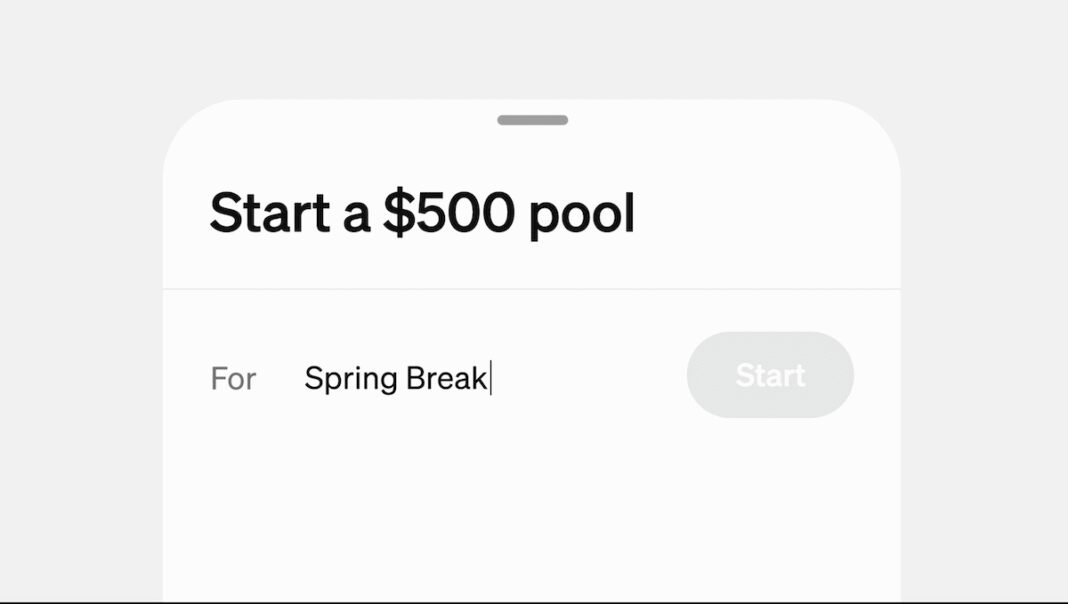

Discover Cash App Pools: Revolutionizing Group Payment Experiences

Cash App has introduced an innovative feature called “pools” to simplify the way groups handle shared expenses. Whether it’s dividing costs for a weekend trip, splitting restaurant bills, or collecting money for joint gifts, this new functionality makes pooling funds straightforward and hassle-free. Initially available to a select group of users, Cash app intends to expand this feature’s availability soon.

The Mechanics behind Cash App Pools

Creating a pool is easy: users set a target amount and invite friends or family members to contribute. Invitations can be sent using $cashtag identifiers or through text messages containing payment links compatible with Apple Pay and Google Pay. This means even those without a Cash app account can participate effortlessly.

Inclusive Contributions Beyond the App

A key advantage of pools is that contributors don’t need to have the app installed; they can pay via widely used mobile wallets like Apple Pay or Google Pay. This approach broadens participation by removing typical barriers associated with peer-to-peer payment platforms.

Control and Access Over Collected Funds

The pool creator maintains full authority over the collection process and can close the pool whenever desired. Once closed, all gathered funds are instantly deposited into their Cash balance, allowing immediate use without delays.

Positioning in an Increasingly Competitive Market

This rollout comes as Cash App seeks to enhance user engagement amid reports of slower-than-expected activity affecting its early 2025 financial performance.By launching pools, it strengthens its stance against competitors such as Venmo and PayPal-both offering similar group payment solutions designed for social spending occasions.

The Future of Social Payments in Digital Finance

- Tackling User Acquisition: With global digital wallet usage expected to surpass 4 billion by 2027, attracting non-users remains vital for growth-oriented platforms like Cash App.

- A Practical Scenario: Consider organizing a community fundraiser where participants easily chip in through pools without juggling multiple transactions or elaborate reimbursements-streamlining collective contributions efficiently.

- Catering to Modern Spending Habits: As younger generations prioritize convenience and openness in managing shared expenses, features like pools align perfectly with these evolving preferences.