CoreWeave Demonstrates Significant Expansion Despite Market Headwinds

Revenue Growth Outpaces Stock Performance

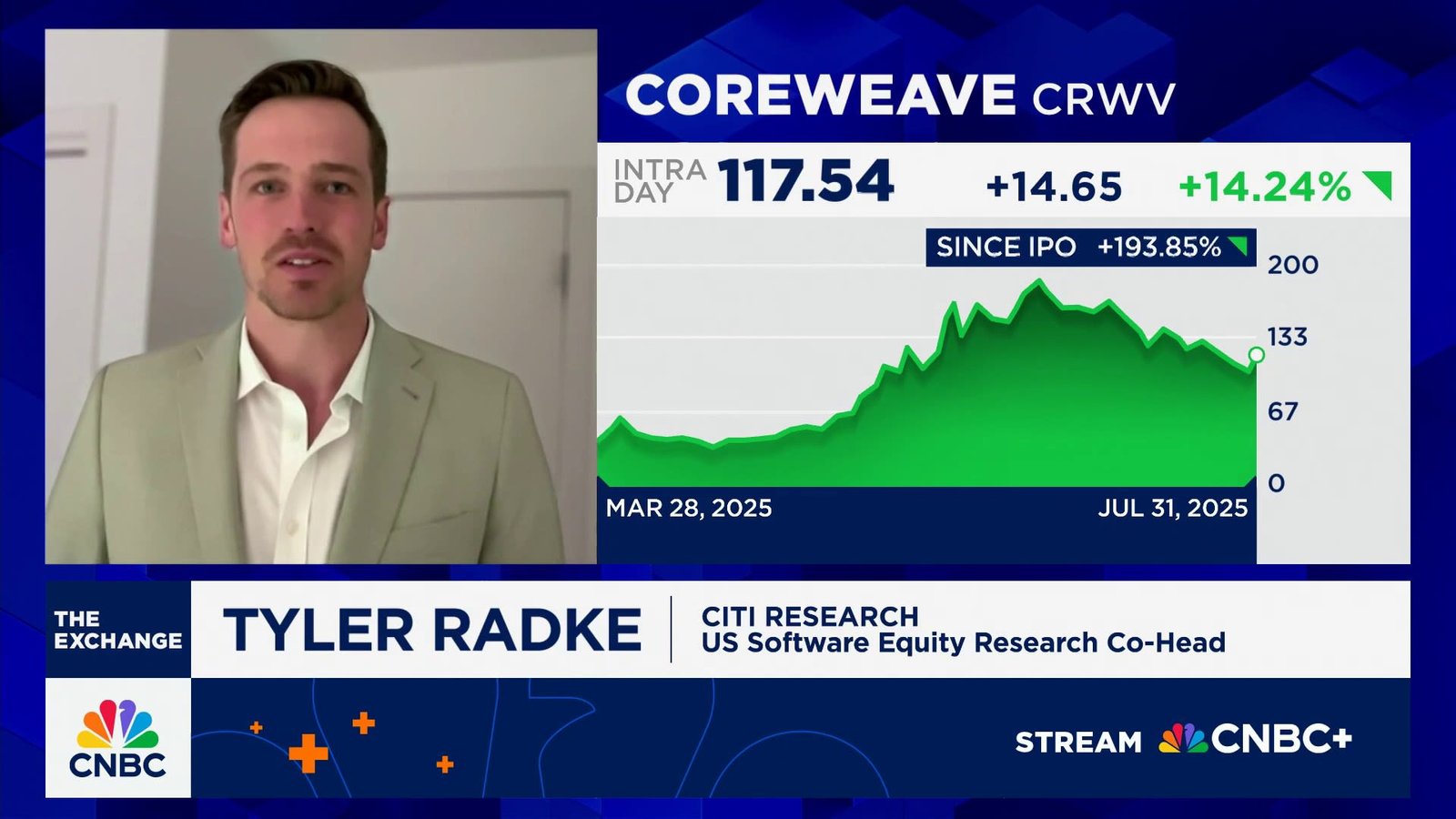

CoreWeave, a prominent provider of AI infrastructure solutions, experienced a 9% decline in after-hours trading even tho its quarterly earnings and projections exceeded analyst expectations. The company reported revenue reaching $1.21 billion,surpassing the forecasted $1.08 billion, while posting a loss per share of 21 cents.

Considerable Yearly Revenue Increase Highlights Rapid Growth

This quarter’s revenue reflects an remarkable surge from $395 million in the same quarter last year,representing over three times growth within twelve months. Although CoreWeave recorded a net loss of $290.5 million-an improvement compared to last year’s $323 million deficit-the operating margin shrank drastically to just 2%, down from 20%.This contraction was primarily driven by hefty stock-based compensation expenses amounting to $145 million.

Supply Limitations Challenge Expansion Efforts

Nitin agrawal, chief Financial Officer at CoreWeave, noted during the earnings call that demand for their AI computing services continues to exceed available capacity. The firm faces intense competition from major cloud providers such as Amazon Web Services as it leases Nvidia GPUs to enterprises seeking advanced AI processing power.

Diversification Through Strategic Partnerships and Acquisitions

CEO Mike Intrator highlighted ongoing efforts to broaden CoreWeave’s client portfolio with collaborations involving influential entities like OpenAI-both an investor and customer-as well as financial institutions Goldman Sachs and Morgan Stanley, who also played key roles as underwriters during CoreWeave’s IPO earlier this year. Complementing organic growth strategies, the company recently acquired Weights & Biases for approximately $1.4 billion; this startup specializes in software platforms that facilitate monitoring and managing AI model advancement.

Upcoming Infrastructure Enhancements and Service Innovations

The company is progressing with plans for a new data center located in New Jersey expected to deliver up to 250 megawatts of capacity by 2026-a strategic move aimed at easing current supply constraints. Additionally, later this year CoreWeave plans to launch spot GPU rentals designed to offer customers more affordable access with flexible terms where GPUs can be quickly reallocated if necessary.

Financial Projections Indicate Sustained Momentum

- Q3 Revenue Estimate: Projected between $1.26 billion and $1.30 billion (analysts had anticipated roughly $1.25 billion)

- Total Revenue Guidance for Fiscal Year 2025: Raised range now set between $5.15 billion and $5.35 billion-implying nearly 174% growth compared with prior periods

- Total Debt Level: Approximately $11.1 billion following recent capital investments and acquisitions

- Market Capitalization: Surpassed an impressive valuation exceeding $72 billion after shares steadily climbed post-IPO debut near ~$40 per share; current trading price hovers around ~$149 per share

navigating Growth While Enhancing Operational Efficiency

The rapid expansion highlights both vast opportunities within the artificial intelligence infrastructure sector alongside challenges related to scaling operations profitably amid rising costs tied to talent acquisition and stock-based incentives.

“Our priority remains fulfilling escalating customer demand while making calculated investments in expanding our capacity,” stated CEO Mike Intrator during the earnings discussion.