Unraveling Gold: Insights into Its Worth, Market Dynamics, and Global Holdings

Core Principles Behind Gold’s value

Teh valuation of gold fundamentally depends on two critical aspects: its mass measured in troy ounces and its purity indicated by karat ratings. A clear understanding of these factors is vital for anyone looking to invest in or trade gold effectively.

The Troy Ounce: The Standard Unit for Precious Metals

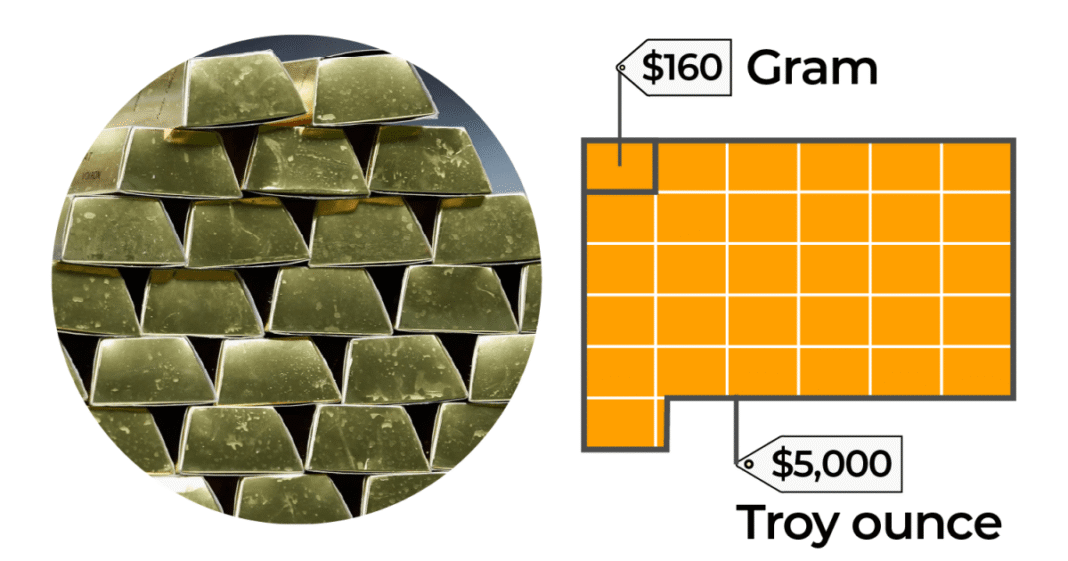

Gold is weighed using the troy ounce system, distinct from the common avoirdupois ounce used daily. One troy ounce equals roughly 31.1035 grams, about 10% heavier than the standard ounce of 28.35 grams. As a notable example,with current market prices hovering near $5,000 per troy ounce as of mid-2024,each gram of gold commands a value close to $161.

A standard large investment bar typically weighs around 400 troy ounces (approximately 12.44 kilograms), which translates into a market worth exceeding $2 million at today’s rates.

Karat Ratings: defining Purity and Durability

Gold purity is expressed through karats (K),where pure gold is rated as 24K or nearly 99.9% pure metal content. Lower karat values indicate alloying with other metals like copper or silver to improve hardness or modify color tones.

- 24K – Nearly 99.9% pure: exhibits a deep yellow-orange shade; extremely soft; favored for bullion bars and coins due to maximum purity.

- 22K – About 91.6% pure: slightly more durable than pure gold; widely used in high-end jewelry balancing beauty with strength.

- 18K – Roughly 75% purity: Offers enhanced toughness while retaining an appealing warm hue; popular globally among fine jewelry makers.

- 9K – Approximately 37.5% purity: Displays a pale yellow tint with superior hardness among common alloys; often chosen for affordable jewelry options requiring durability.

Karat markings such as “750” (for18K) or “999” (for nearly pure gold) are stamped by jewelers worldwide to certify authenticity and quality standards reliably across markets.

The Historical Trajectory of Gold Pricing

The captivation with gold spans thousands of years-from ancient monetary systems to contemporary safe-haven assets during times marked by economic uncertainty and geopolitical tensions alike.

A century ago under the classical gold standard, currencies like the US dollar were pegged directly to fixed quantities of physical gold-around $20 per ounce during much of the late nineteenth century until adjustments raised this rate up to $35 per ounce amid Great Depression-era reforms.

A defining shift occurred in1971 when global leaders abandoned dollar convertibility into physical bullion, ushering an era where supply-demand forces freely determine prices rather than government-fixed rates.

“especially over recent years characterized by inflation spikes post-pandemic and geopolitical unrest-the price has soared dramatically.”

this decade alone has seen approximately a fourfold increase from roughly $1,250 per troy ounce in early2016 levels toward current valuations near $5,000-a reflection not only of inflationary pressures but also intensified investor interest amid ongoing global disruptions such as supply chain bottlenecks and regional conflicts impacting commodity markets worldwide.

Diverse Global Pricing Structures Influencing Costs

The international benchmark price for one troy ounce remains anchored primarily on spot markets denominated in US dollars via major exchanges including london’s LBMA (London Bullion Market Association) and New York’s COMEX futures platform.

- Currencies & Exchange Rates: Local pricing varies according to fluctuations between USD and domestic currencies-for example indian Rupees or Euros-affecting affordability despite uniform base pricing globally;

- Add-On Charges:Mints apply premiums covering manufacturing costs plus distribution logistics;

- duties & Taxes:Treasuries impose different import tariffs-India enforces Goods & Services Tax (GST) around three percent on investment-grade bullion whereas countries like UAE exempt such levies entirely;

Nations also mint culturally notable bullion coins unique within their borders-for example Japan’s Sakura coin symbolizes national heritage much like Mexico’s Libertad series does elsewhere-each featuring distinctive designs that appeal variably across collectors’ communities compared against traditional staples such as South Africa’s Krugerrand or China’s Gold Panda coins now gaining wider recognition internationally due partly to expanding Asian wealth seeking diversification beyond conventional Western assets.

Nations With The Largest Official Gold Reserves Today

An essential measure reflecting economic resilience lies within central banks’ accumulated reserves held predominantly as physical bullion safeguarding monetary stability against currency volatility.

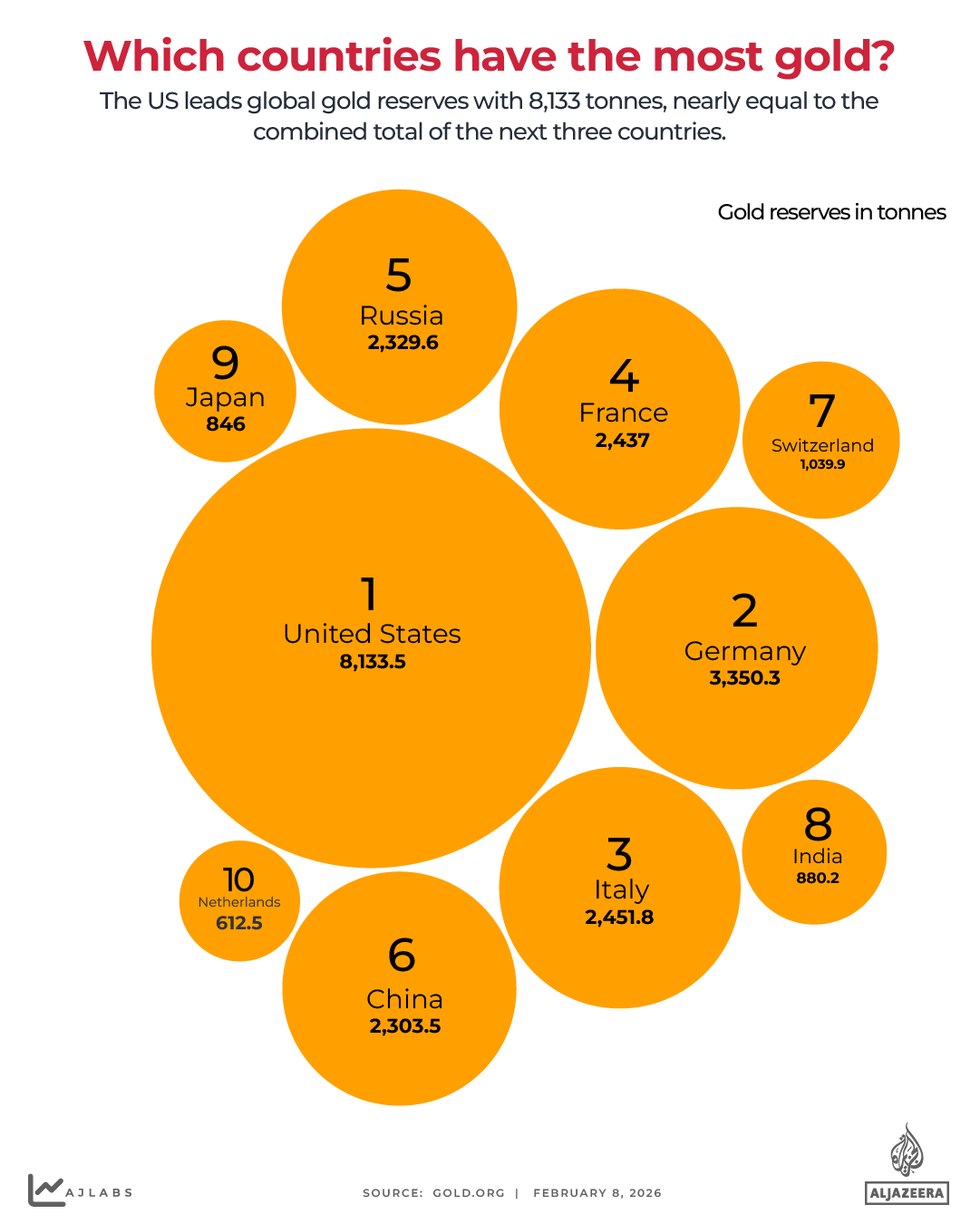

- The United States stands unrivaled , holding approximately 8,133 metric tonnes , almost equal combined holdings from Germany (3,350 tonnes ) plus Italy (~2450 tonnes).

- This concentration highlights America’s strategic positioning amid persistent global uncertainties including trade disputes influencing foreign exchange reserve management strategies worldwide;

- Beyond these top holders are countries including France (~2436 tonnes), Russia (~2300 tonnes), China (~1948 tonnes), Switzerland (~1040 tonnes), Japan (~765 tonnes), India (~760 tonnes)-all maintaining ample stockpile buffers serving both fiscal policy goals alongside signaling investor confidence internationally;

Synthesis: Why Mastery Over These Elements Is Crucial Today

Todays’ investors navigate complex challenges ranging from multi-decade high inflation rates globally-to unpredictable political realignments reshaping trade partnerships-which collectively fuel renewed demand toward tangible assets like gold coins price today . Understanding how weight measurements translate into actual value combined with awareness about regional pricing differences empowers buyers aiming for optimal entry points without incurring excessive premiums related solely to craftsmanship rather than intrinsic metal content.

The dynamic interplay between weight units, purity classifications, cultural coinage variety, evolving historical contexts, & differentiated country-specific policies broadens our comprehension not only about what shapes gold coins price today buts also why it endures as a steadfast pillar amidst fluctuating financial landscapes worldwide."