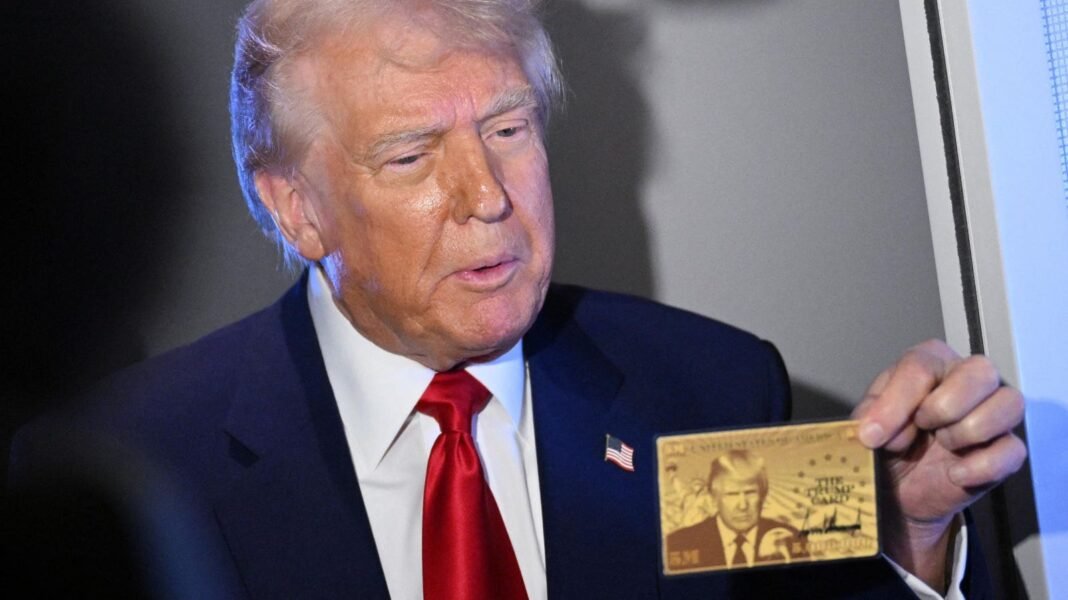

Introducing the trump Gold Card Visa Proposal

The Trump Gold Card visa,a proposed $5 million investment pathway aimed at wealthy individuals seeking U.S. residency and accelerated citizenship, remains largely conceptual. Despite multiple high-profile announcements and promises of an imminent launch, experts in the immigration sector note a lack of concrete plans and insufficient investor enthusiasm to bring this initiative to life.

Key Challenges Hindering the trump Gold Card program

Nuri Katz, founder of Apex Capital Partners with over 30 years advising ultra-wealthy clients on immigration investments, emphasizes that meaningful legal obstacles must be overcome before this program can become operational. He points out that new legislation addressing both immigration policies and tax regulations is essential for any such visa to be legally viable. At present, no official legal framework exists-only promotional campaigns designed to generate interest.

The American Immigration Lawyers Association also agrees that Congressional approval is mandatory to amend current laws enabling this visa’s introduction.

Commerce Secretary Howard lutnick recently announced plans for a dedicated website (trumpcard.gov) expected “within days,” yet attempts to access or register have so far failed. Elon Musk mentioned a confidential pilot test underway but provided no further details. The department of Commerce has not specified when full public access will be granted.

What Exactly Does the Trump Gold Card Visa Offer?

Lutnick and former President Trump have marketed this $5 million investment visa as a strategy to help alleviate America’s enormous $36 trillion national debt burden. Speaking at an Axios event in Washington D.C., Lutnick highlighted benefits beyond permanent residency: faster routes toward citizenship alongside potential tax advantages such as exemption from U.S. taxes on income earned abroad.

This approach aligns with global trends where nations provide residency or citizenship through substantial financial contributions-for instance, Canada’s Start-up visa or Portugal’s Golden Visa programs serve as comparable models.

Currently, the United States operates the EB-5 Immigrant Investor Program which grants green cards for investments between $800,000 and $1 million tied directly to job creation within domestic projects. In 2023 alone, EB-5 attracted nearly $4 billion in foreign capital inflows into the U.S economy.

The proposed Gold Card would effectively supersede EB-5 by raising investment thresholds while potentially offering broader privileges. According to Henley & Partners-a migration advisory firm-demand for EB-5 remains robust as investors rush before anticipated changes; any transition toward a new program is expected to be gradual rather then immediate.

financial Projections Presented by Supporters

Trump has speculated about selling up to one million Gold cards at five million dollars each-potentially generating approximately $5 trillion-and even suggested sales could reach ten million cards yielding an astronomical revenue stream near $50 trillion capable of erasing national debt multiple times over.

Lutnick recently moderated these figures with more conservative estimates: if 200,000 participants invest at full price points it might raise up to one trillion dollars-a substantial amount but far less than earlier claims suggested.

A Reality Check: Market Size Constraints

Katz highlights critical flaws in these optimistic forecasts based on ancient spending behaviors among ultra-high-net-worth individuals (UHNWIs).Typically only 5-10% of their net worth is allocated toward immigration-related investments; thus candidates likely need assets exceeding $100 million justifying such expenditure levels.

Globally there are fewer than 30,000 centimillionaires (individuals worth over 100 million USD), according to henley & Partners’ latest data-with roughly one-third residing within America itself-leaving around 20,000 potential international buyers.

This number falls drastically short compared with Lutnick’s aspiring targets required for massive revenue generation.

Henley & Partners stress that while attractive if structured properly-the pool willing and able pay five-million-dollar fees outright remains limited compared against other residence-by-investment options focused more on tangible economic contributions rather than fee-based donations alone.

Katz concludes reality may now be setting in regarding genuine investor appetite versus marketing hype surrounding this initiative.

Status Update: Is The Official Website Launching Soon?

Katz suspects hesitation behind recent delays amid uncertainty about authentic demand for such an expensive product requiring extensive political backing.

He cautions wealthy prospects remain wary until detailed legislation clarifies terms and protections involved.

Registering prematurely carries risks since data privacy safeguards remain unclear-it is unkown whether submitted data will solely serve government purposes or potentially be shared commercially given its value as a database containing profiles of affluent individuals worldwide.

“There is no advantage registering now,” Katz advises until legal frameworks solidify fully.

A Practical Timeline For Implementation?

Katz stresses building interest via websites differs greatly from establishing functional processing systems supported by law enforcement mechanisms.

Despite repeated promises from Trump aboard Air Force One claiming launches “in less than two weeks,” legislative processes typically span months if not years due primarily slow Congressional procedures combined with complex regulatory reforms needed across immigration statutes and tax codes.

Trump’s current influence over congress may diminish within eighteen months complicating prospects further.

Legal experts confirm presidential authority cannot unilaterally terminate or modify existing programs like EB-5 without Congressional consent; thus unless lawmakers act decisively new visas cannot replace established ones anytime soon.

Skepticism Surrounding Sales Announcements

Lutnick claimed selling 1,000 cards “in one day” raised five billion dollars instantly-a statement met with skepticism among industry veterans including Katz who dismisses it as unrealistic given absence of submission mechanisms or legal backing currently available.

“It was laughable,” he remarks noting no official channels exist allowing direct applications through Commerce Department officials under present conditions.

The Concept’s Origin Story

Lutnick credits billionaire hedge fund manager John Paulson as inspiring idea genesis after questioning why visas aren’t monetized more aggressively despite existing fees under programs like EB-5 already charging up-to-one-million-dollar entry costs per applicant.

Paulson reportedly discussed possibilities directly with Donald Trump leading Lutnick tasked afterward figuring out implementation logistics despite numerous unresolved challenges remaining today.