Neptune Insurance Holdings Initiates IPO Amid Federal Government Shutdown

Amid the onset of a federal government shutdown, neptune Insurance Holdings, a prominent private flood insurance provider in the United States, launched its initial public offering on the New York Stock Exchange under the ticker symbol NP. The company successfully placed over 18 million shares at an initial price of $20 each,with shares rising to $22.50 during their first day of trading.

Private Flood Insurance Surges as NFIP Faces Operational Halt

The timing of Neptune’s IPO aligns with a suspension in services from the National Flood Insurance Program (NFIP), which has temporarily stopped accepting new applications and processing claims due to government closure.This disruption has created significant hurdles for homebuyers who depend on flood insurance to complete mortgage transactions.

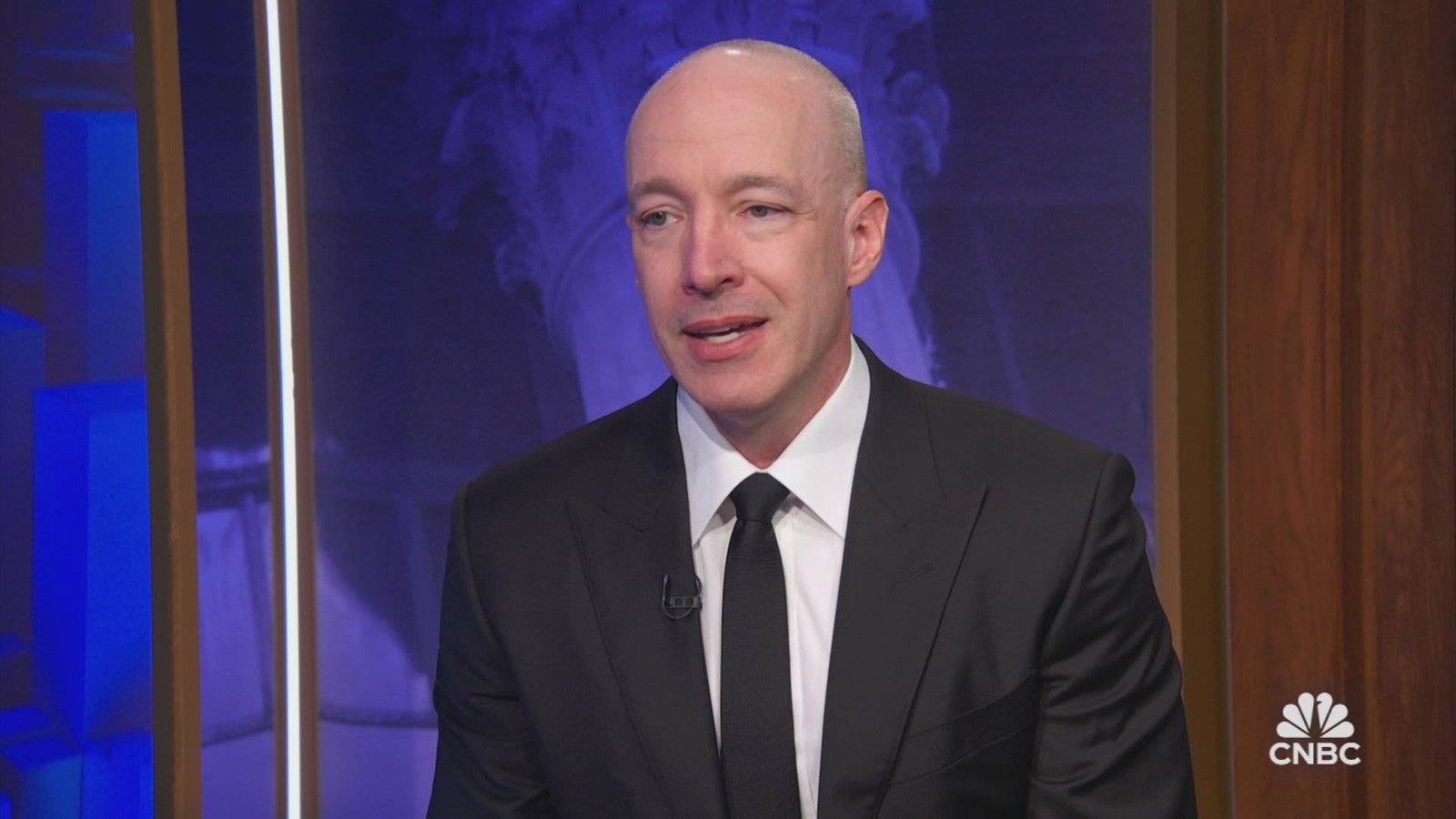

“Neptune continues full operations,” said CEO Trevor Burgess. “Every day, approximately 1,300 people require flood coverage to finalize their home purchases-our offerings remain accessible when others are unavailable.”

Government Shutdown Creates Bottlenecks in Real Estate Closings

The ongoing federal shutdown is causing widespread delays in real estate closings nationwide as many lenders require flood insurance as part of mortgage approval criteria. With NFIP services offline, prospective buyers encounter difficulties obtaining essential coverage through traditional channels.

The Growing Preference for Private Flood Insurers

An increasing number of American homeowners are opting for private insurers like Neptune instead of relying exclusively on government-backed policies. This trend reflects mounting dissatisfaction with NFIP’s limitations and responsiveness amid evolving climate risks.

Cutting-Edge Technology Drives Superior Risk Evaluation

Burgess emphasized that Neptune’s underwriting accuracy outperforms that of NFIP by utilizing artificial intelligence and advanced data analytics to assess risk at an individual property level rather than broad geographic zones such as zip codes or neighborhoods.

“Our pricing reflects actual risk,” Burgess explained. “A quote around $200 annually signals low risk; quotes reaching $12,000 indicate high exposure; and if we decline coverage entirely-that’s a clear indication homeowners should consider relocating.”

The Urgent Need for Enhanced Flood Risk Solutions Amid Rising Costs

A 2024 report from economic analysts estimates that annual flooding costs across the U.S. range between $180 billion and nearly half a trillion dollars. Remarkably, nearly one-third of all NFIP claims come from areas not officially classified as high-risk by federal standards-highlighting critical shortcomings in current flood mapping methodologies and insurance frameworks.