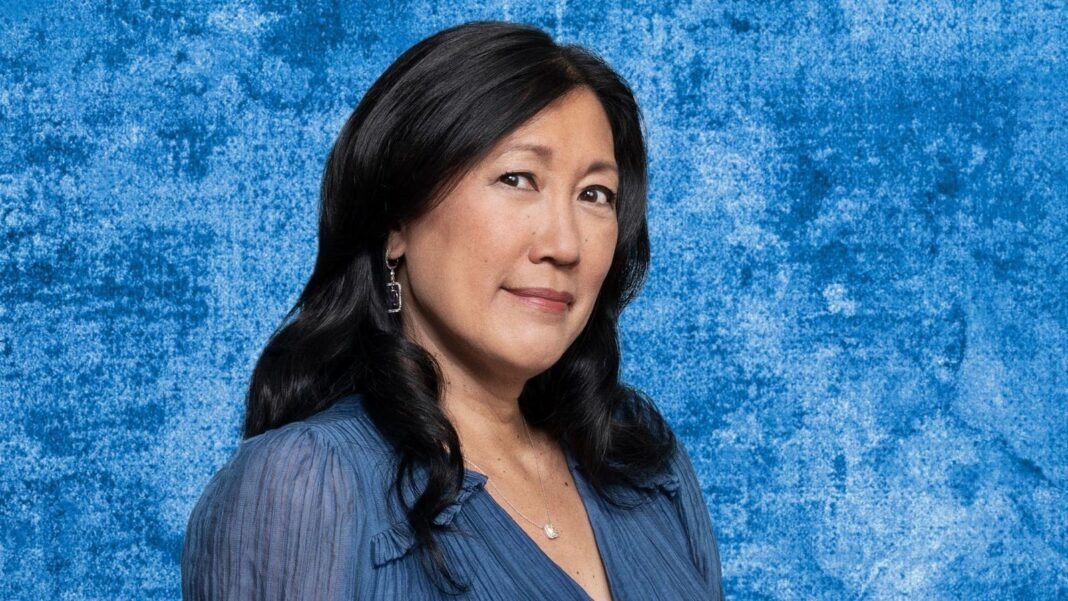

Theresia Gouw: Pioneering Female Billionaire in American Venture capital

theresia Gouw, originally from Indonesia and once a competitive figure skater, emerged as one of the earliest investors in Facebook and has become the first female billionaire venture capitalist in the United States. Her path from immigrant beginnings to a leading Silicon Valley investor highlights determination and forward-thinking leadership.

From Immigrant Beginnings to Silicon Valley Innovator

Gouw was born to Chinese-Indonesian parents in Indonesia but her family fled political turmoil when she was just three years old. They resettled near Buffalo, New York, were she cultivated an early fascination with data by analyzing football statistics alongside her father during Buffalo Bills games. This early exposure laid the groundwork for her enduring passion for analytics.

At a time when only 40% of students from her community pursued higher education, Gouw became the first at her high school to enroll at Brown University, majoring in engineering. She later earned an MBA from Stanford University.After co-founding a software startup early on, she transitioned into venture capital with Accel partners.

Driving innovation and Growth at Accel Partners

Over 15 years at Accel, Gouw played an instrumental role in supporting Facebook during its infancy-when it operated out of Mark Zuckerberg’s dorm room as a one-year-old startup. Though not publicly listed post-IPO, estimates indicate she held around eight million shares during facebook’s 2012 public offering-a stake that would be valued well over $5 billion today if fully retained.

In 2014, seeking to rekindle the spirit of late-1990s tech investing focused on early-stage startups, she co-founded Aspect ventures with Jennifer Fonstad. After five successful years collaborating there, they amicably parted ways to pursue distinct visions aligned with their individual values within venture capital.

Acrew Capital: Investing With Diversity as Core Principle

In 2019, gouw launched Acrew Capital alongside partners spanning generations-from Gen X through Gen Z-with diversity embedded deeply into its mission. Managing $1.7 billion across funds targeting sectors such as data security,fintech innovation,and health technology,Acrew emphasizes inclusion through initiatives like its diversify Capital Fund.

- The Diversify Capital Fund focuses on investors who are women or people of color; currently over 80% of its founding team fits this profile-and it strives to boost depiction on startup boards and ownership structures.

- Acrew typically invests between $1 million and $20 million per company depending on growth stage; smaller amounts support seed rounds for emerging startups.

- The fund avoids rigid quotas but operates under research-backed beliefs that diverse leadership teams consistently deliver superior decision-making outcomes and financial returns.

Empowering historically Black Colleges & Universities Through venture Partnerships

An innovative programme spearheaded by Gouw integrates Historically Black Colleges & Universities (HBCUs) into venture capital networks traditionally out of reach due to disparities in endowment sizes-for example Fisk University’s $37 million compared with Stanford’s $37 billion.

working closely with legal advisor Ed Zimmerman-who also invested personally-Acrew contributed fully funded stakes worth millions back into fisk University’s endowment via investments made through the Diversify capital Fund.

This model expanded nationally via The Historic Fund launched in 2023 involving ten VC firms supporting nine HBCUs collectively raising over $10 million plus matching allocations within participating funds.

These efforts aim not only for financial gains but systemic change by connecting underrepresented institutions directly with wealth-building opportunities inside tech innovation financing ecosystems.

Navigating Industry challenges Amid Political Shifts

the broader venture capital landscape remains difficult: women account for just 17% of partner or principal roles across U.S.-based VC firms as reported for 2024. Additionally,women-founded startups received approximately 22%(down from 25% last year). these declines coincide partly due to federal rollbacks on diversity programs introduced under previous administrations combined with corporate cutbacks on DEI initiatives amid shifting political climates.

Despite these headwinds,Theresia continues championing equity-driven investment strategies , embedding inclusion authentically within Acrew’s culture rather than treating it as mere compliance or trend-following.

Diversity rooted In Genuine Leadership Commitment

“Progress frequently enough feels like two steps forward followed by one step back,” reflects Gouw regarding DEI momentum.

Her philosophy rejects tokenism; instead focusing on meritocracy enhanced through expanding access points such as mentorship programs linking female founders via organizations inspired by All Raise-a nonprofit dedicated exclusively toward empowering women entrepreneurs throughout Silicon Valley.

“Having board members who truly value diversity ensures talent is recognized irrespective of background,” notes Simon Taylor CEO of HYCU whose Series B round was led by acrew.

A Crew With Vision: Performance Highlights And Future Directions

Acrew has completed roughly 150 investments since inception , including standout successes like fintech unicorn Chime-which targets an IPO valuation exceeding $11 billion-and Divvy Technologies acquired for approximately $2.5 billion.

While some portfolio companies have closed operations-as expected given market volatility-the firm maintains competitive internal rates of return placing it solidly among peers founded around similar periods.

However,a more cautious fundraising surroundings driven by rising interest rates coupled with geopolitical uncertainties means future growth demands strategic adaptability beyond core focus areas alone-including recent thematic shifts toward AI-powered solutions announced earlier this year.

Cultivating Role Models For Emerging Investors And Entrepreneurs

The visibility surrounding Theresia’s accomplishments holds vital symbolic importance especially among young Asian American women aspiring toward leadership roles historically dominated elsewhere:

“Seeing someone break barriers inspires others,” affirms Lauren Kolodny cofounder at Acrew emphasizing multigenerational mentorship woven throughout their culture.

Ed Zimmerman echoes this sentiment highlighting public recognition encourages replication:

“Theresia leads quietly yet powerfully; greater exposure will motivate others.”

The Road Ahead For Women In Venture Capital And Tech Innovation

- Diversity remains limited:women occupy less than one-fifth share among top VC decision makers despite mounting evidence linking inclusivity positively correlates with stronger financial performance;

- Evolving investment models:complex funds like Acrew demonstrate how blending cultural alignment alongside rigorous deal selection fosters lasting long-term growth;

- Persistent challenges:political shifts threaten prior progress requiring renewed advocacy combined strategically targeted philanthropy;

“The issue persists even if enthusiasm diminishes,” caution industry experts underscoring ongoing disparities affecting founders’ access to capital based more often on gender or ethnicity rather than pure ability.”