InDrive’s Transformation: From Ride-Hailing Pioneer to All-in-One Super-App

Known for its unique bidding-based ride-hailing model that has gained traction across Asia and Latin America,InDrive is now evolving into a complete super-app. This strategic shift aims to extend its services beyond transportation by offering essential daily goods directly to users in emerging economies.

Grocery Delivery Debut: Kazakhstan as the Testing Ground

The company’s initial step into this broader ecosystem began with grocery delivery in Kazakhstan, setting the stage for expansion into markets like Brazil, Colombia, Egypt, Pakistan, Peru, and Mexico over the coming year.This initiative follows InDrive’s impressive achievement of surpassing 360 million app downloads and facilitating over 6.5 billion transactions globally-making it the world’s second most-downloaded ride-hailing app, trailing only Uber since 2022.

Kazakhstan was chosen as a pilot due to its high digital adoption rates and serves as home to InDrive’s largest operational hub. Here, customers can access more than 5,000 grocery products with an ambitious promise of delivery within just 15 minutes. Early feedback reveals strong user engagement with an outstanding net promoter score (NPS) of 83% and an average frequency of five grocery orders per month-indicators of rapid acceptance among local consumers.

A Dark Store Strategy Designed for Customer Retention

indrive utilizes a dark store model focused mainly on ready-to-eat meals while maintaining approximately 10% fresh produce availability in Kazakhstan-a tactic aimed at encouraging repeat purchases and fostering loyalty. The network has grown by nearly 30% in August alone through additional dark stores.However, future expansions may adopt different approaches such as partnerships with neighborhood shops depending on regional market conditions.

kazakhstan’s Role: A Strategic Launchpad Fueled by Digital Growth

Operating across close to a thousand cities in 48 countries-with leadership positions in eight-InDrive selected Kazakhstan as it represents Central Asia’s largest economy combined with robust digital infrastructure growth. The country’s tech sector is currently valued at $26 billion-a remarkable eighteenfold increase as 2019-driven by surging startup activity and investment inflows that create fertile ground for innovative digital services like those offered by InDrive.

The company aims to disrupt traditional grocery delivery models by emphasizing affordability similar to global discount supermarket chains-providing budget-conscious consumers better access without sacrificing quality or variety.

“Many people struggle to find affordable groceries or settle for lower-quality options due to limited choices,” said Smit. “Our mission is delivering superior alternatives at competitive prices.”

Navigating the Complex Super-App Ecosystem Globally

The super-app concept has experienced varied outcomes worldwide; while platforms like WeChat and Gojek have flourished through integrated service ecosystems, others such as Meta have faced challenges despite notable investments. Drawing from experience working alongside WeChat during its early development stages, InDrive plans extensive use of artificial intelligence technologies-to tailor user experiences personally while improving accessibility for individuals with disabilities or low literacy levels.

A Bold Investment Approach accelerates Expansion Goals

Since late 2023, InDrive established a dedicated venture capital fund targeting $100 million over several years focused primarily on startups within emerging markets aligned with their super-app vision; about one-third has already been deployed toward scaling multi-service platforms.

This includes backing ventures such as Pakistan-based Krave mart among others-even though no definitive timeline exists yet regarding full-scale grocery rollout under the InDrive brand there.

Differentiation Through Affordability Versus Competitors Like Uber

While Uber continues expanding globally via food delivery services including Uber Eats,Smit emphasizes that InDrive specifically targets price-sensitive segments often overlooked by larger competitors;

“Affordability remains paramount for our core users,” he explained. “This focus distinctly shapes our product development compared against rivals.”

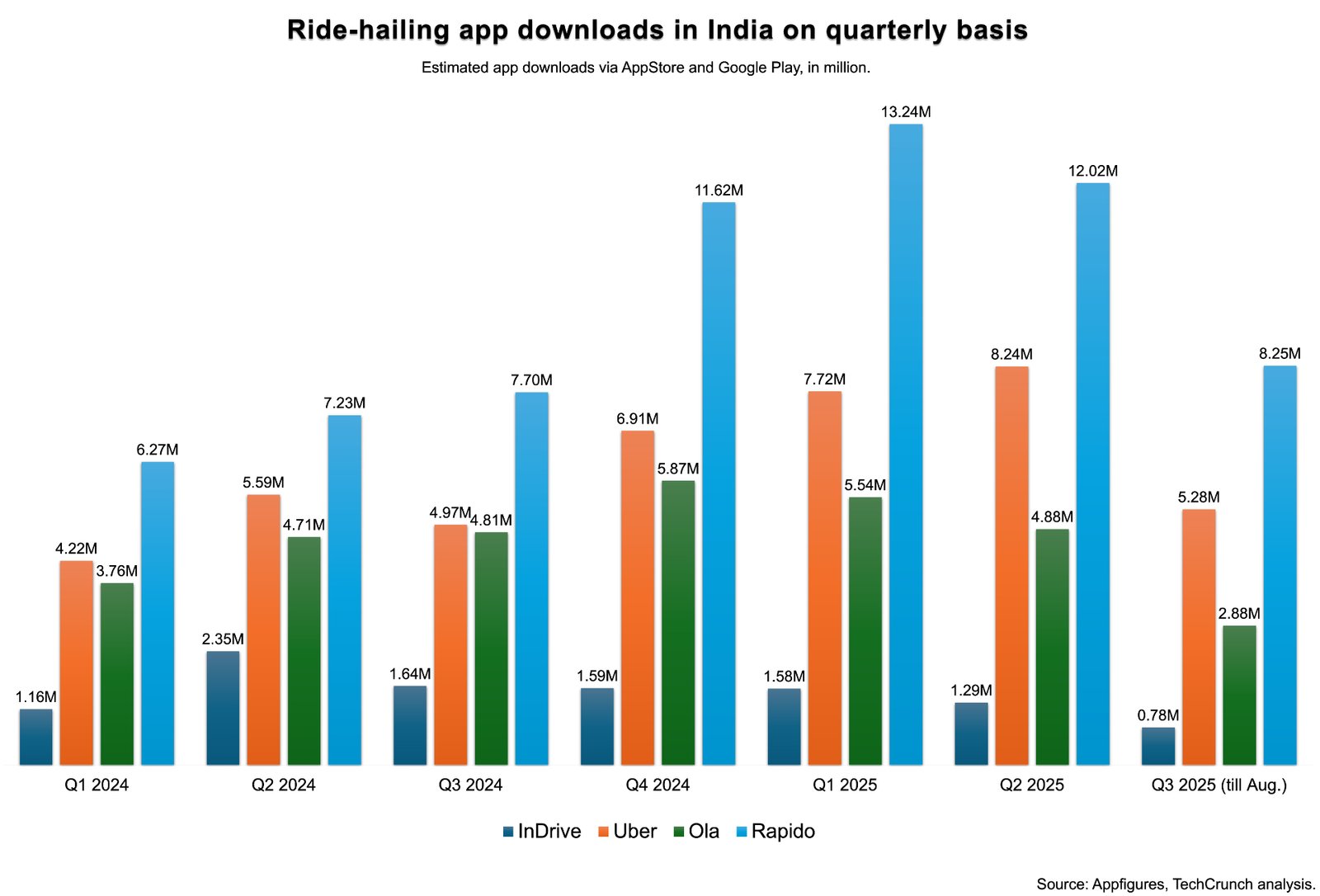

Tackling Arduous Markets: India Remains a Tough Challenge

The South Asian market continues proving elusive despite sustained efforts; competing against entrenched players such as Ola and Rapido alongside Uber itself hasn’t yet yielded expected traction.

- A recent decline saw over one million fewer downloads year-over-year (-22%) for InDrive contrasting sharply against competitors’ gains (Uber +60%, ola +13%, Rapido +81%).

- User safety concerns related to bidding misuse-including incidents where drivers impersonate riders leading aggressive price negotiations-weaken trust locally.

- The company acknowledges these challenges openly while dedicating resources toward safety education programs targeting both passengers & drivers alike.

Piloting Innovative Models Amid market Complexity

- Diverse payment schemes enabling daily driver payouts are under trial along freight-focused expansions complementing traditional passenger rides.

- Sustained patience remains crucial given past patterns where some regions initially stagnated before experiencing growth following competitor exits or shifts.

Beyond Rides & Groceries: Expanding Into Financial Services & Micro-Mobility Solutions

Apart from current rideshare and grocery offerings live across multiple countries including Brazil & Mexico,sizable plans exist around financial inclusion tools such as microloans accessible via app interfaces initially targeted at drivers but potentially extending towards passengers and small businesses involved within logistics networks.

This aligns well with rising fintech adoption seen recently throughout frontier economies seeking convenient embedded credit solutions inside familiar platforms.

Additionally,micro-mobility integrations connecting users seamlessly with public transit systemsand local merchants are envisionedto foster city-specific service bundles tailored preciselyto each market’s needsand capabilities.These collaborations will leverage existing expertisewhile partneringwith specialized providers when necessary,says Smit.

“Our goal is localized portfolios capturing key verticals adjacentto our core business,but we remain open topartner when outside their rangeof experience,” he explained.