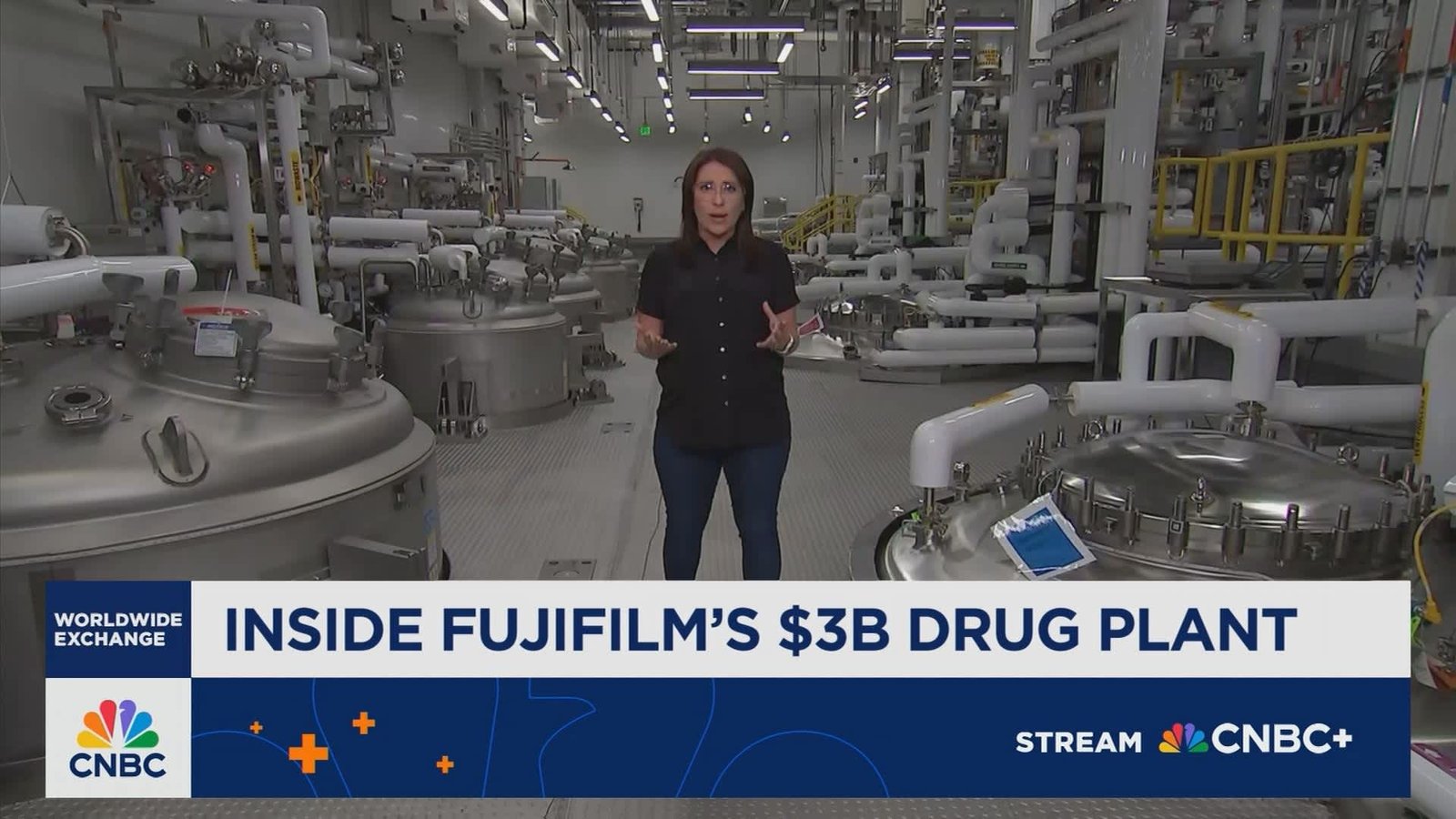

Fujifilm’s Advanced Biologics Manufacturing campus in North Carolina

A Massive Facility Designed for Next-Generation biologic Production

Located in Holly Springs, North Carolina, Fujifilm Biotechnologies has developed an expansive biologics production site featuring a corridor nearly provided that three football fields.This campus consists of four interconnected buildings purpose-built to manufacture cutting-edge biologic therapies.

The first two buildings are scheduled to commence operations this fall, focusing on producing drug substance-the essential raw material for biologic medicines-for prominent clients such as Regeneron and Johnson & Johnson. Construction continues on the remaining two structures, with plans to bring them online by 2028, considerably boosting overall manufacturing output.

driving Domestic Pharmaceutical Growth Amid Global Trade Shifts

This major investment coincides with recent U.S. policy initiatives aimed at strengthening domestic pharmaceutical production through potential tariffs on imported drugs. However, Fujifilm’s project was initiated well before these trade policies took shape.

Bringing this vision to life demanded over five years of development and an investment exceeding $3 billion-underscoring the complexity involved in establishing complex pharmaceutical manufacturing capabilities within the United States.

“Pharmaceutical production requires uncompromising safety protocols,” stated Lars Petersen, CEO of Fujifilm Biotechnologies. “Every step must adhere to strict cleanliness standards and be thoroughly documented for regulatory compliance.”

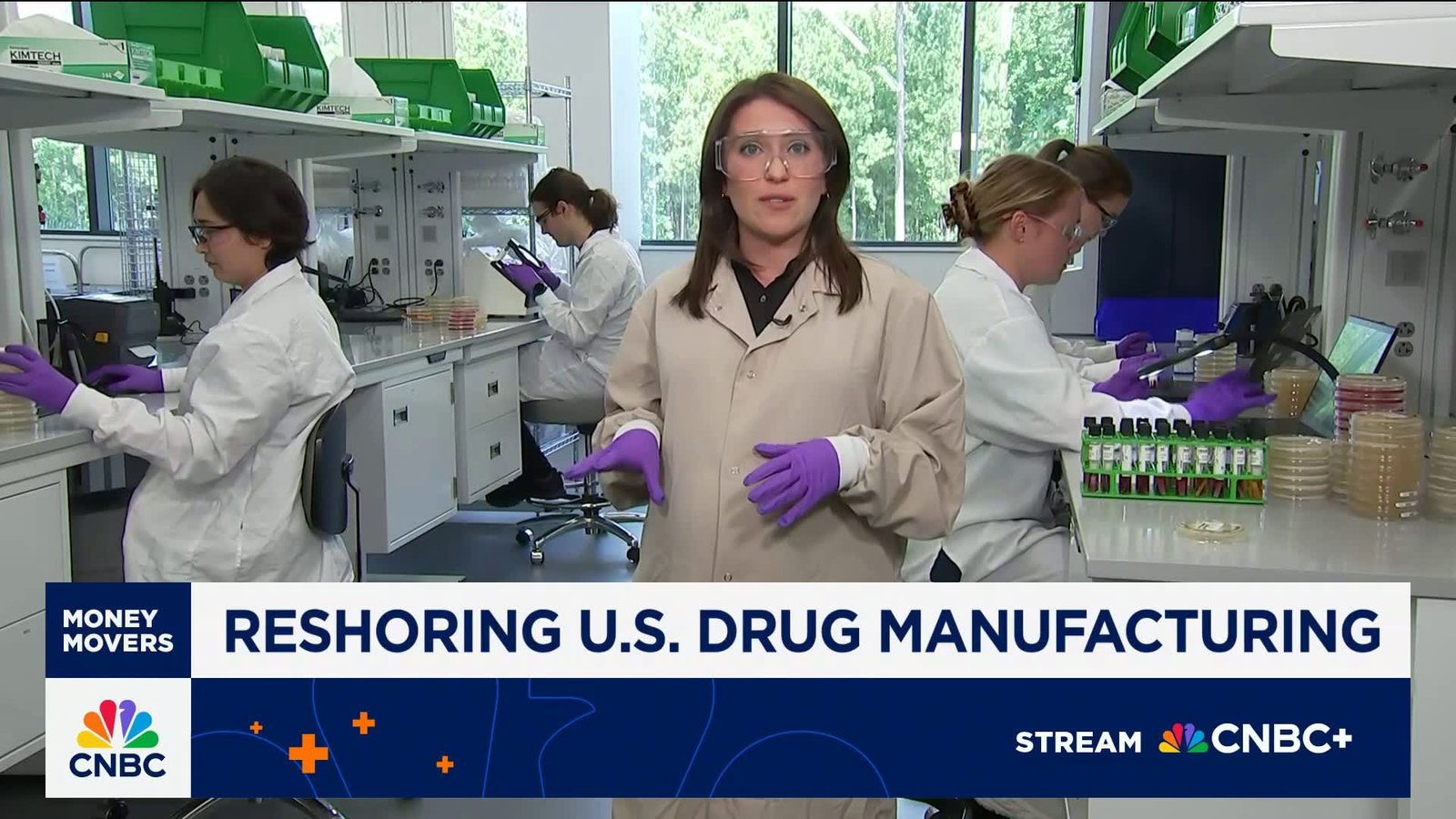

The Complex Science Behind Producing Biologic Medicines

Manufacturing biologics involves cultivating living cells that consistently generate specific proteins-a process both expensive and technically demanding. Len Schleifer,CEO of Regeneron,highlights that developing these therapies demands meticulous timing and precision due to their biological complexity.

The Holly Springs facility will eventually operate 16 bioreactors each capable of holding 20,000 liters by 2028-enabling annual production estimated at around 50 million doses primarily focused on monoclonal antibodies used extensively in treating cancer and autoimmune disorders.

A single batch requires nearly two months from initiation through cell growth, purification stages, and preparation for downstream processing within a highly sensitive supply chain where even minimal contamination can lead to complete batch loss.

The Rising Importance of U.S.-Based Drug Manufacturing

The push toward expanding domestic pharmaceutical capacity reflects strategic efforts by leading companies aiming to reduce dependence on foreign suppliers amid geopolitical tensions and evolving trade regulations worldwide.

- Regeneron: Secured a decade-long $3 billion agreement at Holly Springs-doubling its U.S.-based biologics output without constructing new plants from scratch; leveraging existing infrastructure accelerated delivery timelines considerably.

- Johnson & Johnson: Committed $2 billion over ten years at the same location as part of its broader $55 billion investment strategy focused on innovation hubs across America; recent tax reforms lowering corporate rates have enhanced incentives for local manufacturing according to company executives.

A Flourishing Life Sciences Cluster rooted in North Carolina

This region has emerged as a biotech hotspot attracting approximately $28 billion in investments since 2016-with last year alone witnessing record commitments exceeding $10.8 billion based on state economic reports.Nearby firms like Amgen are also expanding via multi-billion-dollar projects while Genentech is developing new fill-finish facilities critical for locally packaging injectable treatments efficiently.

“Talent availability combined with collaborative industry culture drives innovation here,” remarked Laura Rowley from the North Carolina Biotechnology Center.“Being surrounded by peers creates unique opportunities that fuel breakthroughs.”

Tackling Challenges While Accelerating Domestic Capacity expansion

Catching up with global competitors remains challenging despite increased investments; currently only about 18% of finished generic and branded pharmaceuticals (excluding Puerto Rico) originate from manufacturers based within the United States according to recent FDA import data analyzed independently focusing on supply chain security.

- Diverse Supply Sources: Europe continues dominating especially branded injectable drugs similar to those produced at Holly springs-with nearly half sourced there today;

- Tactical Advantages: Partnering with established sites like Fujifilm provides companies faster market access compared with building new plants themselves;

“Technology transfer between sites typically takes two-to-three years involving extensive validation followed by regulatory approvals,” says Gabriela de Almeida from Boston Consulting Group.“This timeline highlights why operational flexibility is vital when responding swiftly to tariff threats or supply disruptions.”

No Concrete Plans yet For Extreme Tariff Scenarios

Theoretical proposals suggesting tariffs up to 250% remain largely speculative; industry leaders acknowledge implementing such drastic measures would require fundamental restructuring beyond current contingency strategies according experts monitoring global life sciences trends closely worldwide.

An Agile Future Built On Proven Designs And Scalability

Petersen emphasizes how replicating successful plant blueprints accelerates future expansions: “Duplicating each facility cuts design time dramatically.” If demand surges after full operation begins next year, doubling capacity could be achieved within three additional years-a pace unmatched just five years ago thanks partly because lessons learned now streamline construction processes more than ever before.”

“Weather facing tariffs or pandemics disrupting global supply chains,” Petersen added,

“our objective was always embedding adaptability into our infrastructure so we can respond rapidly when market conditions evolve.”