Evaluating Klarna’s Market Entry and Future Growth Trajectory

Klarna,the Swedish fintech company known for its buy now,pay later services,recently made a notable splash with its initial public offering (IPO) on wall Street. Even though the stock experienced a robust debut rally, analysts beleive the current valuation remains attractive for investors seeking long-term exposure.

Strong Debut Amidst a Revitalized IPO Landscape

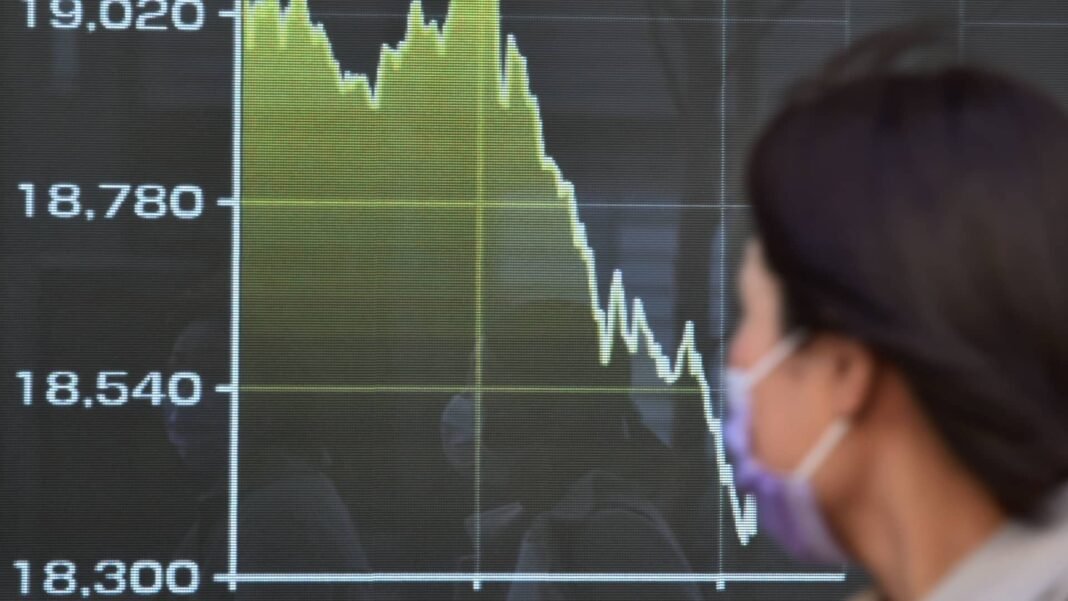

the company priced its shares at $52 each and saw an remarkable first-day gain of over 14%, closing well above the initial offering price. this launch coincides with a broader revival in IPO activity across global markets, pushing key IPO indices to levels not witnessed in several years. The premium pricing reflects solid enthusiasm from investors eager to back innovative fintech enterprises.

Expanding Revenue Beyond Conventional Buy Now, Pay Later Models

While Klarna is primarily recognized for allowing customers to defer payments interest-free over short periods, it also diversifies revenue through multiple avenues. These include consumer credit products that carry interest fees, strategic advertising collaborations embedded within its app ecosystem, and advanced financial wellness tools designed to help users track and manage their expenditures more effectively.

Robust Credit Assessment Driving Portfolio Stability

A standout feature of Klarna’s business model is its rigorous underwriting process. Despite relying heavily on automated systems-a standard approach among digital lenders-the firm enforces strict credit criteria that have contributed to maintaining strong portfolio health and minimizing default rates. This disciplined risk management underpins enduring growth prospects.

From Profitability roots to Strategic Global Expansion

Klarna enjoyed profitability during its early years before pivoting toward aggressive international expansion starting around 2019. The company has since entered twelve new markets including deepening presence in the united States-moves that temporarily weighed on earnings but laid groundwork for scalable growth worldwide. Recent data from 2023 onwards indicate improving profit margins as operational efficiencies take effect.

Ownership Dynamics and Capital Deployment Considerations

An important aspect of this IPO is that much of the stock offered came from existing shareholders rather than newly issued shares by Klarna itself. Investors frequently enough favor offerings where proceeds directly fuel business development rather than providing liquidity exits for early investors; though, given Klarna’s mature capital structure after nearly two decades in operation coupled with steady cash flows today’s transaction appears aimed more at broadening shareholder base than urgent fundraising.

Klarna Compared With Leading Fintech Competitors

- Affirm: A notable rival boasting consistent profitability alongside measured expansion within consumer finance sectors.

- Sezzle: Another publicly traded BNPL provider showing recent positive earnings momentum amid growing market share.

The performance trajectories of these peers reinforce confidence that Klarna can similarly drive shareholder value creation as it advances toward sustained profitability milestones.

Navigating Forward: Valuation Insights & Growth outlooks

Klarna currently commands a market capitalization exceeding $17 billion-a valuation reflecting optimism about future scaling opportunities combined with trust in executive leadership strategies. While not yet profitable like some competitors such as Affirm or Sezzle are today, ongoing operational improvements suggest reaching this benchmark could be imminent if current trends persist uninterrupted into coming quarters.

“The success seen by comparable publicly listed companies offers reassurance; although those firms have already achieved profitability whereas Klarna remains on course toward similar outcomes,” industry experts observe.