Keurig Dr Pepper Set to Acquire JDE Peet’s in a Historic $18 Billion Deal

revamping the Coffee portfolio Through Strategic Acquisition

Keurig Dr Pepper is moving forward with plans to acquire the Netherlands-based coffee adn tea powerhouse JDE Peet’s for an estimated $18 billion. This bold acquisition aims to rejuvenate Keurig’s lagging coffee segment and significantly alter the dynamics of the global coffee industry.

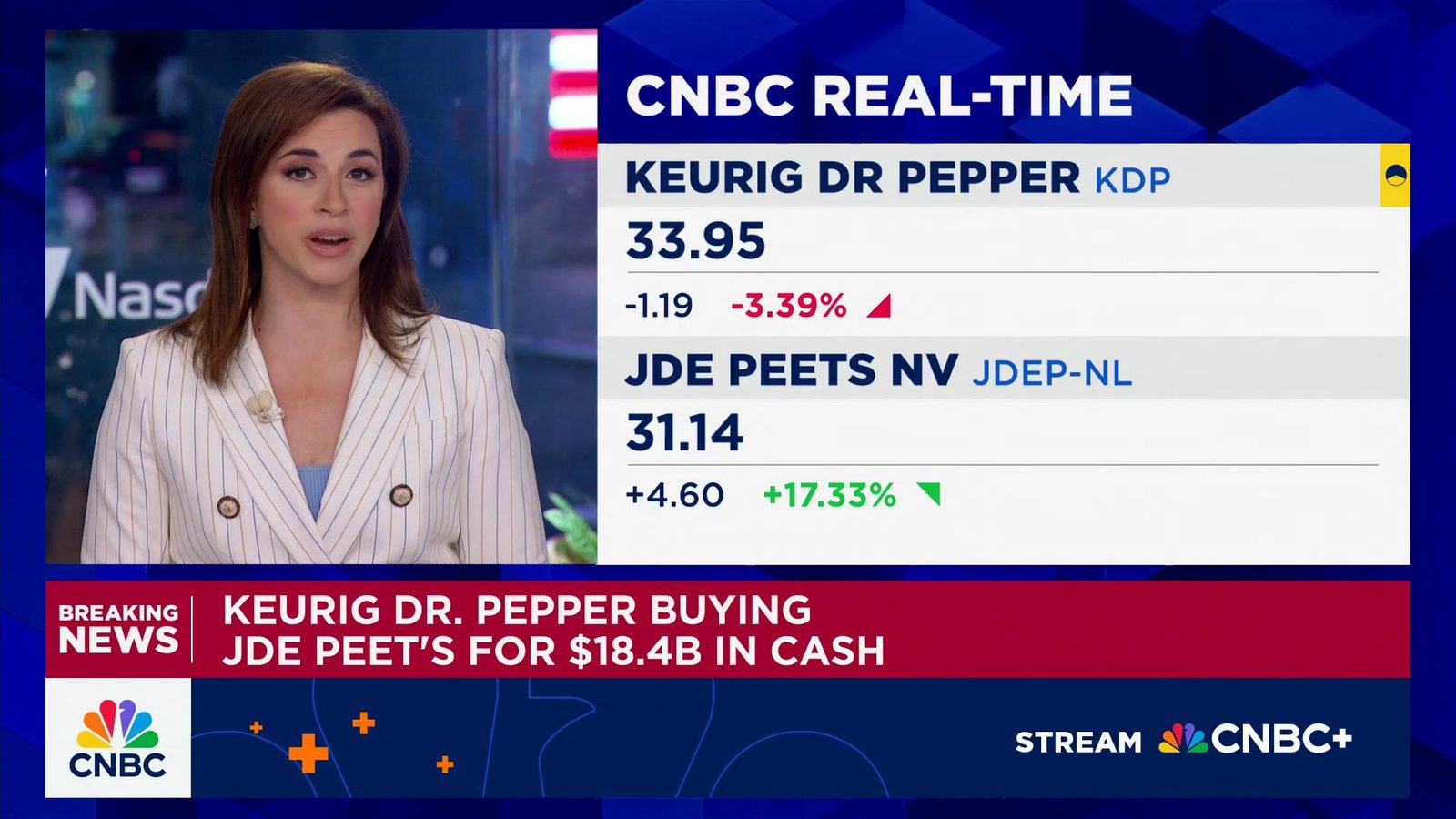

Financial Overview and Market Response

the announcement triggered a nearly 8% decline in Keurig Dr Pepper’s stock during early trading, while shares of JDE Peet’s soared by approximately 15%.The deal involves Keurig offering €31.85 per share-equivalent to about $37.30-a cash premium of 33% over JDE Peet’s recent average price,valuing the equity at roughly €15.7 billion ($18.4 billion).Ahead of closing, JDE Peet’s will issue a dividend payout to shareholders.

Anticipated Operational Efficiencies and Savings

This merger is projected to generate around $400 million in cost synergies within three years by streamlining supply chains and consolidating marketing initiatives across both companies.

Current Challenges Within Keurig Dr Pepper’s Coffee Division

Keurig Dr Pepper owns prominent brands such as Green Mountain Coffee, Snapple, 7Up, and Dr pepper but has faced declining revenue in its U.S.-based coffee buisness-down 0.2% year-over-year with quarterly sales near $900 million-largely due to waning demand for single-serve pods and brewing machines.

the company has been focusing on attracting price-sensitive consumers who prefer brewing at home while expanding its portfolio into ready-to-drink cold brew beverages designed to rival Starbucks’ and Dunkin’s offerings.

A Shared investment Legacy with JAB Holding Company

Both companies share historical connections through their former common investor: JAB Holding Company controlled by the Reimann family. While currently holding onyl a minority stake (4.4%) without board representation in keurig Dr Pepper, JAB remains the majority shareholder of JDE Peet’s.

Post-Merger Corporate Realignment Plans

The transaction is expected to finalize during H1 2026 after which Keurig Dr Pepper plans to split its beverage operations from its expanded coffee business into two separate publicly traded U.S.-based entities.

This restructuring reverses part of their original strategy from their 2018 merger that combined Keurig Green Mountain with Dr Pepper Snapple Group-then North America’s third-largest beverage firm generating approximately $11 billion annually.

“Combining carbonated soft drinks with a predominantly coffee-focused operation was always an unconventional approach,” industry experts observe regarding this strategic shift.”

Leadership Roles Following Separation

- The newly independent coffee company will be headed by Sudhanshu Priyadarshi, current CFO at Keurig Dr Pepper, managing an anticipated annual revenue close to $16 billion post-merger.

- The beverages division will continue under CEO Tim Cofer’s leadership with forecasted yearly sales around $11 billion after separation.

sustained Leadership at JDE Peet’s Until Completion

Dutch CEO Rafael Oliveira will remain at the helm until deal closure ensuring smooth operational continuity throughout integration phases.

Coffee Sector Trends: Divestitures Amid Competitive Pressures

Keurig isn’t alone as rising commodity prices and intense competition prompt major players worldwide to reassess portfolios. Such as, Coca-Cola is reportedly contemplating selling Costa coffee-a brand it acquired for over $5 billion-to concentrate on core businesses amid shifting consumer preferences favoring specialty coffees brewed either at home or sourced from local cafes globally.

A Transformative Era for Global Coffee Brands

This landmark acquisition underscores ongoing consolidation trends within beverage industries as companies pursue scale advantages while adapting product lines toward evolving consumer tastes shaped by convenience-driven lifestyles accelerated as the pandemic.