Rivian’s future Vision: Expansion, Obstacles, and the impact of the R2 SUV

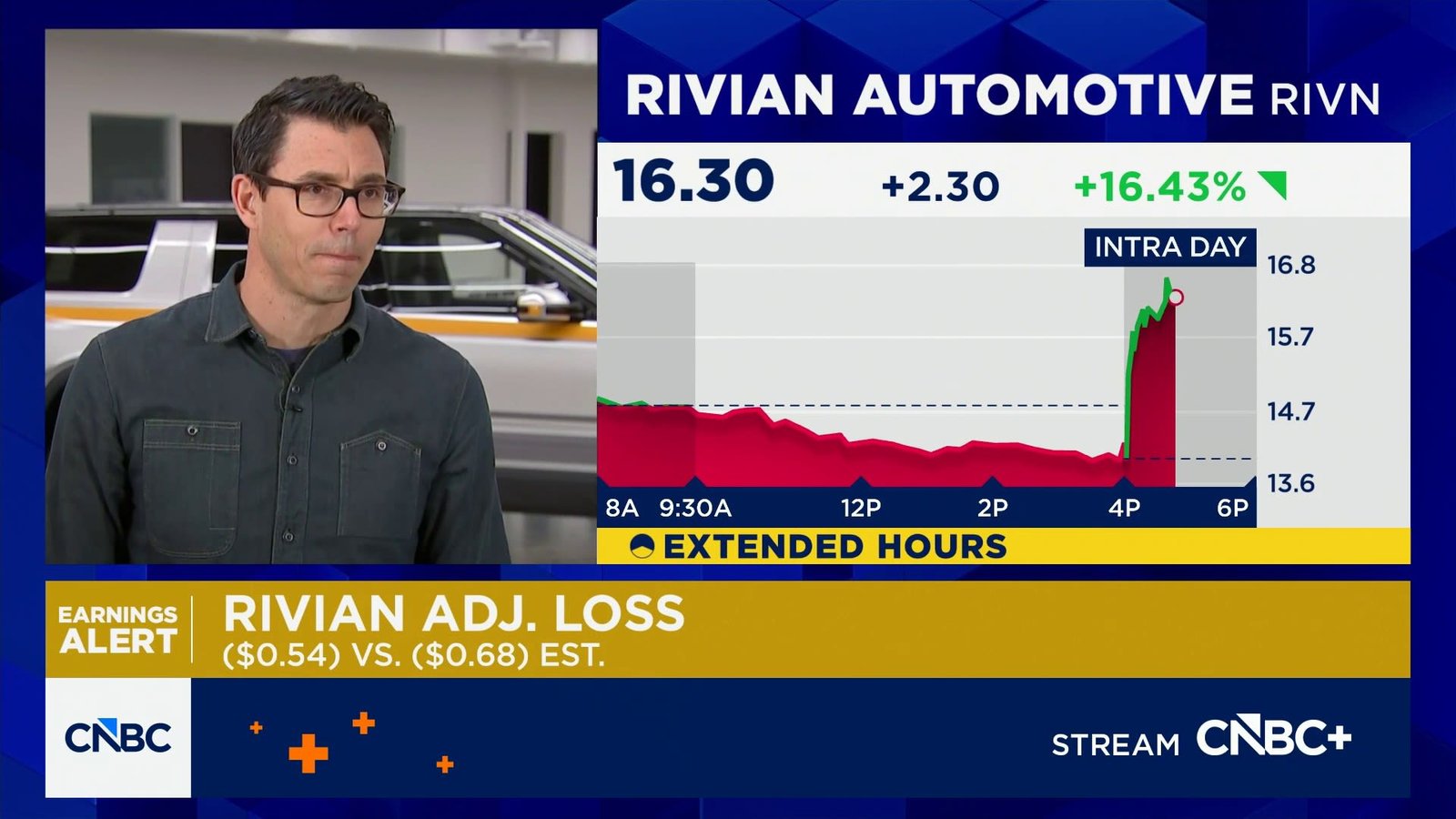

Robust Q4 Results highlight Momentum for Growth

Rivian Automotive exceeded market expectations in the final quarter, demonstrating resilience amid financial hurdles. The company reported adjusted losses per share of 54 cents, outperforming analysts’ forecasted loss of 68 cents. Revenue totaled $1.29 billion, slightly surpassing predictions of $1.26 billion.

Throughout 2025, Rivian achieved $4.97 billion in revenue-an 8% rise compared to the previous year-with $1.7 billion generated in Q4 alone. Impressively, Rivian recorded its first-ever annual gross profit at $144 million last year, driven largely by a strong fourth-quarter gross profit contribution of $120 million.

The R2 SUV: A Catalyst for scaling and Profitability

The forthcoming release of Rivian’s midsize electric SUV-the R2-is poised to be transformative for production scale and cost efficiency. Set to begin deliveries in Q2 2026 with a price point near $45,000, this model aims to halve manufacturing expenses while streamlining assembly processes.

CEO RJ scaringe highlighted that by late 2027 the R2 is expected to dominate Rivian’s sales volume as production intensifies at their Normal, Illinois plant-expanding from one shift initially to two shifts within the year.

Anticipated Growth metrics and Financial Projections for 2026

- Vehicle Deliveries: Projected between 62,000 and 67,000 units-a substantial increase representing nearly a doubling compared with estimated deliveries in 2025.

- Adjusted pre-Tax Losses: Forecasted between $1.8 billion and $2.1 billion due to ongoing investments during scaling phases.

- Capital Expenditures: Expected around $1.95 billion to $2.05 billion-up from approximately $1.7 billion last year-to support expansion initiatives.

Tackling Financial Challenges Amid Rapid expansion

The fiscal year 2025 served as a foundational period while positioning 2026 as a pivotal turning point toward lasting growth despite continued losses linked primarily to ramping up new vehicle models like the R2.

CFO Claire mcdonough described this phase as transitional; although gross profits may decline relative to last year’s figures due to increased costs associated with product launches and capacity expansion efforts.

evolving Market Conditions Affect Profit Margins

A significant factor impacting recent earnings was reduced income from regulatory credit sales following changes in federal fuel economy policies-a shift that contributed notably to an accelerated net loss nearing $804 million during Q4 alone.

Total net losses improved compared with prior years but still reached about $3.6 billion for all of last year-roughly half what was recorded before but indicating ongoing financial pressure amid growth efforts.

Sufficient Cash Reserves Bolster Ambitious Plans

The company ended Q4 holding nearly $6.59 billion in liquidity reserves-including close to $6.1 billion in cash equivalents-which provides essential runway amid aggressive investment cycles required by today’s global EV manufacturing scale-up demands.

Diverse Product Portfolio Extends Beyond Consumer Vehicles

Apart from consumer SUVs and pickups priced above seventy thousand dollars each-which have experienced slower adoption recently-Rivian continues producing electric delivery vans primarily purchased by Amazon (its largest shareholder). This commercial segment remains crucial given accelerating fleet electrification trends driven by sustainability mandates across logistics industries worldwide.

“Introducing more affordable models like the R2 could substantially reshape our competitive landscape,” industry experts note amidst intensifying rivalry within the EV sector.”

Navigating Innovation While Pursuing Profitability Targets

If Rivian successfully implements its strategy focused on reducing costs through design innovation combined with scaled manufacturing output via expanded shifts at existing facilities-the company could realize meaningful progress toward profitability beyond mere revenue growth over coming years.

A prudent approach remains vital given persistent macroeconomic uncertainties affecting supply chains globally alongside evolving international automotive emissions regulations.