Starbucks Confronts Persistent Obstacles amid Strategic Realignments

Following the market close on Tuesday, Starbucks is poised to release its fiscal third-quarter results, with Wall Street experts closely monitoring key financial indicators that reveal the company’s current standing.

Forecasts for Starbucks’ Upcoming Financial Report

- Expected earnings per share: $0.65

- Anticipated revenue: $9.31 billion

The coffee powerhouse has faced a continuous downturn in same-store sales within its two primary markets-the United States and China-registering five straight quarters of decline. Industry analysts predict this negative momentum will persist, projecting a further 1.3% decrease in same-store sales for the latest quarter.

Evolving Strategies Under New Executive Direction

Since Brian Niccol assumed the role of CEO, Starbucks has focused on refining its menu selections and boosting operational productivity by increasing employee presence in stores to speed up service delivery. A key program driving this effort is the “Green Apron service,” which emphasizes hospitality training designed to strengthen customer connections and foster loyalty.

Tackling external Challenges: Economic Fluctuations and Supply Chain pressures

The hurdles facing Starbucks extend beyond internal adjustments; volatile coffee bean prices, tariff-related costs, and global economic uncertainties have complicated growth prospects across international markets.

A Closer Look at China: Reassessing Strategy Amid Intensifying Competition

Deteriorating performance in China-heightened by aggressive expansion from local competitors such as HeyTea offering more budget-amiable alternatives-has prompted Starbucks to consider strategic options including a possible partial sale of its Chinese operations. Market speculation values Starbucks’ China business at nearly $10 billion.

The Pandemic’s Role in Shaping Consumer Preferences

The Covid-19 crisis accelerated changes within China’s beverage industry landscape, enabling domestic brands like Luckin Coffee and HeyTea to capture substantial market share through lower-priced offerings compared to Starbucks’ premium positioning.

Outlook on Financial Stability and Market Positioning Ahead

This past October, Starbucks refrained from providing a full-year forecast for fiscal 2025 while unveiling initial elements of a recovery plan aimed at stabilizing growth amid ongoing challenges.

The company’s stock price has seen modest gains exceeding 1% year-to-date despite prevailing uncertainties but continues to hold strong with a market capitalization near $106 billion as investors balance potential risks against recovery opportunities.

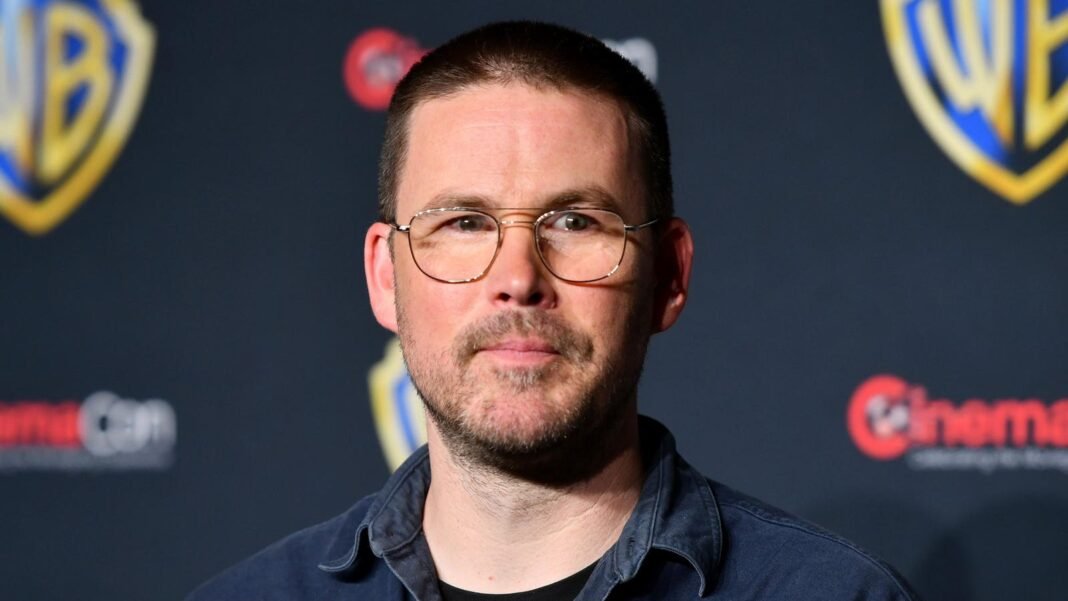

“A busy café scene highlights how global brands like Starbucks are continuously evolving within shifting retail environments.”