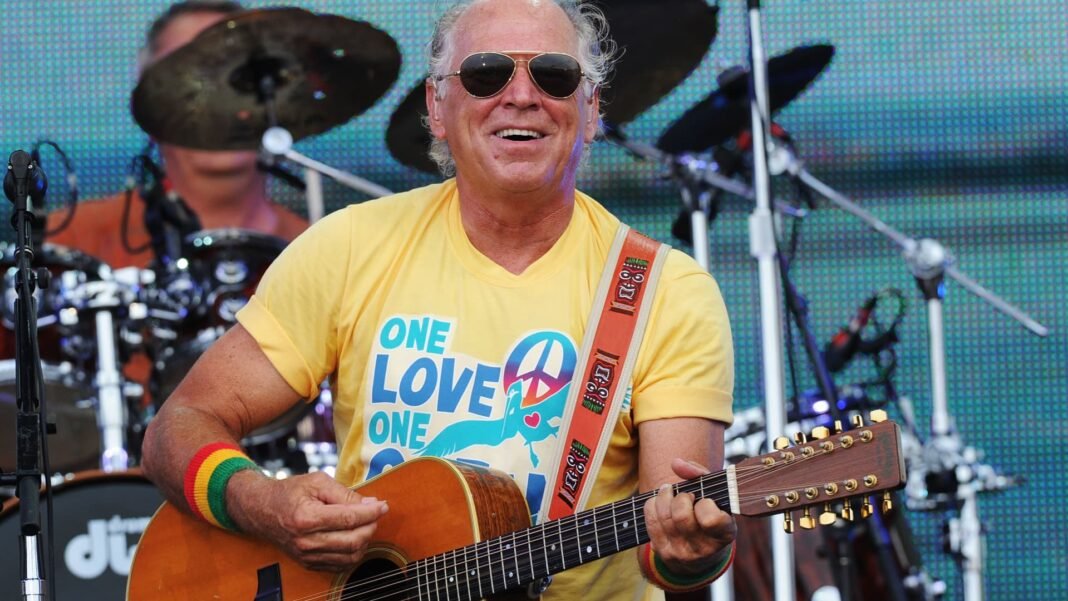

Unraveling the Legal battle Over Jimmy Buffett’s $275 Million Legacy

The dispute over the late Jimmy Buffett’s estate, valued near $275 million, highlights a growing phenomenon of inheritance conflicts as vast fortunes transfer between generations. With global wealth transfers projected to exceed $100 trillion in coming decades, such legal battles are becoming increasingly common.

Overview of the Estate and Its Complex Assets

Jimmy Buffett was renowned not only for his iconic songs like “Cheeseburger in Paradise” but also for building an extensive business empire. His holdings include approximately $35 million in real estate, a $15 million investment in Strange bird Inc.-a company involved with private aviation-plus vehicles worth around $5 million and musical instruments appraised at about $2 million. Additional investments total roughly $12 million.

A significant portion of his wealth is tied to Margaritaville, a lifestyle brand encompassing nearly 30 restaurants and bars worldwide, 20 hotels, casinos, cruise lines, vacation clubs, and branded merchandise. Through JB beta LLC, Buffett’s stake in Margaritaville is estimated at close to $85 million.

The Trust Arrangement: intentions Behind Shared Control

Buffett’s will was originally drafted over three decades ago and updated multiple times before his death. it established a marital trust granting lifetime benefits exclusively to his widow Jane Buffett while naming their three children-Savannah, Delaney, and Cameron-as remainder beneficiaries who would inherit after Jane’s passing.

The trust appointed Jane alongside Richard Mozenter-a longtime accountant and business manager with over 30 years working closely with Buffett-as co-trustees. This dual trustee structure aimed to balance oversight with family involvement but has as become a source of tension.

Conflicts Between Co-Trustees Emerge Posthumously

- lack of Clarity: Jane alleges Mozenter withheld essential financial documents related to the trust’s assets;

- Dismissive Communication: Requests for facts were reportedly met with evasiveness or hostility;

- High Trustee Fees: Mozenter charges approximately $1.7 million annually-about 0.6% of total assets-which some argue is disproportionate given modest income returns;

- Poor Asset Performance: Despite managing hundreds of millions in assets including Margaritaville distributions totaling around $14 million within eighteen months,

Mozenter declined to provide future earnings projections; - Tensions Over Income Sufficiency: Mozenter suggested that Mrs.Buffett might require “adjustments” due to insufficient income from trust funds covering expenses.

A Reciprocal Lawsuit Intensifies Dispute

Mozenter responded by filing suit in Palm Beach County alleging that Jane obstructed his fiduciary duties by refusing cooperation on management decisions related to the trust’s businesses.

He accuses her of placing personal interests above those owed under fiduciary responsibilities-a claim that deepens mistrust between them.

The Broader Context: Why Such Estate Conflicts Are Rising

This case exemplifies an increasing trend where families face complex disputes amid unprecedented intergenerational wealth transfers globally.

legal experts note that appointing co-trustees frequently enough leads to clashes when roles are unclear or communication breaks down.

“Disputes frequently arise from mismatched expectations combined with limited interaction among trustees,” explains an estate litigation specialist.

Navigating Dual Trusteeship When One Is Also spouse

- Sole Beneficiary vs Shared Authority: While many estates simplify matters by naming one person as both sole trustee and beneficiary,

Buffett opted for shared control likely intending checks-and-balances given concerns about asset stewardship; - Divergent Perspectives on Management: Mozenter claims jimmy expressed reservations about Jane handling finances alone,

prompting him to implement controls limiting her unilateral authority; - Paternalism Versus Openness: Beneficiaries frequently enough feel excluded or under-informed while trustees may act protectively believing they honor decedent wishes.

“The emotional complexity intensifies when spouses serve as trustees together,” notes veteran estate attorney Stewart Albertson.

“Imagine sharing decades together then suddenly losing control over your own financial affairs overnight.”

Court Proceedings: What Lies Ahead?

- The jurisdiction remains unsettled due to competing lawsuits filed both in California (Los Angeles) and Florida (Palm Beach);

- A judge must first decide which venue will hear substantive arguments;

- If conflicts remain irreconcilable between co-trustees,

courts commonly appoint neutral professional fiduciaries such as corporate trustees or banks; - This approach aims for impartial asset management but may disappoint family members desiring direct influence over legacy decisions.

“Professional fiduciaries bring objectivity free from emotional bias,” says litigation expert Alex Weingarten.

Earnings Versus Trustee Fees: A Closer Look at Financials

- Mozenter’s annual fee approximates 0.6% relative to total managed assets-a figure aligned with industry standards where fees can reach up to or beyond 1%..... . .

The apparent modest income stems partly because many holdings-including real estate properties, private aircraft, and luxury vehicles-incur substantial upkeep costs without generating steady cash flow.

The net yield on purely revenue-producing investments could be considerably higher than headline numbers suggest.(This section replaces original content discussing fees/returns.)

Essential Lessons For Families Managing Wealth Transfers

- Prioritize Open Communication Before Passing : Clear conversations among all stakeholders regarding roles & expectations can prevent misunderstandings later.

Had Jimmy clearly explained why he chose co-trustees instead of granting sole authority,

many posthumous tensions might have been avoided.

.

..

.

...

.

..

.

..

..

.

..

…

.

.

.

….

.

.

…

..

..

..

....

..

….

..

…..

………..

…….

………….

…………….

…………………………………………

……………………………….

……………………………………….

…………………………………………………………………………………………………………………………………………

………………………………………………………………………………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………

………………………………………………………………………………………………………………………………………….

…………………………………………………………………………………………………………………………………………….

…………………………………………………………

……………………………………………………………………………………………..

………………………………………..

…………………………………… …

…………………………………… ……………………………………… …

… … … … …… …

………….. ………….. ………. ………… ….. ….. ….

….. ….. ………. ….. …………. ………. ………. ………. …..

……………….. ……………….. ……………………………………

………………….. ………………….. ………………….. ………………………………………………………………………. …………………….. —————————–

—————————– ———————————–

———————————— ————————————

————————————- ————————————-

————————————– ————————————–

————————————— —————————————

—————————————- ————————————————-

————————————————– ————————————————–

————————————————— —————————————————

—————————————————- —————————————————-

—————————————————– —————————————————–

—————————————————— ——————————————————

——————————————————- ——————————————————-

—————————————————————- —————————————————————–

—————————————————————– ——————————————————————

—————————————————————— ——————————————————————-

——————————————————————- ——————————————————————–

——————————————————————– ———————————————————————

——————————————————————— ———————————————————————-

———————————————————————- ———————————————————————–

———————————————————————— —————————————————————————————-

————————————————————————- —————————————————————————————–

————————————————————————- —————————————————————————————–

————————————————————————- —————————————————————————————–

————————————————————————- —————————————————————————————–

————————————————————————- —————————————————————————————–

—————————————————————————————— ———————————————————————————————————– ———————————————————————————————————— ————————————————————————————————————– ————————————————————————————————————— —————————————————————————————————————— ——————————————————————————————————————- ——————————————————————————————————————– ——————————————————————————————————————— ———————————————————————————————————————- ———————————————————————————————————————– ———————————————————————————————————————— ——————————————————————————————————— ———————————————————————————————————- ———————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————–>

- Prioritize Open Communication Before Passing : Clear conversations among all stakeholders regarding roles & expectations can prevent misunderstandings later.