Cash App Launches Groundbreaking Features in Its Newest Release

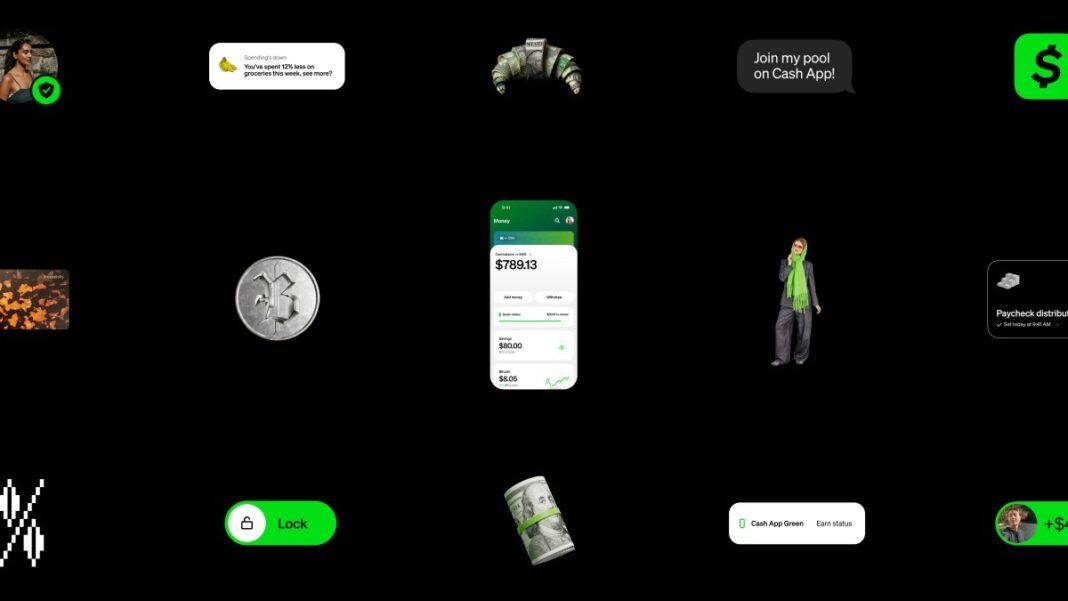

Meet Moneybot: Your AI-Driven Financial Guide

Cash App has introduced Moneybot, an advanced artificial intelligence assistant crafted to provide users with deeper insights into their financial behaviors. This intelligent chatbot evaluates spending habits, monitors income flows, and delivers customized recommendations for saving and investing more wisely.

currently available to a select group of users, Moneybot will soon be accessible to the entire Cash App community. Users can engage with it by posing specific queries like “What is my average monthly expenditure?” or “how have my spending trends evolved recently?” Beyond analysis, Moneybot offers practical suggestions such as splitting bills among friends, checking Bitcoin balances instantly, or requesting payments effortlessly.

Enhancing Cryptocurrency Usage: Bitcoin Payments Made Simple

Pushing the envelope on crypto integration, Cash App now features an interactive map that helps users discover merchants accepting Bitcoin payments nearby.Furthermore, customers can pay in U.S. dollars that are instantly converted into Bitcoin at checkout-removing the necessity of holding cryptocurrency beforehand.

This innovation utilizes the Lightning Network-a layer-2 scaling solution built atop Bitcoin’s blockchain-to enable rapid and cost-effective transactions through QR codes. By streamlining crypto payments this way, Cash App aims to make digital currency more accessible for everyday purchases.

The Road Ahead: Stablecoin Transfers Coming Soon

The platform plans to roll out stablecoin transfer capabilities for selected users in upcoming updates. These digital assets maintain a fixed value relative to fiat currencies and combine price stability with blockchain advantages-reflecting growing demand for reliable yet decentralized payment options.

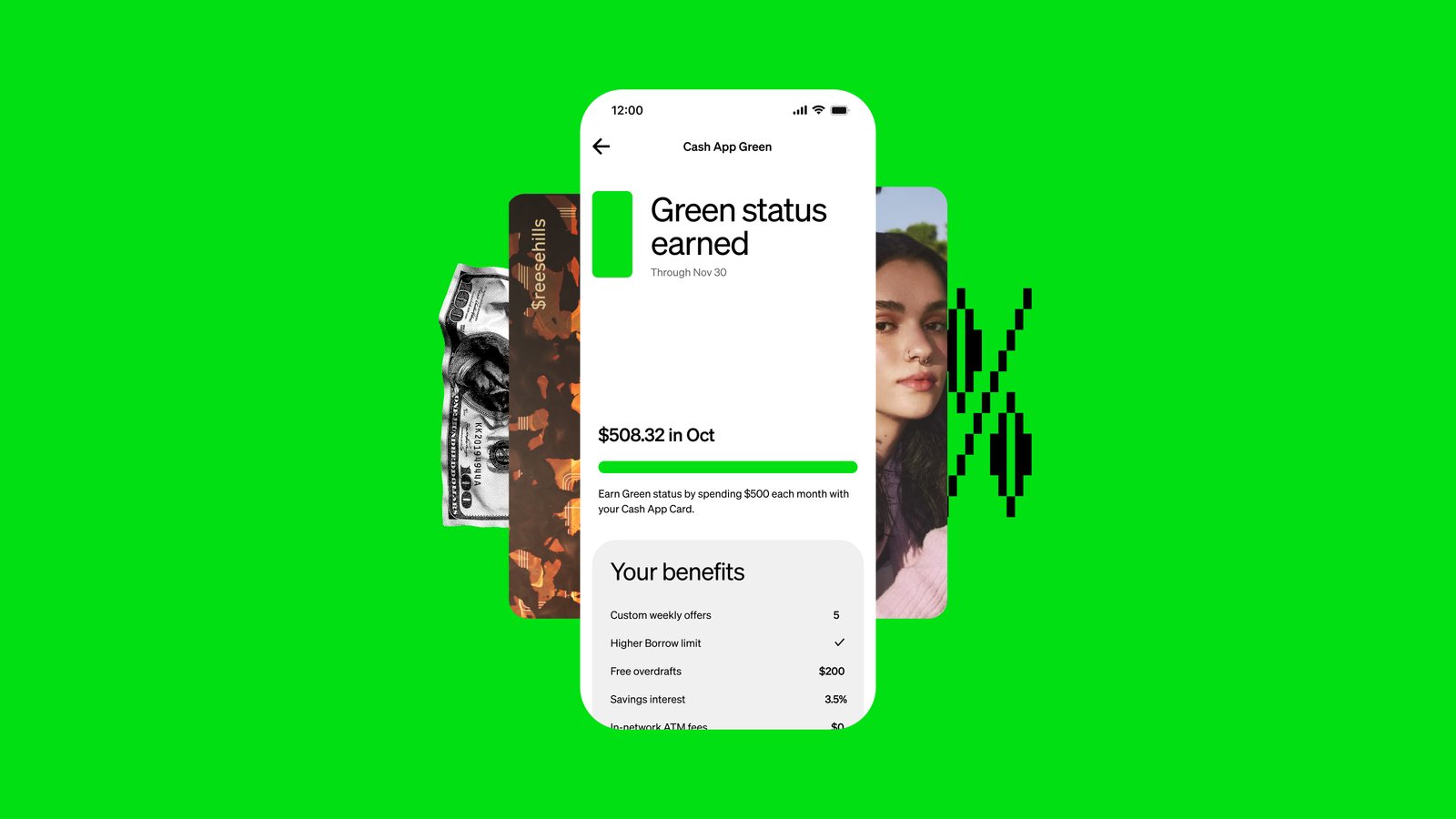

A Fresh Take on Rewards: Introducing Cash App Green Program

The rewards system has been revamped under the new Cash App Green initiative. Previously limited to those depositing $300 or more monthly for benefits like 3.5% APY savings rates, eligibility now extends also to customers who spend at least $500 per month using either the Cash App Card or Cash App Pay services.

- Larger loan amounts: New borrowers may access up to $400 initially; returning borrowers could see increases up to $300 on top of previous limits.

- No-fee overdraft protection: Eligible cardholders receive coverage up to $200 without incurring fees on qualifying transactions.

- Free ATM withdrawals: Access thousands of participating ATMs nationwide without withdrawal charges for program members.

- Savings rewards: Enjoy competitive interest rates reaching 3.5% APY on qualifying account balances under this program.

- Tailored weekly deals: Receive five personalized offers each week from various retailers based on individual spending patterns and preferences.

Broadening Impact With Enhanced Benefits Accessibility

This updated benefits framework is projected to benefit nearly eight million accounts across all U.S states.Additionally, teen accounts now enjoy unrestricted access to a 3.5% APY rate-encouraging early money management skills without balance limitations or caps commonly found elsewhere.

Diverse Financial Solutions Integrated Seamlessly Within One Platform

The latest update expands Cash App Borrow’s availability across 48 states nationwide-offering convenient short-term loans directly within user accounts without extra applications needed. Moreover, customers gain integrated access to Afterpay’s buy now pay later (BNPL) service through Cash App itself; no separate login credentials are required-making flexible payment options easier than ever during shopping experiences.

“As millions increasingly rely on digital wallets not onyl for conventional banking but also cryptocurrency transactions daily,this update positions Cash App as a complete platform bridging conventional finance with emerging digital asset trends.”