Arm and Nvidia Forge New Path for AI Chip Synergy

Arm has revealed that its Neoverse-based central processing units (CPUs) will now support NvidiaS NVLink fusion platform, facilitating smooth interoperability with advanced AI accelerators.This growth is poised too empower hyperscale operators and enterprises aiming for tailored infrastructure by enabling the combination of Arm cpus with Nvidia’s top-tier graphics processing units (gpus).

Broadening Horizons in AI Hardware Integration

Nvidia continues to expand its influence within the artificial intelligence landscape by collaborating extensively across the technology sector. By extending nvlink interconnect compatibility to a wider array of custom processors, Nvidia reduces dependency on proprietary CPUs, fostering a more open ecosystem.

The company’s Grace Blackwell server exemplifies this approach, integrating multiple GPUs alongside an arm-based CPU crafted by Nvidia itself. Still, many data centers still operate servers powered by Intel or AMD chips paired with Nvidia GPUs.

cloud Providers Accelerate Adoption of Arm Architectures

Leading cloud platforms such as google Cloud, Amazon Web Services, and Microsoft Azure are increasingly incorporating Arm-based CPUs into their data centre infrastructures. This transition grants these providers enhanced adaptability in hardware customization while driving down operational expenses-an essential advantage amid surging generative AI demands projected to grow at over 30% annually through 2027.

The Importance of Arm’s Licensing Framework

Diverging from customary semiconductor manufacturers who fabricate physical chips, Arm licenses its instruction set architecture (ISA) and design blueprints. These licenses enable partners to rapidly develop bespoke processors optimized for specialized tasks like AI acceleration.

The recent update introduces a novel protocol embedded within Neoverse cores that streamlines high-speed communication between CPUs and GPUs-a critical capability as modern AI servers often link up to eight GPUs per CPU node for peak computational throughput.

Transitioning Server Designs: From CPU-Centric Models to GPU-Focused Systems

While conventional server architectures revolved around powerful CPUs as the primary compute engines, today’s generative AI workloads demand dedicated accelerator hardware-primarily high-performance GPUs from vendors like Nvidia-to efficiently process complex machine learning algorithms at scale.

Nvidia’s Strategic Collaborations Reshape Industry Dynamics

A landmark moment occurred recently when Nvidia invested $5 billion into Intel-the leading CPU manufacturer-with part of this capital earmarked for enhancing integration between Intel processors and NVLink-enabled AI servers. Such partnerships underscore how cross-vendor interoperability is becoming vital in next-generation computing frameworks.

A Retrospective on the Abandoned Acquisition Bid

Nvidia’s aspiring attempt in 2020 to acquire Arm for $40 billion was ultimately halted due to regulatory obstacles spanning multiple countries including the United States and united Kingdom. This episode highlighted geopolitical sensitivities surrounding consolidation efforts within the global semiconductor supply chain.

Evolving Ownership: SoftBank’s Strategic Moves Amid Market Changes

SoftBank retains majority ownership of Arm but recently divested all holdings in Nvidia amid shifting market conditions. The conglomerate remains committed to pioneering initiatives such as OpenAI’s Stargate project-a multibillion-dollar data center venture leveraging heterogeneous computing platforms combining chips from Arm architectures alongside AMD and Nvidia components-demonstrating confidence in diverse technology ecosystems powering future innovation.

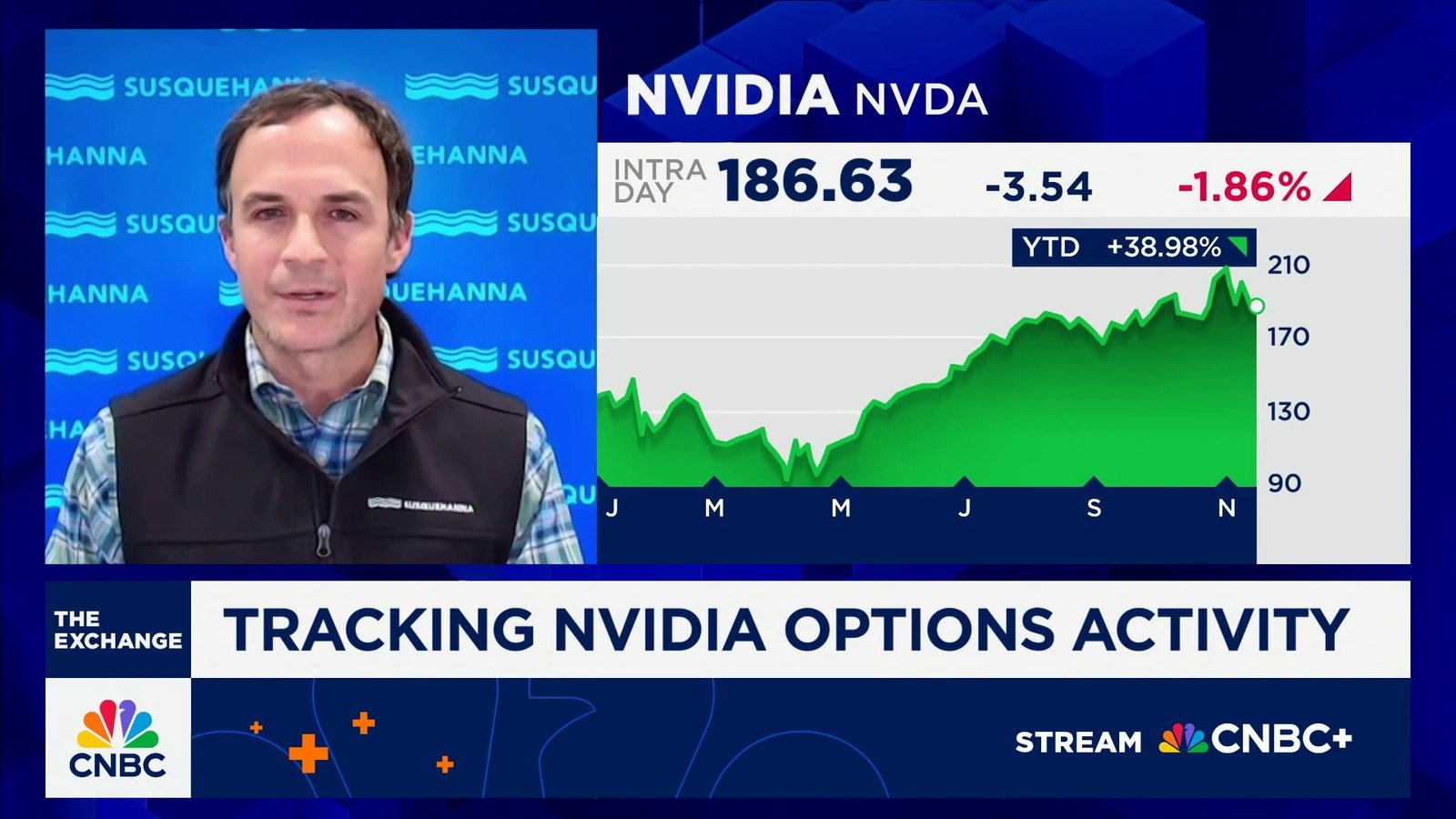

Nvidia’s options pricing exhibits volatility ranging approximately 6-7% up or down according to derivatives market experts specializing in semiconductor equities trading strategies.