Nvidia’s Bold Move: Acquiring groq to Revolutionize AI Chip Technology

Redefining the Future of AI Accelerators

Nvidia has recently secured the acquisition of Groq’s assets, a prominent innovator in high-performance artificial intelligence accelerator chips, for a substantial $20 billion in cash. This deal represents Nvidia’s largest purchase ever, eclipsing its previous record-the $7 billion acquisition of Mellanox Technologies in 2019. Remarkably, this agreement came shortly after Groq completed an impressive $750 million funding round just three months earlier, which valued the company at nearly $6.9 billion.

Groq’s Rise and Market Influence

Established in 2016 by former engineers including Jonathan Ross-one of the key creators behind Google’s tensor processing unit (TPU)-Groq has swiftly positioned itself as a major player amid surging demand for AI inference chips that accelerate complex large language model computations. Despite projecting revenues close to $500 million this year due to booming interest in AI hardware solutions, Groq was not actively pursuing a sale when Nvidia initiated discussions.

Leadership Transition and Operational Independence Post-acquisition

The transaction encompasses all of Groq’s assets except its emerging cloud division, GroqCloud, which will continue operating autonomously under CEO Simon Edwards without interruption. Meanwhile, pivotal figures such as founder Jonathan Ross and company president Sunny Madra will join Nvidia to facilitate scaling efforts and integrate Groq’s advanced inference technology into Nvidia’s expansive AI ecosystem.

Nvidia’s Expanding Role Within the AI Hardware Ecosystem

This acquisition aligns with Nvidia’s aggressive growth strategy supported by an extraordinary cash reserve exceeding $60 billion as of mid-2024-up from just over $13 billion at the start of 2023. Beyond acquisitions like this one, Nvidia has invested heavily across various startups including crusoe Energy Systems (specializing in energy-efficient computing), Cohere (focused on advancing large-scale AI models), and CoreWeave (an emerging cloud provider tailored for AI workloads preparing for public listing).

Strategic Partnerships Fueling Future Innovation

Nvidia also revealed plans to invest up to $100 billion into OpenAI initiatives involving deployment commitments surpassing 10 gigawatts worth of their products-a clear indication of their dedication toward powering next-generation generative AI models worldwide. Additionally, collaborations such as a recent multi-billion dollar investment into Intel underscore Nvidia’s cooperative approach within the semiconductor industry landscape.

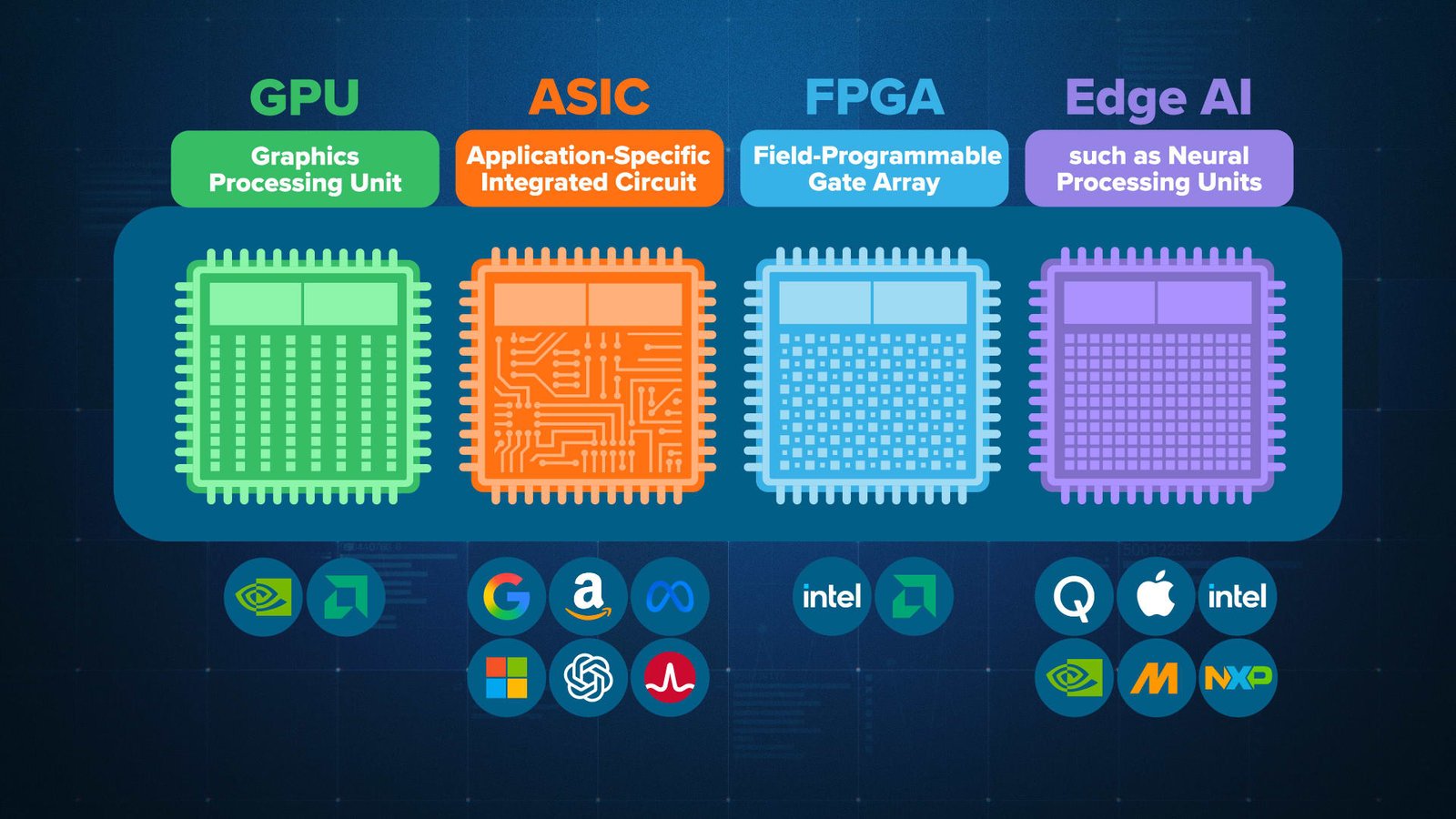

The Competitive Arena: Tech Giants Racing Ahead

Leading technology companies like Meta Platforms,Google,and microsoft have similarly intensified efforts over recent years by acquiring top-tier talent through licensing agreements or direct recruitment from promising startups specializing in artificial intelligence hardware innovation.

Cerebras Systems: A Rising Challenger Amid Market shifts

Cerebras Systems stands out as another formidable competitor; despite withdrawing its planned IPO after raising over $1 billion due to market volatility or strategic recalibration reasons not publicly disclosed-thay remain committed challengers developing processors optimized specifically for generative AI workloads that directly compete with industry leaders like Nvidia.

“Incorporating low-latency processors from pioneering companies such as Groq enables us to expand our NVIDIA AI factory architecture,” stated Jensen Huang, CEO of Nvidia-emphasizing ambitions beyond mere acquisition toward enhancing the entire ecosystem.”

A Balanced Integration Strategy Without Full Company Absorption

Nvidia clarified that while it is licensing intellectual property from Groq alongside integrating key personnel from their team into its operations, it is not acquiring the startup outright but rather securing essential technologies critical for expanding real-time workload capabilities across diverse applications-from autonomous vehicles to data center acceleration tasks.

The Growing Energy Challenge Amid Generative AI Expansion

The rapid expansion of generative artificial intelligence models exerts increasing pressure on global power infrastructures-a challenge underscored by experts analyzing how these massive computational demands strain existing electrical grids worldwide. Innovations driven by companies like Nvidia focus not only on boosting performance but also improving energy efficiency-vital factors ensuring enduring growth within this fast-evolving sector.