Enterprise Technology Stocks Rally on AI-Driven Market Surge

AI Sparks Meaningful Growth in Enterprise Tech Sector

The past week witnessed a remarkable surge in enterprise technology stocks, with mongodb leading the charge by soaring 44%, marking a historic peak for the company. This upswing reflects a broader market enthusiasm fueled by advancements in artificial intelligence. Pure Storage followed closely with an impressive 33% jump-its second-largest weekly gain-while Snowflake and Autodesk posted gains of 21% and 8.4%, respectively.

Expanding Influence of AI on Cloud infrastructure and Hardware Providers

The emergence of generative AI technologies since late 2022, catalyzed by breakthroughs such as OpenAI’s chatgpt, has propelled companies specializing in AI infrastructure into rapid growth trajectories. Nvidia remains at the forefront, delivering high-performance GPUs critical for training elegant AI models. Simultaneously, cloud service leaders like Microsoft, Google, and Oracle are scaling their platforms to meet escalating demand for flexible AI deployment environments. Hardware manufacturers including Dell Technologies and Super Micro Computer have also benefited substantially by supplying essential components that power data centers handling intensive AI workloads.

Wall Street’s Perspective: Growth Potential Versus Market Disruption

Investors continue to weigh whether artificial intelligence will act primarily as a growth engine or disruptor within enterprise technology markets. Recent earnings reports indicate many firms are beginning to realize measurable advantages from integrating AI solutions into their business processes.

Cautious but Growing Adoption of Artificial Intelligence Among Enterprises

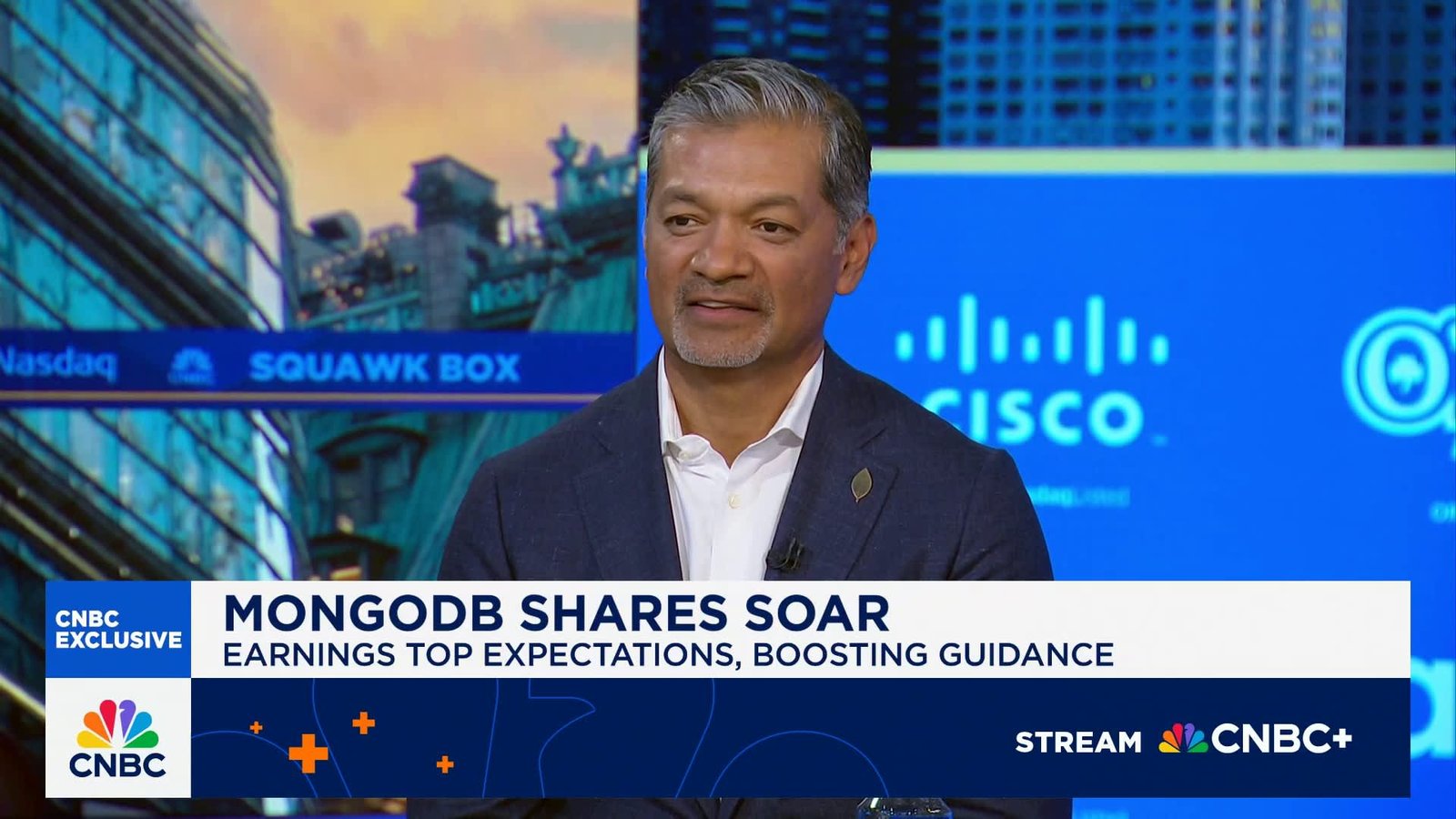

Mongodb CEO Dev ittycheria highlighted that while enterprises are increasingly deploying AI-driven agents to automate functions such as sales workflows and back-office operations, widespread adoption is progressing steadily rather than explosively. “Companies seek clear performance improvements before committing additional resources,” he remarked during an interview on CNBC’s “squawk Box.”

Mongodb reported quarterly revenue reaching $591 million-a robust 24% year-over-year increase-surpassing analyst expectations pegged at $556 million according to LSEG data. Earnings also exceeded forecasts alongside optimistic guidance for the full fiscal year.

Surging Customer Acquisition Driven by Emerging Tech Startups

This year alone, Mongodb has added over 5,000 new customers-the highest first-half acquisition rate ever recorded by the company-with many being “AI-native” startups relying heavily on Mongodb’s cloud database services as foundational infrastructure supporting their operations.

Pure Storage Benefits from Rising Data Needs Fueled by Meta Partnership

The data storage specialist Pure Storage experienced a notable stock increase of approximately 32% following strong quarterly results that outpaced market expectations along with raised annual revenue forecasts. A significant factor behind investor confidence is Pure’s recent contract with Meta (formerly Facebook),where it supports extensive storage demands driven by Meta’s expanding use of artificial intelligence technologies.

the recognition of revenue from deployments at Meta began during Q2; CFO Tarek Robbiati emphasized growing interest from other hyperscale cloud providers eager to replace outdated storage systems with more efficient solutions offered by pure Storage.

Nvidia Maintains Leadership Thru Consistent High-Growth Performance

Nvidia delivered another outstanding quarter reporting revenue growth of 56% compared to last year-marking its ninth consecutive quarter surpassing half-century percentage increases-and reinforcing its status among the world’s most valuable companies due to its dominance in supplying advanced processors essential for global AI development efforts.

“It was an extraordinary report,” commented Brad Gerstner, CEO of Altimeter Capital.

“Nvidia continues accelerating at unprecedented scale.”

This sustained momentum highlights Nvidia’s central role amid massive investments across sectors building large-scale artificial intelligence capabilities despite some moderation after earlier triple-digit expansion phases during initial market surges.

Snowflake Strengthens Market Position With Its Integrated Snowflake AI Data Cloud Platform

Snowflake recently announced better-than-expected earnings alongside increased product revenue guidance for the upcoming fiscal year. The company now serves over 6,100 customers utilizing Snowflake AI-a significant rise from just above 5,200 last quarter-as enterprises rapidly adopt integrated data analytics powered through embedded machine learning models within Snowflake’s platform architecture.

“Our progress leveraging AI has been exceptional,” stated Snowflake CEO Sridhar ramaswamy during the earnings call.

“Nearly half our new customer acquisitions today stem directly from our advancements in artificial intelligence.”

Autodesk Embraces Transformation With Strategic Focus on Artificial Intelligence Innovation

A longstanding industry player since its founding in 1982 known primarily for AutoCAD software widely used across architecture and construction fields, Autodesk saw mixed stock performance relative to broader tech indices recently but made meaningful progress following operational changes prompted earlier this year-including workforce reductions near nine percent advocated by activist investor Starboard Value aimed at improving efficiency.

The company launched Project Bernini last year focused on developing innovative “AI-powered CAD engines”, enhancing design automation capabilities through machine learning techniques integrated into core products.

A Pragmatic Viewpoint: Balancing Risks And rewards Of Automation Technologies

Tackling concerns about automation perhaps displacing conventional software roles, Autodesk ‘s CEO Andrew Anagnost acknowledged these challenges but expressed optimism: “While AI may transform software landscapes-it won’t replace Autodesk itself.”

Bigger Picture: What Investors And Businesses Should Consider Moving Forward

- diverse winners Across The Ecosystem: From GPU innovators like Nvidia powering next-generation computing needs; cloud providers scaling infrastructure capacity; specialized vendors such as MongoDB enabling adaptable databases-all segments demonstrate strong tailwinds largely driven directly or indirectly through surging demand linked back to generative artificial intelligence applications worldwide.

- Cautious Optimism Prevails: Despite excitement surrounding early-stage internal workflow automation deployments within organizations-full-scale adoption remains gradual pending demonstrable ROI metrics guiding further capital allocation decisions globally versus speculative hype observed around ChatGPT launches two years ago onward .

- Evolving Competitive Dynamics:This fast-changing environment encourages legacy players like Autodesk undergoing transformation efforts alongside agile startups carving niches focused exclusively around emerging tech stacks centered upon bright automation tools designed specifically toward vertical industry challenges ranging anywhere between manufacturing design optimization up through social media content moderation infrastructures requiring petabyte-scale real-time analytics pipelines supported via hybrid multi-cloud architectures .