Meta’s Strategic Stake in Scale AI: Redefining Investment Approaches in the AI Sector

An Innovative deal structure with Significant Financial Outcomes

Meta has forged a distinctive agreement to acquire a 49% ownership interest in Scale, an emerging leader in artificial intelligence. This transaction places Scale’s valuation at over $29 billion and facilitates substantial cash distributions to existing shareholders and employees with vested equity,all while enabling them to retain their stakes.

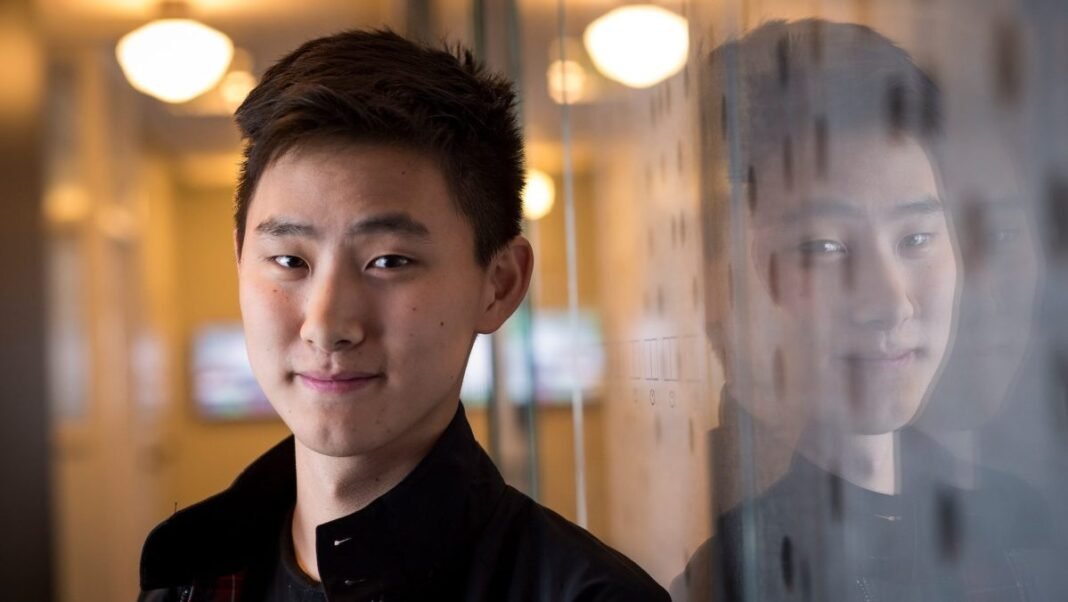

Leadership Vision and Company Origins

At the heart of this deal is Alexandr Wang, Scale’s founder and CEO, who famously left MIT at age 19 to establish the company. Under his guidance, Scale has rapidly grown by specializing in human-verified training data-an essential resource powering today’s AI innovations across diverse sectors.

A Shift from Conventional Share Purchases to Dividend-Based Liquidity

This transaction diverges from standard acquisitions where shares are typically bought outright from founders or investors. Instead, it primarily involves dividend payouts that provide liquidity for early backers without transferring full ownership control. As a notable example, Accel Partners-one of Scale’s initial investors-is expected to receive close to $2.5 billion through this mechanism.

The Expanding Investor Network and Market Evolution

Scale boasts heavyweight investors including Amazon alongside Meta itself. Just twelve months prior, following a $1 billion Series F funding round valuing the company near $14 billion, its worth has more than doubled due to this latest deal structure. The scale of dividend payments here is unprecedented within private AI startups and prompts discussions about regulatory oversight concerning such financial arrangements.

The Critical Role of Human-Verified Data in Modern AI Development

Scale focuses on delivering meticulously labeled datasets verified by humans-a cornerstone for enhancing machine learning models today. As industries increasingly depend on precise data annotation for applications like autonomous driving systems or advanced language models such as GPT-4 variants deployed globally, companies like Scale have become indispensable partners fueling technological progress.

Future Implications: Regulatory Challenges and Industry Shifts

This novel financial approach blurs customary boundaries between acquisition deals and investment returns while strategically positioning Meta within an intensely competitive AI landscape. Industry watchers anticipate close regulatory scrutiny given the magnitude of payouts involved along with potential impacts on market competition worldwide.

“This landmark transaction highlights how leading technology firms are pioneering new investment frameworks amid accelerating innovation cycles.”