Emerging Patterns in Energy Investment and Sustainability for 2025

The landscape of clean energy financing in the United States is undergoing critically important transformation, even as political debates continue to challenge renewable initiatives. Despite skepticism from some quarters, investment in sustainable energy technologies is reaching historic highs.

Robust Growth in Renewable energy Funding Amid Political Resistance

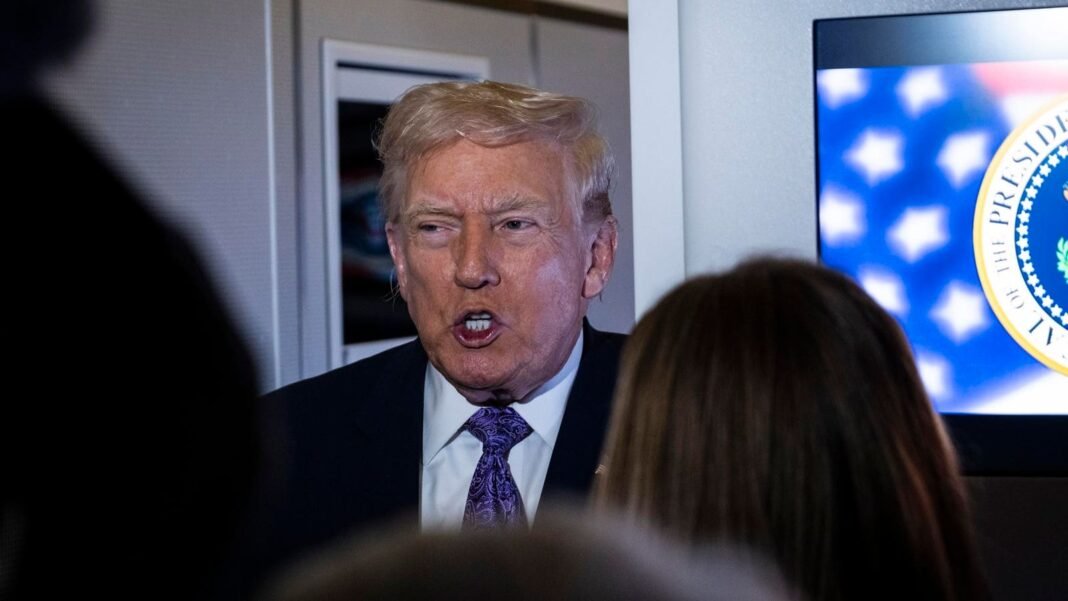

Although former President Donald Trump publicly criticized wind and solar power as inefficient and expensive during his speech at the United Nations General Assembly, investments in clean energy within the U.S. have maintained strong momentum. Efforts by his governance to reduce incentives for electric vehicles (EVs) and renewable projects slowed but did not stop this upward trend.

Recent data indicates that expenditures on clean energy solutions and sustainable transportation surged by 8% year-over-year during Q3 2025, totaling an unprecedented $75 billion within a single quarter. Cumulatively, spending through September shows a 6% increase compared to the same timeframe last year.

Main Drivers Behind Investment Increases: EV Demand and Home-Based Renewables

A notable spike occurred just before federal tax credits for EV purchases expired at the end of September 2025,motivating consumers to expedite their vehicle acquisitions. Concurrently, there was a marked rise in residential adoption of heat pumps and battery storage systems integrated with solar panels as homeowners pursue greater autonomy over their energy consumption.

The Impact of AI Data Centers on Large-Scale Renewable Projects

The rapid growth of artificial intelligence infrastructure has considerably boosted electricity demand across the country. This surge contributed to a 15% increase in funding directed toward utility-scale renewable installations and industrial decarbonization technologies compared with Q3 2024 figures.

Challenges Within Manufacturing Slow overall Progress

However, not all segments are experiencing growth; investments related to cleantech manufacturing-notably battery production facilities-have declined by more than 25% compared to last year’s levels. This marks the fourth consecutive quarterly decrease amid persistent supply chain disruptions affecting this vital sector.

Additionally, announcements regarding industrial decarbonization projects dropped sharply by over half relative to Q3 2024. The elimination of federal EV incentives is anticipated to further dampen expansion throughout late 2025 and into early next year.

The Surge of Advanced Nuclear Power Driven by AI Energy Needs

A new frontier in nuclear technology is emerging alongside soaring electricity requirements fueled primarily by AI data centers worldwide.In Austin, Texas-based Aalo Atomics is developing compact nuclear reactors tailored specifically for high-demand environments such as data processing hubs or powering tens of thousands of homes together.

Aalo atomics’ Small Modular Reactors: From Concept to Reality

This company manufactures robust steel containment vessels onsite designed for ten-megawatt fission reactors; five units combined will produce approximately fifty megawatts suitable for ample commercial applications. CEO Matt Loszak highlights that these are active construction projects rather than theoretical models.

Aalo plans to achieve “criticality”-the point where self-sustaining nuclear reactions begin-at its Idaho National Laboratory facility by mid-2026 coinciding with America’s semiquincentennial celebrations. Full commercial operation aimed at electricity generation is expected shortly after regulatory approvals are secured during 2027 with support from industry veterans formerly associated with SpaceX manufacturing teams.

Nuclear Innovation Race Among Emerging Startups

- Twelve firms including Valar Atomics, Oklo, Kairos Power, and X-energy compete globally with similar small modular reactor designs focused on flexible grid integration or dedicated power supply;

- This new generation promises enhanced safety through factory prefabrication while advancing climate objectives amid rising global electricity demand;

- The convergence between escalating AI-driven load growth and advanced nuclear technology investment underscores an evolving synergy shaping future global energy systems.

Sustainable Investing Strategies Amid Changing Global Aid Dynamics

With international aid flows declining-especially from major contributors like the U.S.-impact investors are adjusting approaches toward underserved markets across Africa and other developing regions where infrastructure deficits remain significant but opportunities flourish.

Navigating Reduced ESG Focus Among Institutional Investors

An experienced impact investor reflects on supporting nearly two-and-a-half decades worth of startups addressing poverty-related challenges via innovative business models rather than traditional aid alone. While philanthropic funding has recently contracted causing disruptions across health systems & environmental programs worldwide; it also opens avenues toward blended finance structures combining philanthropy with commercial capital aimed at long-term market development rather of short-term relief efforts exclusively.

Pioneering Off-Grid Electrification Transforming Lives Globally

“Beginning modestly over ten years ago with off-grid solar lighting devices allowed us-and our entrepreneurs-to understand how best serve customers lacking access,” explains one leader.

“Today we have enabled affordable light or electricity solutions impacting more than three hundred million low-income individuals.”

- Despite progress made so far roughly six hundred million people still lack reliable off-grid access mainly concentrated across African nations;

- An innovative financing mechanism called “the hardest-to-reach” targets sixteen challenging countries including Somalia & South Sudan using $60 million philanthropic seed capital plus $200 million blended debt facilities;

- Diverse stakeholders ranging from global philanthropists through Korean commercial banks collaborate under this model aiming both social impact & financial sustainability;

Embracing Risk Is Crucial For Breakthrough Impact Investments

“Accepting failure as part-and-parcel when investing where risks abound due macroeconomic volatility or fragile governance structures,” one expert states.

“Ignoring these risks carries even greater costs such as increased emissions driving instability or forced migration.”

This comprehensive perspective encourages tailoring return expectations according investor risk tolerance while prioritizing transformative outcomes beyond mere financial metrics-a philosophy gaining momentum among progressive impact funds today.

Sustainability developments Influencing Our present Day World

- zillow removes climate risk scores from property listings following debates about accuracy influencing homebuyer decisions .

< li >Europe confronts severe groundwater depletion as extended droughts linked directly with climate change threaten agriculture & drinking water supplies .

< li >New York City comptroller calls for divestment from BlackRock citing inadequate action on climate commitments affecting pension fund management .

< li >Ozone layer recovery continues steadily , marking success post-Montreal Protocol enforcement.

< li >Los Angeles captures nearly five point five billion gallons water runoff after recent storms , enhancing urban resilience efforts .

< li >Soil carbon sequestration potential underestimated previously , offering improved natural climate mitigation capacity .

< li >EPA proposes rollback air pollution standards risking thousands premature deaths annually according experts’ warnings .