Empowering Families to Manage Gaming Expenses with Lootlock

The Growing Concern of Unexpected In-Game Purchases

Parents increasingly encounter the challenge of unforeseen charges on their credit cards due to their children’s in-app spending.Numerous families report receiving bills amounting to thousands of dollars from popular mobile and console games, frequently enough without prior warning or approval. This trend has escalated as game developers embed micro-transactions and pay-to-win elements that encourage ongoing financial engagement.

Understanding How Game Mechanics Drive Spending

The gaming industry frequently leverages advanced psychological techniques, such as behavioral analytics and social influence tactics, to motivate young players toward frequent purchases. These methods aim to boost revenue by enticing users into acquiring premium content or virtual assets. Regulatory authorities have expressed concern over these strategies, noting how they can exploit vulnerable audiences.

The Shift Toward Continuous Micro-Transactions

in recent years,the business model for manny games has shifted dramatically-from one-time purchases toward persistent micro-transactions embedded within gameplay loops. This evolution means even casual gamers may unknowingly accumulate critically important expenses over time.

Introducing Lootlock: A Parental Control Innovation

Lootlock was created in response to this widespread issue by combining expertise in gaming and financial technology. Designed specifically for parents seeking control over their children’s gaming expenditures, this app offers a streamlined way to monitor and limit spending on family credit cards linked to digital game stores.

The story Behind Lootlock’s Creation

A close friend struggling with managing allowances for his three enthusiastic gamer kids inspired the advancement of Lootlock. His previous method involved handing out cash allowances that were then tracked through credit card payments-a process both tedious and prone to oversight errors.

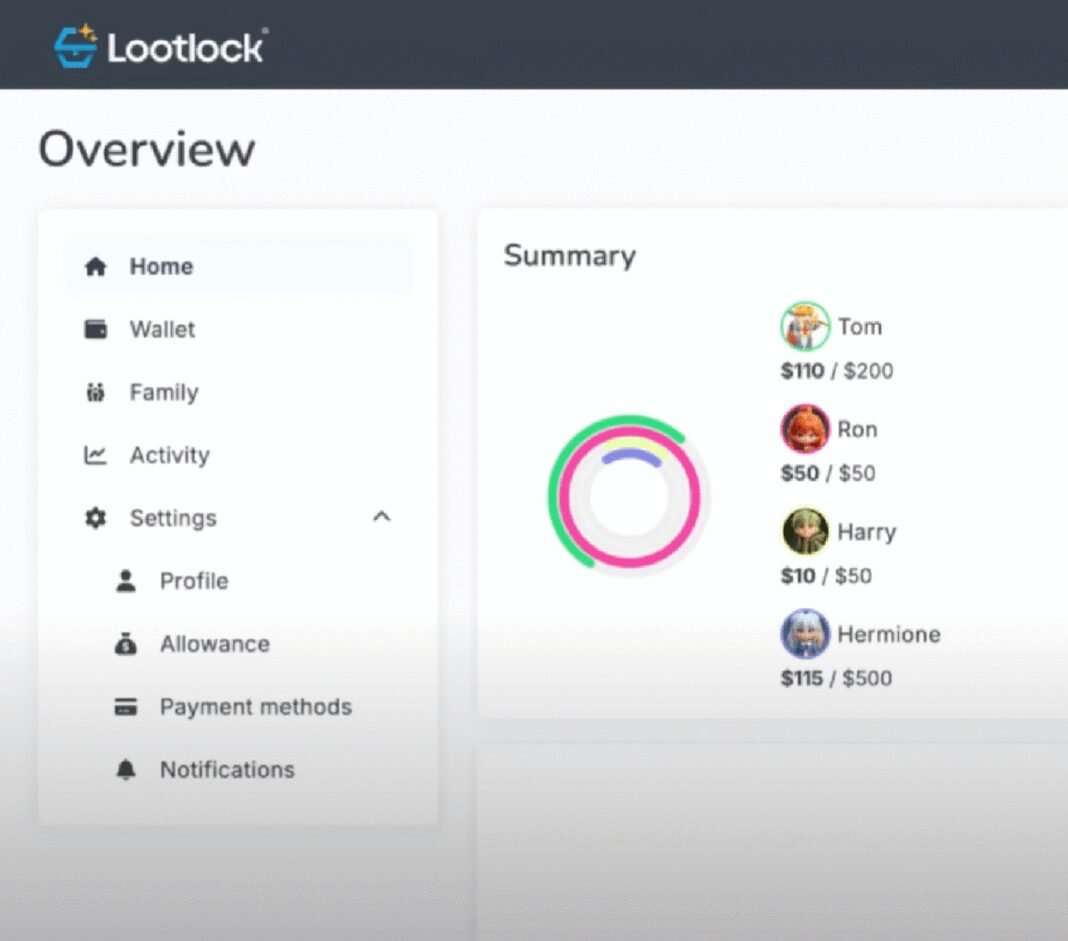

Main Features that Empower Parents and Kids Alike

- Preloaded Digital Cards: parents fund a prepaid digital card connected directly with their child’s device wallet for controlled spending.

- Scheduled Allowances: Automatic weekly or monthly top-ups can be set up with partial funds locked until specific criteria are fulfilled.

- user-governed Unlocking: children earn additional spending privileges by completing chores or meeting goals approved via parental text confirmations.

- Simplified Spending Limits: Funds are restricted exclusively for gaming-related transactions preventing unauthorized use elsewhere online.

merging Financial Literacy with Engaging Gamification Elements

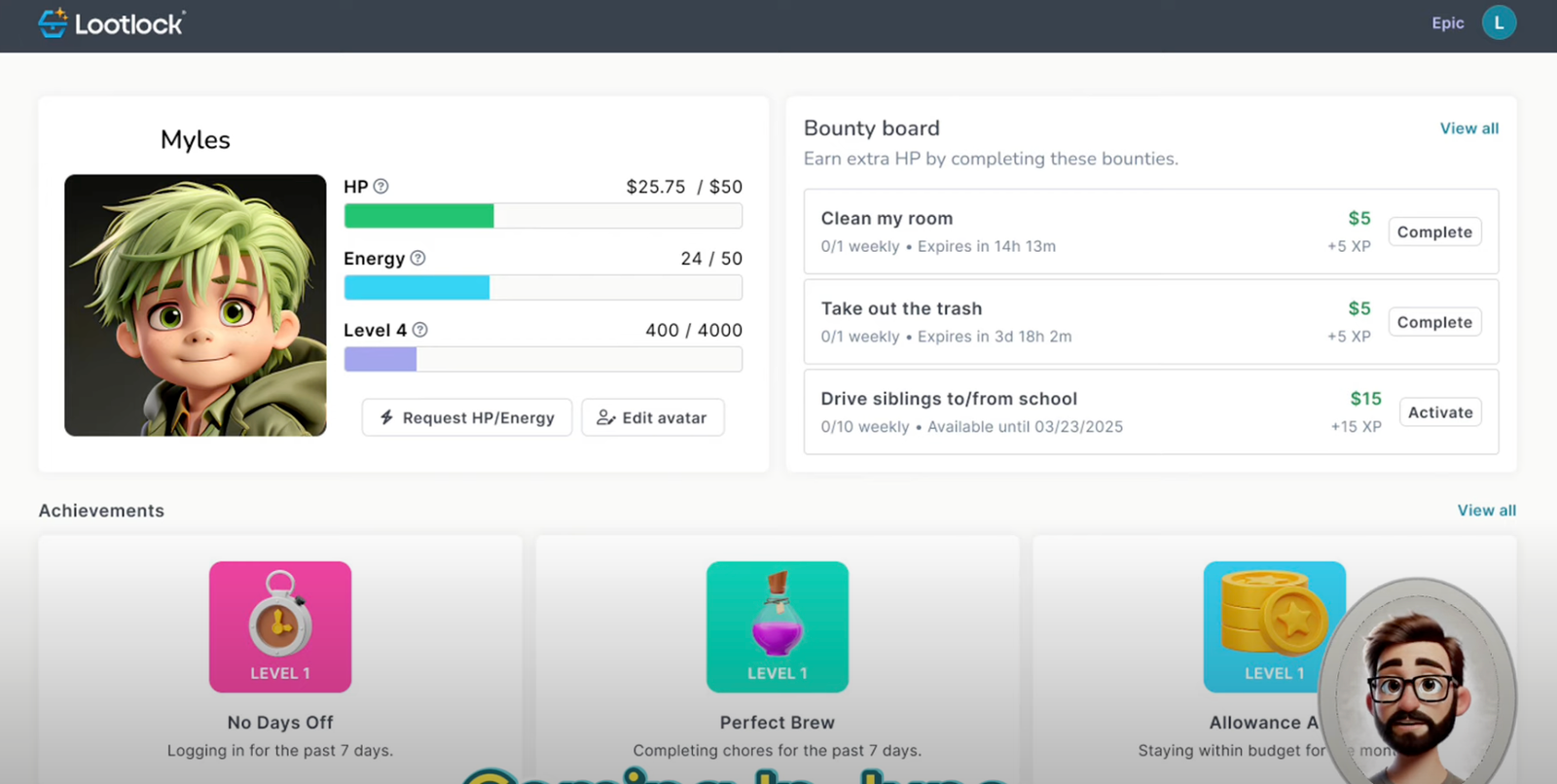

Lootlock goes beyond basic budgeting tools by integrating gamified features designed to teach children about money management responsibly. Kids choose avatars that evolve based on positive financial behaviors-such as regularly reviewing balances and adhering strictly to limits-earning rewards like virtual gear usable across platforms including Discord communities tailored for young gamers.

Bounty Boards: Turning Chores Into Rewards Through Playful Incentives

A forthcoming feature called “bounty boards” will enable parents to assign household tasks which children complete in exchange for “bounties.” Accumulating enough bounties automatically unlocks extra allowance funds inside the app, blending real-life responsibilities with engaging gameplay mechanics aimed at encouraging both fiscal discipline and domestic contribution simultaneously.

The Wider Benefits for Modern Families Navigating Digital Economies

This innovative approach not only protects households from unexpected financial burdens but also instills early lessons about budgeting tailored specifically toward young gamers-a demographic increasingly targeted by aggressive monetization worldwide. Recent surveys indicate more than 75% of children aged 6-12 engage regularly in video games globally; solutions like Lootlock address an urgent need among families adapting together within evolving digital marketplaces.

A Rising Star Within Fintech Solutions Focused on Gaming Controls

Lootlock operates through a small yet dedicated team committed fully self-funded efforts focused on refining its platform continuously while maintaining user-kind design principles centered around empowering rather than restricting families’ autonomy over finances during gameplay sessions worldwide.

“Our mission is granting parents precise authority over when-and how-their kids spend money while playing,” emphasizes Pompa-highlighting empowerment instead of outright bans as key.”

Lootlock’s Emerging Role at Technology Conferences

This year marks a pivotal moment as Lootlock presents its solution at major tech events held late October in San Francisco-reflecting growing demand globally for responsible tools addressing finance management amid shifting consumer expectations surrounding interactive entertainment industries today.